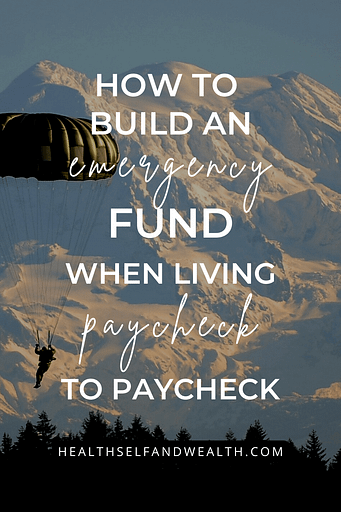

Having an emergency fund is like a skydiver having a parachute. “But what if I can’t afford a parachute?”

While personal finance experts typically define an emergency fund as savings to cover 3-6 months of expenses, it seems unattainable and unrealistic for those living paycheck to paycheck or close to it.

With surging prices and wages barely inching upwards, the traditional 3-6 month suggestion isn’t cutting it. How do you find money to save when you don’t have any money to save?

Saving money can be difficult. But it’s also difficult to rely on a credit card to cover an unexpected tire blowout.

Especially if you live paycheck to paycheck, saving money for emergencies is the best financial decision you can make.

Here’s how to build an emergency fund when living paycheck to paycheck.

- Understand your current financial habits

- How much do you really need in an emergency fund?

Please note I am not a licensed financial advisor. This information is for education purposes only. Every person has a unique financial situation. The best approach will be different for everyone. Accordingly, do your own due diligence before making any financial decision.

Understand your current financial habits

While external factors like skyrocketing prices and flat wages make it harder to save, you and I have little control over the external environment. Instead of focusing on the obstacles, this post will share specific steps you can take to transform your individual financial landscape.

Because in life we have two options: let life happen like watching a movie or act like the main character in our story because we have control over our outcomes.

Something tells me you’re the main character in your story. 😉

Regardless of your savings goal or current stage in your journey, let’s reflect on our current financial habits. If you use Beat the Budget or the Personal Finance Planner, you can pull your monthly incomes and expenses from there.

If you don’t currently track your incomes and expenses, you can look at your bank account or debt/credit card history from last month.

Once you know your monthly income and spending, find the difference to understand your monthly savings.

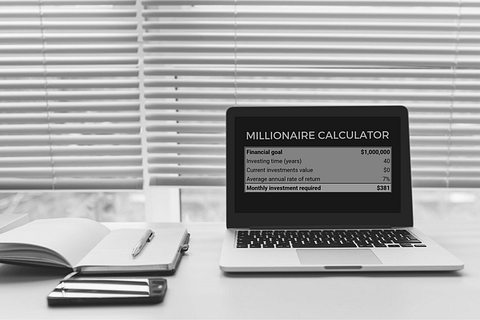

Your monthly savings is the single most important predictor of your financial success. Regardless of your income, spending less than you earn is the key to building wealth.

Right around now I often hear someone say, “Don’t I need to be making way more money for that?”

I agree, it should be easier to save when you have a higher income. However, half of six figure earners live paycheck to paycheck.

This proves earning more money does not translate to successfully saving money.

Instead, start learning the skill of saving money now, regardless of your current income.

There are 2 components of saving money:

- your income

- your expenses

The best way to start saving money is to start by tracking your monthly incomes and expenses. And of course, the difference, AKA your savings.

Sometimes I hear a resistance to tracking spending – and I blame Dave Ramsey. Unlike him, I’m never going to recommend that you forgo your cup of Joe or skip the guac.

Instead I encourage you to track your spending monthly. I also recommend manually tracking your own spending instead of using an automated app like Mint or Copilot because you’ll learn so much about yourself by inputting 10 back to back receipts from Chick-fil-A. (Your girl likes her extra pickles and the convenience!)

Society has also conditioned us to evaluate our spending as bad. Especially as women, the Dave Ramsey’s of the world berate us for spending on our nails, clothes, or beauty products. Ugh – I feel tempted to swerve on a tangent, but I won’t.

Instead, treat your spreadsheet or bullet journal spending tracker as a safe space. Just watch how you spend your money, without judgment.

Be kind to yourself like your kind to your best frenemy’s egotistical fiance because you don’t want to be uninvited from the wedding.

Once you understand your monthly earning and spending habits, you’ll also have a stronger understanding of what really adds value in your life. Through the process of tracking, many people also realize they were spending money in ways they didn’t realize or intend to.

This process will help you painlessly adjust your spending so you can reach your financial goals faster.

Shameless plug – here’s the Beat the Budget google sheets spreadsheet I created and use to save money. You could also create your own spreadsheet or use a bullet journal.

Because the first step to improving your financial landscape is understanding it.

How much do you really need in an emergency fund?

“I thought building 3-6 months of an emergency fund required making way more money so you can save. If my monthly expenses are $4,500-$5,000 and I make $5,500, it will take me many years to save for an emergency fund.”

I got called out for comparing a 3-6 month emergency fund to a financial parachute – and rightfully so!

I’m grateful this person shared specific numbers to put this into context. If you spend $5,000 a month, a 3-6 month emergency fund would be $15,000 – $30,000. If you earn $5,500 and spend $5,000, that means saving $500 a month.

At that rate, it would take 2.5 – 3 years to reach the recommended amount!

I also feel obligated to point out the typical US salary falls at $54,000, whereas $5,500 a month is a $66,000 salary.

But do you really need 3-6 months of expenses in an emergency fund?

Well I see an emergency fund as the financial equivalent of a skydiver’s parachute. Except no one willing takes a financial nosedive.

I want my “parachute” to protect me from two unpredictable financial risks:

- Losing my primary source of income

- Having a large unexpected expense

I also want to feel financial peace. To me that means I never want to worry about having enough money to pay my bills, even the unexpected ones.

Every person has a unique risk tolerance, so you’ll have to decide what you need to feel secure.

Here’s how I think about it. As you read this, consider how you feel.

Bare Bones Budget

If I lost my primary source of income, I would adjust my spending habits to a “bare bones budget”.

Here’s my current budget:

| Category | Monthly Goal | Notes |

| Housing | $1,250 | Rent, water, electric, wifi, renters insurance, phone |

| Food | $250 | Groceries |

| Health | $152 | Health insurance, vision insurance, other health expenses |

| Transportation | $120 | Gas, auto insurance |

| Entertainment | $150 | Restaurant, fun, travel, steaming, experiences, fitness |

| Supplies | $0 | Personal care, clothing |

| Business | $0 | |

| Other Expenses | $100 | |

| Total | $2,022 | This is your total estimated monthly expenses. |

For 2022, I’ve fallen within this +/- $300, although I suspect when I fill out my planner for October it may reveal higher spending than normal. Follow the TikTok or Instagram to see the update at the end of the month.

I would ruthlessly cut my spending like a bear fasting during winter hibernation. Here’s how my bare bones budget would look:

| Category | Monthly Goal | Notes |

| Housing | $1,250 | Rent, water, electric, wifi, renters insurance, phone |

| Food | $250 | Groceries |

| Health | $400 | Health insurance, vision insurance, other health expenses |

| Transportation | $120 | Gas, auto insurance |

| Entertainment | $0 | Restaurant, fun, travel, steaming, experiences, fitness |

| Supplies | $0 | Personal care, clothing |

| Business | $0 | |

| Other Expenses | $0 | |

| Total | $2,020 | This is your total estimated monthly expenses. |

Umm okay, I did that exercise, but it didn’t reduce my spending at all. I realized I wouldn’t have health insurance anymore if I lost my job. It looks like you can get on Cobra but that’s ~$400 a month on the low end, which I added in.

My “bare bones budget” still requires spending ~$2,000 a month.

Perhaps when you do this exercise, you’ll find you have expenses you could cut. Don’t forget to add back in health insurance if you’d need that.

If you could give up some spending, you could use your bare bones budget as the base for your emergency fund.

Unemployment benefits

I also think about how long it would take me to find another job. Or what I’d be willing to do to make money. (I’m talking about working at McDonald’s not selling pictures of my feet on the Internet!)

With my advanced resume writing skills, I’m confident I could find another job in 3 months at the longest.

I also never hear people talk about collecting unemployment if you get laid off.

Let’s include this as part of our financial parachute. The average maximum weekly unemployment benefit is $474.

If I got the max average benefit of ~$500 a week, it would be enough to cover my typical monthly expenses. (Although I doubt I would get the max.) I could collect this for 12 weeks or more, depending on the state.

If you earn any additional wages in a week, your unemployment benefits will be reduced in those weeks.

Benefits and unemployment duration vary by state, which you can see summarized here.

If you worry about losing your primary source of income, estimating your unemployment benefits may help provide some peace of mind.

Remember taxes do not automatically get deducted from unemployment benefits, so keep that in mind to avoid a surprise during tax season.

If you feel confident unemployment benefits could cover some of your expenses, perhaps that helps you feel more comfortable reducing your overall emergency target.

Medical expenses

Another large, unexpected expense comes from healthcare. Medical expenses can be ridiculous so it’s unrealistic to expect emergency savings to handle big big medical bills.

Instead, my plan is to negotiate and create a payment plan if unexpected medical expenses would exceed my emergency savings.

Other considerations

I don’t have kids, if things got super bad I could move in with my family. If I got really desperate, I could withdraw from my investment accounts. I do have more than one source of income.

Basically my financial parachute has more backup parachutes. Take some time to reflect on your own scenario to identify yours.

Decide how desperately you want to avoid pulling the backup parachute like moving back home. Figure out what amount feels right to you.

Conclusion

How to build an emergency fund when living paycheck to paycheck comes down to finding savvy ways to save money through tracking your habits and lowering your savings goal to make it realistic.

Now I didn’t throw out a precise number for how much you really need in your emergency savings because I don’t know. You’re the only person who can decide what’s right for you.

But this analysis convinced me 3-6 months might be nice, but I understand it’s not realistic. If it’s not realistic, it’s not useful!

Set a goal that feels achievable to you. If you forced me to give you a specific number to aim for, I say $600. Because on average it costs $600 to replace 4 tires.

If you can’t afford tires in case of an emergency blowout, how will you get to work? (Unless you live in New York City, then just pretend you get my comparison.)

Start somewhere, whether you save $10 a month or $500. And track your progress towards your goal! (Beat the Budget will track your savings for you! 😉

Also finance is more fun with friends! Join the Wealth Women Club for once weekly newsletters. Think of it like the WSJ but if it came from your friends’ group chat.

Join the club here.