If you’re curious about my story…

I became interested in personal finance when I was 19, mostly out of a survival instinct. I found myself unexpectedly responsible for my own financial and physical well-being.

I was in college at the time, without a job and without an understanding of how I was going to keep a roof over my head, buy groceries, or stay in school.

I had to learn how to make and manage money fast, with serious implications if I failed.

I started by finding a job, securing merit and need based scholarships, and overcoming my fear of budgeting. My budget became my BIBLE during this time.

I mastered the art of scarcity and minimal spending so I could stay in school. For example, I didn’t have heat or A/C in my living space. (Looking back, I’m lucky I didn’t lose a toe in the winter!)*

*I fully recognize there are other people who have survived worse situations. I am only sharing this to illustrate I felt like I was in a constant state of fight or flight, survival mode. I also acknowledge my situation gave me the strength and motivation to be where I am today.

While living with a strict budget, I realized I would always feel this sense of financial insecurity because there was nothing left for me to cut! If I wanted to save more to have a greater sense of security, my only option was to increase my income.

And I did. Survival is a powerful motivator.

I also read books from experts in the personal finance space and quickly discovered earning more and spending less could only get me so far. I could be the highest earner or best saver in the world, and it wouldn’t be enough to transform my situation.

But investing and compound interest could. That’s when I learned to invest in index funds, so my additional earnings could continue to grow.

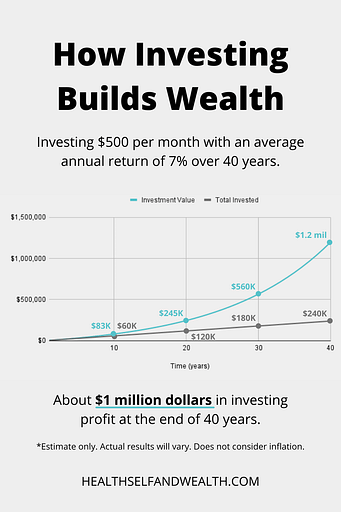

Here’s an example of a chart I saw that really made the power of investing click.

When I graduated, I secured a good, salaried job making more money than ever before. However, even when I started earning that money, I didn’t feel like I made it. I still felt like I was in survival mode.

Accordingly, I was saving as much as possible and investing the rest. After about a year, I realized I had two major limitations:

My scarcity mindset was preventing me from earning as much as I could. The scarcity mindset feeds off the belief that money is a limited resource. It’s difficult to truly believe, simultaneously, that money is limited and also that there’s the unlimited potential to earn more.

I had to learn to shed the scarcity mindset and embrace abundance instead. That’s when my outcomes started to shift. I started seeing more examples of other high earners that I could aspire towards. I started putting myself out there and earned a new, higher paying job as a manager at a Fortune 50 company at age 23.

I now feel like I am living my best life and it’s my mission to help you do the same. No matter what your personal finance journey looks like, I created Health Self and Wealth to help you.

The best place to start is the Wealthy Women Club. You will get a short Wealthy Women newsletter on Wednesdays. As a bonus, you’ll get my free guide on becoming a wealthy woman.

Unlock your financial freedom

Your free guide to become a wealthy woman.

Thank yourself for taking time to prioritize your wellbeing today, Wealthy Woman.