There are thousands of ways to evaluate funds, but that’s the problem! When I was first determining how to choose funds, I analyzed over 16 metrics for hundreds of funds, which resulted in decision paralysis for 6 months.

Now even though I love analyzing financial data, I can think of better ways to spend those 6 months. Instead what if you could look at just 3 metrics in 5 minutes to determine if the investment is for you or not?

Here are the 3 best metrics I use now to quickly and effectively choose funds to invest in. Plus I’ll share 2 investing secrets your financial advisor doesn’t want you to know.

Before we jump in to analyzing my favorite kind of data (money data, duh!), please note, I’m not a financial advisor.

This information is for education purposes only. Every person has a unique financial situation. The best approach will be different for everyone. Accordingly, do your own due diligence before making any financial decision.

What is an investment fund?

If investment fund is a new word for you, it means a collection of stocks.

For example, a fund is like a bundle, such as the Hulu, Disney+, and ESPN bundle. Instead of getting just one item for your money, you get multiple. If you run out of shows to watch on Hulu, you’ve “diversified” your investment and can count on Disney+ to keep you entertained.

What’s the difference between a mutual fund and an index fund?

Two primary types of funds include mutual funds and index funds. While they both contain multiple stocks, a mutual fund has a fund manager, we’ll call her Amanda, actively buying and selling stocks on behalf of the fund.

An index fund has a fund manager, we’ll call her Paisley, who passively buys all the stocks and holds them.

An index fund mirrors its underlying index. It’s like Paisley peeking at the smart kid’s answers in elementary school.

An index fund copies the underlying index by holding all the same stocks.

Contrast this to a mutual fund or individual stock investing. That’s like when Amanda decides she’ll get better answers on her own, without glancing at the smart kid’s paper.

Will Amanda do better than Paisley? Maybe a time or two. But Amanda will certainly do more work and over the long run, Amanda will fail to consistently beat the smart kid and Paisley, since she’s copying the smart kid.

Amanda, the active mutual fund manager, charges more for her services. Accordingly, you expect her fund’s performance to beat Paisley, the passive mutual fund manager.

However over a 15 year period, business insider found 90% of active fund managers fail to consistently beat the standard index, the S&P 500.

Index funds say f*ck it, I’m going to save my time and money, copy the smart kid, and get better returns on average over the long term.

That’s why I only invest in index funds because I refuse to pay more for worse returns with mutual funds.

If you want to learn more about index fund investing, check out this Ultimate Index Fund Investing Guide.

How to choose funds using 3 important metrics

Underlying index

Think of the underlying index as a one sentence summary that explains what to expect from the fund, like a book summary explains the book.

Harry Potter: Harry, a teenage wizard must stop evil super villain Lord Voldemort from ruling the world – both magical and muggle.

Here are some descriptions of common indices you may find listed as part of the Fund Strategy when you search for funds. Unfortunately the finance fund strategies don’t read like a novel.

You’ve likely heard about some of these, whether in the Wall Street Journal or your favorite rap lyrics.

S&P 500 Index contains 500 large U.S. stocks used as the benchmark for U.S. stock market performance.

Dow Jones Industrial Average contains 30 U.S. large blue chip dividend stocks.

Nasdaq-100 contains 100 large U.S. stocks, weighted heavily in technology.

CRSP US Total Market Index contains the total U.S. stock market including all size stocks.

Russell 2000 contains 2000 small U.S. companies. (FYI – Small companies mean a value of $250 million – $2 billion.)

FTSE Developed All Cap ex US Index contains developed international stocks of all sizes in major markets of Canada, Europe, and the Pacific.

FTSE Emerging Markets All Cap China A Inclusion Index contains stocks of all sizes from international emerging markets.

When looking at any index fund, I always start by first understanding the index it tracks as it’s the best clue to predicting what stocks the index fund holds. Remember, they just copy the smart kid AKA the underlying index.

10 year average annual return

If I had to guess, you want to invest because you want to grow your money. Me too.

That’s why I always evaluate the average annual 10-year return so I can estimate how my investments may grow over time.

I feel obligated to reveal even though we use the historical index fund performance to predict its future performance, it does not guarantee it.

The estimated return will certainly be wrong every single year, but we’re okay with those fluctuations over the short term. Instead we assume the average return over the next 10 years will match the last 10 years fairly closely.

If that assumption makes your stomach a little uncomfortable, like sitting in the backseat while your nephew drives for the first time, well, that’s why we diversify!

Let’s look at the S&P 500 for an example.

| Year | Annual% Change |

| 2022 | -15.65% |

| 2021 | 26.89% |

| 2020 | 16.26% |

| 2019 | 28.88% |

| 2018 | -6.24% |

| 2017 | 19.42% |

| 2016 | 9.54% |

| 2015 | -0.73% |

| 2014 | 11.39% |

| 2013 | 29.60% |

| 2012 | 13.41% |

The average 10 year return for the S&P 500 is 12.07%. All my type-A, love to be in control friends would much rather see a table of returns that look like this.

| Year | Annual% Change |

| 2022 | 12% |

| 2021 | 12% |

| 2020 | 12% |

| 2019 | 12% |

| 2018 | 12% |

| 2017 | 12% |

| 2016 | 12% |

| 2015 | 12% |

| 2014 | 12% |

| 2013 | 12% |

| 2012 | 12% |

Investing may feel more like a roller coaster than a drive through Illinois. Although, what you decide to invest in will play a massive role in how bumpy or smooth your ride feels.

Historically, if you are willing to ride the roller coaster, you’ll experience more high highs and more low lows, but it often comes with a greater reward.

If you feel more comfortable on a flat drive, you’ll likely trade those massive dips for lower overall returns.

What ultimately matters is getting to reaching your final destination, your financial goals. You should pick the path that does 2 things:

- Equips you to reach your financial goals and

- Gives you enough peace of mind to stay on the ride, even when you experience unexpected bumps along the way.

As a long term investor, I always look at the 10 year return, nothing shorter. If a fund does not have a 10 year return, I will probably not invest in it.

I remember my corporate finance professor explaining, “They discontinue the funds that do not perform well over the short term. If the fund has existed for over 10 years, it’s a good sign it’s meeting expectations.”

I also want to see a positive 10 year return for index funds. I will caveat, I’m a young investor, so I’ve never experienced an extended recessionary period. I suspect a recession lasting 10+ years could make the average 10 year return negative, in which case I would still continue investing.

If that happens, I would expand the time horizon for my average annual return calculation to have a better understanding of the returns over the longer term.

Net Expense Ratio

Lastly, like a good business woman, I must consider the costs too because ultimately my investing profit matters most.

I look at the net expense ratio. Especially if you’ve hired a financial advisor, you need to ask them about this for any funds they have you invested in. (As well as their overall management fee.)

I LOVE index funds because their expense ratios usually sit very close to 0%. For example, VOO, an S&P 500 index fund, has an expense ratio of .03%. That means for every $10,000 you have invested, you pay $3.

You can also look at the expense ratio by subtracting it from your average 10-year annual return. For example, our S&P 500 return (12.07%) – expense ratio (.03%) = total annual average return (12.04%).

I always aim to minimize expense ratios on index funds because as long as they track the same index, they are basically the same otherwise.

I choose funds that have an expense ratio of .25% or less because that’s what I learned from people who are smarter than me.

Mutual funds often have higher expense ratios, some even as high as 1%! (Quick math 12.07% – 1% = 11.07%).

While 1% may not seem like much, when we consider the time value of money, it adds up, see below.

| Index Fund | Mutual Fund | |

| Average 10 year annual rate of return | 12.07% | 12.07% |

| Expense ratio | .03% | 1% |

| Net average 10 year annual rate of return | 12.04% | 11.07% |

| Initial investment | $100K | $100K |

| Time | 30 years | 30 years |

| Value | $3M | $2.3M |

Over a 30 year period in the example above, that 1% expense ratio adds up to $700K. Like a good business woman, be very careful about letting seemingly small percentages cut your investing profit. That money should go to you, not the finance industry!

Not to mention, if you go with a mutual fund, the person trying to beat the smart kid (S&P 500) will probably fail over the long term. That means, you would likely get an average annual return less than the 12.07% in the example.

You tend to pay more for mutual funds to get worse returns.

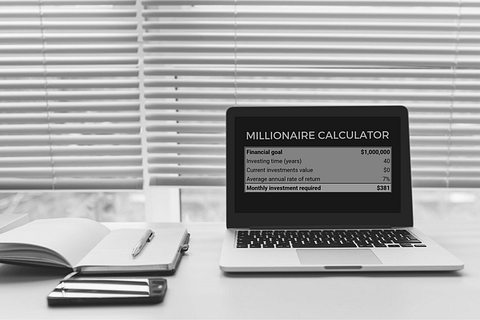

One more watch out – if you decide to hire a financial advisor, they may take another percentage for their management fee. Over your lifetime, that decision could cost you over $1 million, see the example below.

| Index Fund | Mutual Fund | |

| Average 10 year annual rate of return | 12.07% | 12.07% |

| Expense ratio | .03% | 1% |

| Management fee | 0% | 1% |

| Net average 10 year annual rate of return | 12.04% | 10.07% |

| Initial investment | $100K | $100K |

| Time | 30 years | 30 years |

| Value | $3M | $1.8M |

Most people don’t realize how much of their money goes to a financial advisor or financial institution because these fees are not typically obvious.

Because I want you to keep your hard earned money in your pocket, here are a few other cost metrics I always check as well.

- Transactions fees: Amount you pay every time you invest or sell a fund. (Success criteria: $0)

- Front-load fees: Percentage of your total investment value you pay to buy the fund, like paying a Troll to enter his bridge. (Success criteria: $0)

- Back-load fees: Percentage of your total investment value you pay to sell the fund, like paying a second Troll to exit his bridge. (Success criteria: $0)

- 12b1 fees: “Marketing” fees, idk what that really means either. (Success criteria: $0)

Usually index funds don’t have these fees. I have not found an investment compelling enough to justify any of these fees to date. In other words, I have never invested in a fund with these fees.

How to choose funds conclusion

I choose index funds by evaluating 3 key metrics: the underlying index, average 10 year rate of return, and net expense ratio. With this information, I feel confident deciding an initial nay or yay. I will check out a few other metrics if the fund does pass my initial 3 metric screening criteria.

The purpose of researching funds is to feel confident with your decision and have peace of mind.

While you may decide to hire a financial advisor to help you choose funds, it’s still important you understand at least these 3 metrics for evaluating the funds they choose for you. No one cares more about your financial well-being than you do!

Often financial advisors come with hidden fees. We saw how just a 1% management fee could cut an extra million out of your investing profits over a 30 year period.

If this was helpful, you may also enjoy our free weekly email newsletter keeping you up to date with the latest financial news you can use. Join here.