“If you have debt, you should never see the inside of a restaurant unless you are working in one,” says Dave Ramsey. Another nameless TikToker shares the “optimal” way to prioritize tax advantaged retirement accounts.

So often experts in the personal finance space, including myself on occasion, will share logical, optimal decisions. (Well, Dave may just be talking loudly.)

The flaw is it ignores the fact that we make decisions based on emotion first, not logic.

Most people describe me as logical as do I, so I resisted this notion for years.

At some point though, I realized making decisions based on emotion isn’t bad. (Although no wonder I thought that because of how society paints an “emotional woman”.)

While logical financial decisions are likely “optimal”, it relies on us executing with computer like precision and apathy.

Our emotions have a strong influence over our money decisions. Instead of resisting this, now I embrace it. I create financial plans that I feel confident and comfortable in because I realize if I don’t, the emotional impulse has a stronger influence than logic.

We don’t hear people talk about this as much, so here are 3 confessions of a money expert detailing how emotions have influenced my money mindset and decisions, even when logic disagreed.

I hope these 3 short stories will bring you comfort and peace of mind. And maybe the permission you didn’t know you needed to give yourself some grace.

- Short story 1: Midwest squirrel scarcity mindset

- Short story 2: Decision paralysis

- Short story 3: Imprisoned in a bar-less cubicle

Please note I am not a licensed financial advisor. This information is for education purposes only. Every person has a unique financial situation. The best approach will be different for everyone. Accordingly, do your own due diligence before making any financial decision.

Short Story 1: Midwest squirrel scarcity mindset

A scarcity mindset is the human equivalent of a squirrel stashing nuts for winter.

Often our past experiences with money shape our predominant money mindset.

I developed this scarcity mindset as a survival instinct at 19. (This is forward looking so I’m not sharing details, but if you want to know more, you can read my story here.)

At the time, the scarcity mindset served its purpose. I had to keep my expenses minimal to avoid living beyond my means.

But even when my financial situation improved and I had a stable income, I still felt like a midwest squirrel unconvinced winter had ended.

Thanks to my daily reflection, I could pull an exact quote from the day I felt ready to let the abundance mindset guide my actions instead of continuing to let the scarcity mindset dictate.

1/12/22

“All the advice I gave today applies to me. I am no longer in survival mode. I am leveling up to living and thriving. It’s not about pinching every penny, it’s about increasing my earning potential…” – me, Adley

Also this exercise and listening to Taylor Swift’s iconic Midnight’s album on repeat since the release sent me down a rabbit hole, so now here’s documented proof of where I was April 29th.

Although, on April 29th I began to plan the first vacation I’ve ever taken myself on. This vacation signaled my financial security to myself.

The scarcity mindset served me when I needed it most. But I had to learn to let it go, let go of the constant feeling of fight or flight, let go of worrying that one wrong move would knock down all my progress like dominos cascading to the ground.

January 12th I decided to let it go. Let go of the woman who struggled. Embrace the woman who stood strong in her place.

I feel like I must reveal this decision was not necessarily a logical one. Logically, I should have shedded the scarcity mindset June 14th, 2021. I had a stable income that would equip me to follow the formula for building wealth. I had a fully funded emergency fund. Heck, I even had 5-figures invested.

Biology explains this. We are high functioning animals. But just like animals, we make decisions based on emotion. I used to resist this notion, especially as a data analyst by day.

But by night I’m a writer. That’s why my daily reflection is one of the best decisions I’ve ever made for my well-being: financial, emotional, mental, and social.

For me, writing helps me process my emotions. Since we make decisions emotionally first, this helps me make better decisions.

I adopted the scarcity mindset out of an emotional survival instinct. I shifted into abundance through emotional healing.

This feels a lot like a journal entry, but hey, I’ll publish it anyway just in case you can relate.

Short Story 2: Decision paralysis

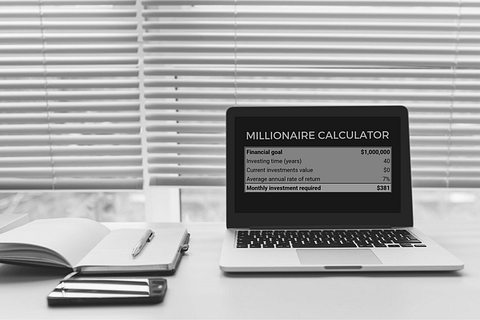

Ask any successful investor their biggest investing regret and every single one will make a remark along the lines of, “I wish I started sooner.”

Me too. I first felt an urge to invest at age 18 because we played the stock market game in high school. I mentioned it to my parents, but I didn’t get any useful guidance, so I gave up on it rather quickly.

Fast forward and 20-year old Adley sits in seat 227 of her corporate finance lecture hanging onto the suited professor’s every word about the time value of money.

Time value of money – a dollar today is worth more than a dollar tomorrow. Because inflation.

I learn to calculate the future value of money and realize just how much money I am losing by not investing.

You can thank this course for the magic formulas you see in the Financial Freedom Spreadsheet that estimate when you will reach financial freedom.

So do I invest after this course? Not yet. Even though my former Wall Street professor confesses that 90% of professionals fail to beat the S&P 500, I still hesitated to invest in his S&P 500 index fund recommendation.

In retrospect, I still didn’t feel confident. I still knew so little about investing! My worst fear was losing money.

Fast forward I’m 21 now, reading I Will Teach You to Be Rich by Ramit Sethi.

His book read like a step by step playbook for building long term wealth. I finished the book, then proceeded to research index funds for 6 more months before taking the leap!

I cringe writing this because I missed out on the Covid dip. I cringe harder as I admit, I ended up investing in an S&P 500 index fund.

I could’ve started over 1.5 years earlier.

Oh and I didn’t even feel confident when I made the first investment, even though I spent all that time researching it!

I started by investing a small amount, the financial equivalent of dipping just a toe in pool to test the waters.

My experiment with investing grew my comfort and confidence. I also wrote a step by step index fund investing guide blog post to help you gain investing confidence.

I have to remind myself now that if I waited until I felt fearless, I would never do anything at all. Instead I choose bravery, even though sometimes fear still comes along for the ride. Glennon Doyle taught me that’s okay.

I’m also learning to abandon perfection and embrace failure. I heard someone say, “If you do it perfectly the first time, you probably waited too long.”

Fail quickly to learn quickly. Or even better, learn from the mistakes of others, like you’re doing right now.

Keep this momentum going. Join our free Wealthy Women Club, the place I typically exclusively share my mistakes. It’s like getting the Wall Street Journal once a week, but if it came from your friends’ group chat.

See for yourself.Short story 3: Imprisoned in a bar-less cubicle

I’ve always been the straight A student. I may have an obsessive personality. I compete with the person I was yesterday, hard. Anna Sitar said some people are like sailboats and others are speedboats. While Anna is a sailboat, I’m certainly a speedboat.

I have goals. I have a general idea about what I want to achieve in the next 5-10 years and what my life looks like. I have no desire to slow my momentum, but if I can add more gas, why the hell not?

On June 14th 2021, the first day of my first full time job, I remember scanning the 4-story red brick building thinking, is this every day, for forever?

Within a week of my first role, I had a plan to retire early. I refused to remain trapped in a barless 6-foot cubicle.

I discovered the Financial Independence/Retire Early movement when I sought to learn all I could about investing in that 6-month span I mentioned earlier.

I used an early version of the Financial Freedom Spreadsheet and my trusty Personal Finance Planner to crunch the numbers.

Aha! If I invested 50% of my income and found a way to increase my income by an additional $3,000 per month, then I could retire by 30! If my income and investments remained the same, then I could retire around 37.

There was one major flaw with my plan that took me about 6 more months to realize. Even if everything went better than I could imagine, I still had to work for at least 8 more years!

While I think most people want to pursue financial freedom because they want to spend their time in a way that brings them joy, the actual decision to pursue financial freedom sometimes overshadows the initial intention.

Put another way, I made myself miserable shooting for this goal.

I didn’t realize the problem was not a 9 to 5. Instead it was the specific role. It turned out, I didn’t successfully pick my dream job right out of college.

But I didn’t want to admit that so early in.

I believed I was locked in that barless cubicle for at least 2 years. Because a career coach once told me that you should stay in a job for at least 2 years or it looks bad.

Glennon Doyle would remind us we are cheetahs, but we don’t have to let society keep us in cages, especially unlocked ones.

Not to mention, on average staying at a job for longer than 2 years means losing HALF your lifetime earnings.

I swear, employers make up these rules to keep us behaving in our unlocked cages.

With a lot of pushing from my sister, who always looks out for me, I finally acknowledged my job was the source of my misery (as well as me for taking it too seriously).

I started looking for new jobs with higher compensation, less pressure, and a better work life balance.

I found it. I love my new job and company now. Well as much as an independent soul like me could ever love working for someone else.

Now I’ll add, I also decided to make a personal switch when I switched companies. As much as I didn’t like my previous external environment, my happiness is only ever in my own hands. I have control over my own happiness.

I promised myself I would never put my work over my own well-being again. Because the company will always put the company first. I must do the same for myself.

This mindset shift has helped me maintain a greater sense of peace, despite the business world always having emergencies as if we’re doctors saving lives in the ER. (Spoiler alert: It’s never life or death.)

Oh and I’m still 100% pursuing financial freedom because if I haven’t explicitly said it yet, I want to have complete control over my own life.

But I’m no longer counting down the days to retirement. When I think about staying at this current company forever, I smile. I picture it, and it’s a good life.

There are so many things I want to do, I could fill 9 lives. But we only get one life. And I’m unwilling to give up any of my dreams.

Instead I’m willing to do what it takes to enjoy every moment, while actively building the lives I want to live.

Regardless of where I drive my speedboat, I’m going to enjoy my time, including the hours I sell to my corporation.

Conclusion

Money experts may share the most logical, optimal personal finance content, but often fail to recognize the predominant role emotion plays when we make decisions.

I hope hearing my 3 stories of emotional financial decisions, despite being a money expert, encourages you. You don’t have to make the most “optimal” decision every time to reach your goals.

Expecting that kind of perfection from yourself can lead to decision paralysis, which I experienced when it took me 3 years to begin investing.

Once I did begin investing, I went all in on the FI/RE movement and made myself miserable in the process.

Pursuing FI/RE also kept me in the scarcity mindset state, which held me back.

Above all, give yourself grace for the financial decisions you’ve made leading up to this point and going forward. Even the money experts don’t get it right every time.

If you liked reading my confessions, you would also like our wealthy women club with weekly email newsletters containing more confessions like this.

Join the club here, all genders welcome.