Do you want to understand the different investment accounts available to you? There are endless long articles filled with confusing jargon and detail, you feel like you need a translator to interpret them.

Wouldn’t it be nice to just have a super simple rundown of the types of investment accounts and their primary advantages and disadvantages?

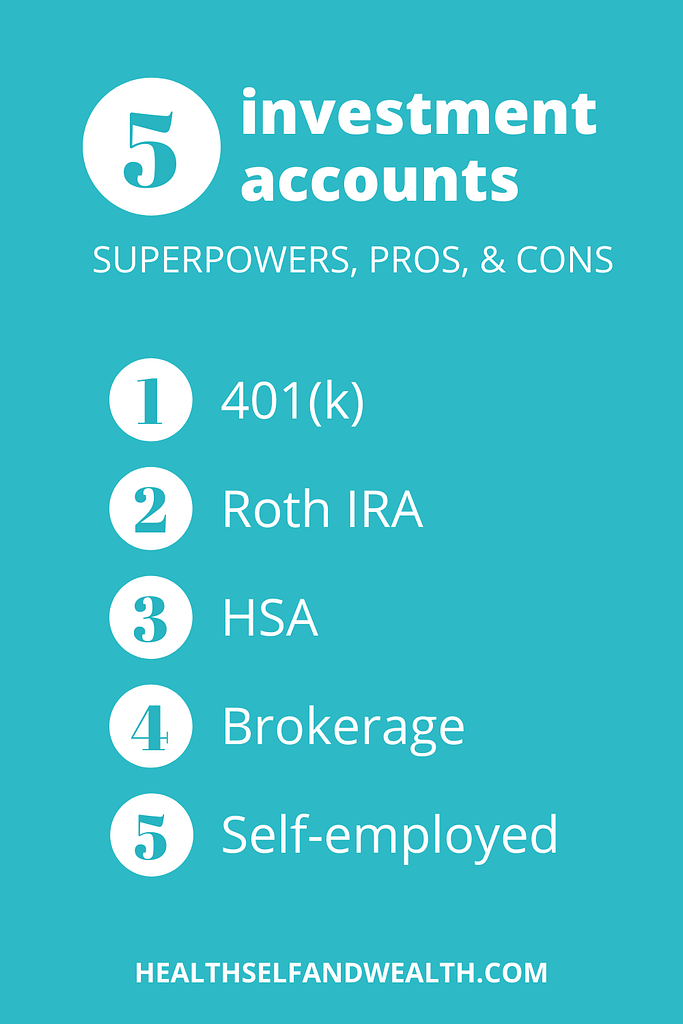

Here are 5 types of common investment accounts, with a breakdown of the pros and cons and what I call the “superpower” of each account.

Please note: I am not a licensed financial advisor. This content is for educational purposes only. Every individual has a unique situation. Always do your own due diligence before making any decisions.

What is an investment account?

Think of an investment account as a purse. First, you pick out your purse, then you put your items in it. A purse holds your items like an investment account holds your investments.

401(k) or 401(k) Equivalent

A 401(k) is a retirement account offered by your employer.

Superpower: employer match

Pros: The main advantage of this account is that typically your employer will match your contributions up to a certain percentage. If you aren’t taking advantage of an employer match, you’re missing out on your money!

Your investment contributions are also tax-advantaged.

If you ever needed to withdraw money from this account, you may have the option to take a loan from your 401(k).

Cons: This account is so powerful, the government limits your contribution amounts. As of 2022, the maximum contribution is $20,500.

If you withdraw from this account before you turn 59.5, you may face 10% penalty fees and pay taxes on it. However, a 401(k) loan may be an alternative option depending on the situation.

Roth IRA

A Roth IRA is an individual retirement account.

Superpower: compounded, tax-free gains😍

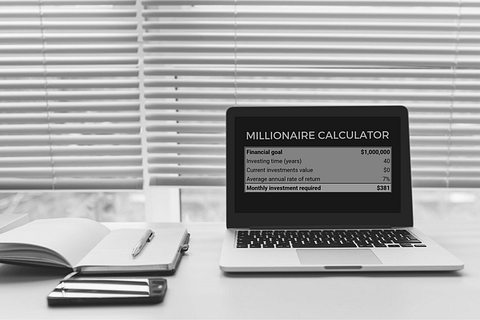

Pros: Compound interest over the long term in this account is the easiest way to earn a LOT of money and keep 100% of the profits (because the gains are tax-free!). The earlier you start contributing, the more easy money you earn.

Cons: The maximum contribution amount in 2022 is $6000. This further attests to how powerful this account is. You know if it’s good if the government limits how much you can contribute!

You have to earn your contribution amount to contribute to this account. In other words, if you want to contribute the full $6000, you must earn at least $6000 in income this year.

High earners are not allowed to contribute to this account. Although Nerd Wallet has a great explanation of a loophole that allows high earners to contribute to a back door Roth IRA.

HSA

A Health Savings Account is an investment account that works with a high deductible health insurance plan. This money can be used tax-free to pay for qualified medical expenses.

Superpower: triple tax-advantaged

Pros: This account is triple tax-advantaged because contributions, gains, and qualified withdrawals are tax-free.

After you turn 65, the penalty for withdrawing the money for non-qualified medical expenses goes away. At that point, this account becomes like other retirement traditional retirement accounts.

If you can pay for medical expenses out of pocket, do so to let your investments grow. Save your receipts because you can withdraw money for qualified medical expenses anytime. Then if you need money later, withdraw it for those qualified expenses.

Cons: Since this account is triple tax-advantaged, the contribution amounts are greatly limited. Again, strict limits = powerful account.

There are penalty fees on non-qualified withdrawals. And you’ll owe taxes on them.

Brokerage Account

Superpower: no contribution limits

Pros: There’s no limit to how much you contribute.

You typically have more investment options than you would with a 401(k) or HSA.

You can withdraw the money anytime for any reason. Although there may be some fees associated with early withdrawals depending on your investments.

Cons: You will owe taxes on all taxable transactions.

Self-employed investment accounts

If you are self-employed, you may be able to invest in a SEP IRA or a solo 401(k).

The superpower of these accounts is tax-advantaged investing for the self-employed.

You can learn more about these accounts from the IRS website.

Conclusion

If you have only one takeaway from this, it’s to start investing as soon as you are able to. No matter what account you get started with, investing is a decision that builds your wealth.

If you want to take it one step further, experts recommend prioritizing the accounts in the following order: 401(k) up to employer match, IRA, HSA, 401(k), brokerage.

Use the pros, cons, and superpowers to tweak this order to fit your unique financial situation.

If you want to make your first investment, sign up for this free 10-day investing challenge to walk you through some foundational steps. If you are already an investor, still sign up for tips on optimizing your investments.

Thank yourself for taking the time to make your financial well-being a priority today.

[…] ended up just taking a small step. I opened a Roth IRA and invested just a little bit of money into an S&P 500 index fund. After taking that first […]