What are your financial goals? Maybe you are saving up for a vacation, buying a new car, or early retirement. Whatever your financial goals are, this post will equip you with the tools to achieve your goals faster.

There are three components to achieving a goal: objective, motivation, and monitoring. Take a moment to reflect on what your financial goals are. This is your objective.

Secondly, why do you want to achieve this goal? Your primary reason will serve as your motivation. The stronger your reason is for wanting to achieve this goal, the faster you will achieve your goal.

Have you ever had a clearly defined goal and a strong motivation for making it happen, but it still didn’t? This final component is often overlooked, but without it, it’s unlikely you’ll achieve your goals. You must monitor your progress towards your goals.

Think back to a time where you didn’t achieve a goal. Were you tracking your progress towards the goal? It can be exceptionally difficult to monitor your progress toward your financial goals – but it doesn’t have to be anymore.

This post dives into a proven way to monitor your progress towards your financial goals. It will not only equip you to achieve your financial goals, but to achieve them faster!

*If you’d prefer to listen to today’s post, watch a video version of today’s post on YouTube.

Accelerating Your Progress Towards Your Financial Goals

Regardless of what your financial goal is, it probably involves allocating a certain amount of money to achieve your objective. When it comes to money, we have the most control over what we do with the money we already have. Accordingly, we’ll focus on how you can plan to spend your money in a way that aligns with your goals.

Every month I track how much money I have coming in and how much I’m spending. It’s so important to be aware of this information because I can ensure I’m allocating my money in a way that will get me closer to my goals.

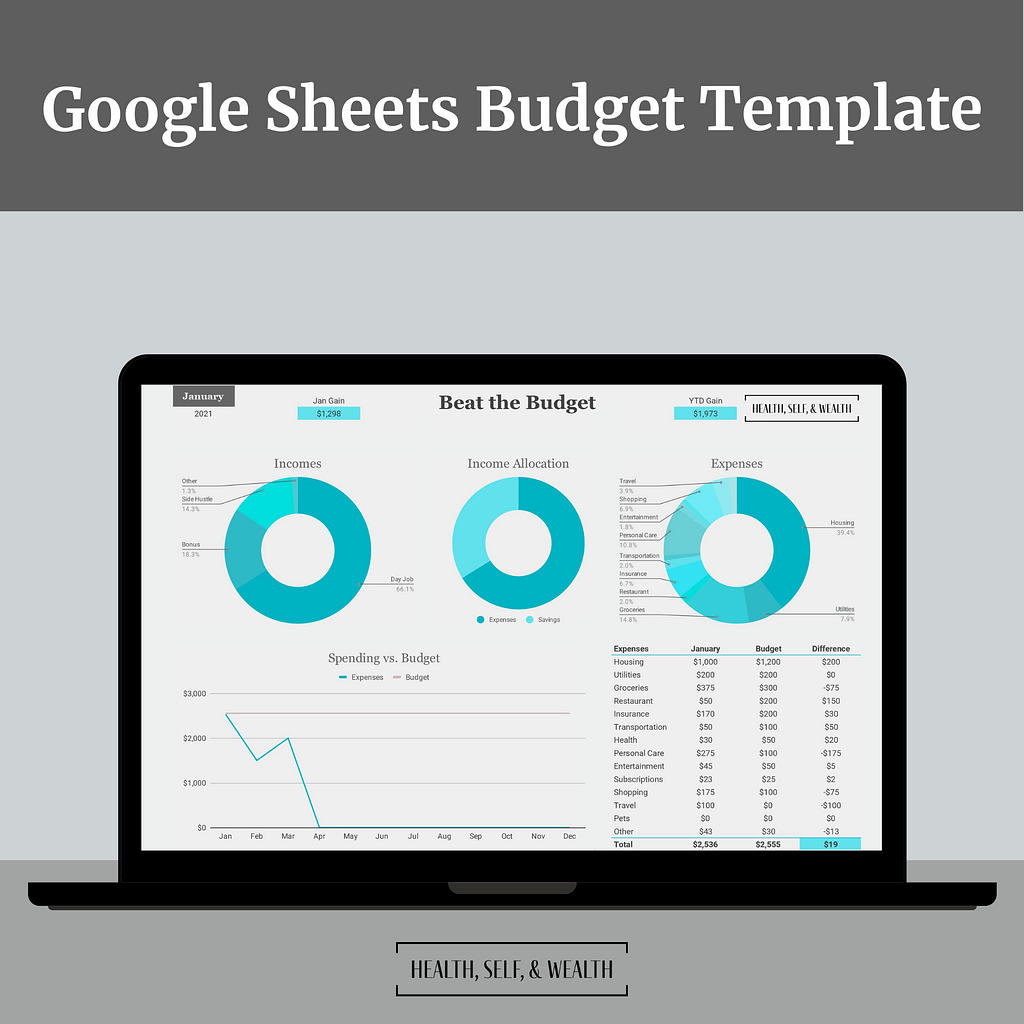

I will walk you through the tool I use every month to easily monitor my progress towards my goals, Beat the Budget.

Beat the Budget – Monitoring

The summary page automatically calculates and displays your income and spending information for each month. The best part is that the spreadsheet tracks your gains for each month. If you’ve entered complete and accurate information on your data sheet, then this number is the extra amount you have available for investing, debt payoff, or your emergency fund.

You don’t have to do any math to see an accurate estimate of how much extra money you have available for achieving your financial goals. Can you see how this would accelerate your progress towards your goals?

You can also see a detailed breakdown of your spending against your spending plan. Monitoring this information is a great way to see if your spending habits are in alignment with your ultimate goals. How would you benefit from seeing this information every month?

For example, let’s say your financial goal is going on a vacation with your friends next year, so you need to save a specific amount of money. By using this tool, you can see if you’re on track to reach your goal in time.

Instead maybe you see you’re spending more money at restaurants than you intended to. If going on the vacation is more important to you, you can decide to spend less at restaurants so you can go on vacation.

However, if you weren’t tracking your progress, you may not have even realized you weren’t saving enough to meet your financial goal. Can you see how knowing this information would help you make better decisions so you can reach your ultimate goals?

Beat the Budget Tool – Setup

Your first step is determining how you want to spend your money. Housing is likely your biggest expense. Experts recommend spending no more than 30% of your salary to cover all your housing related expenses.

Another consideration is how much to allocate towards investments. The payoff of investing early is exponential, so consult this post when you’re deciding how much to allocate towards investments. Experts often recommend investing at least 10 – 15% of your salary.

Now you can decide what you’ll do with the rest. You will have some needs like food and transportation, and you will also decide what fun things you want to purchase too!

You can set these decisions on the setup page of the Beat the Budget tool.

Beat the Budget – Tracking

Once you have your setup complete, you will track your income and expenses in the data sheet. You can put in as much or as little detail as you’d like. Regardless of the level of detail you decide to include, make sure you’re entering complete and accurate information.

Your results on the summary page are a direct result of the data you entered.

How You Can Get Started Now

Whether you’re investing for early retirement or saving for a vacation, this Beat the Budget tool will accelerate your progress towards your financial goals!

It’s a one time investment that you can use for a lifetime. You can invest in yourself today to be where you want tomorrow. How would having this tool help you achieve your financial goals faster and easier?