When I first started independently managing my own money at age 19, I felt like a sunken swimmer, fighting to resurface. Only, once I broke the surface, I discovered I was alone in the Atlantic, without a view of a ship or shore.

Before this point, I depended on my parents financially, particularly my bread-winning father, but that was no longer an option. I didn’t have a job, meaning I didn’t have any income. But I still had bills to pay.

I had to learn how to successfully make and manage money fast, with serious implications if I failed.

That’s when I decided to learn everything about personal finance. I refused to let constant financial anxiety, like a swimmer treading water lost at sea, become my permanent reality.

Over the last 5 years, I transformed my financial situation. Now money provides me with the greatest source of peace, as if the steps I took led me to my own private island.

If I could go back in time and throw myself a metaphorical life raft with words, I would tell my 19-year old self, “This obstacle won’t break you. It will create you.”

Now my mission is encouraging you, inspiring you, and sharing information to help you conquer your financial challenges too.

Because money gives us control over our own lives. It can either be our greatest source of freedom and peace, or the destroyer of it.

You already have all you need to improve your financial landscape within you.

I’m going to share my personal finance 101, step-by-step, process and information I used to transform my financial reality and reach my first $100K so you can do the same.

- Why does money matter to you?

- The formula for building wealth

- Put your financial well-being in your routine

Please note I am not a licensed financial advisor. This information is for education purposes only. Every person has a unique financial situation. The best approach will be different for everyone. Accordingly, do your own due diligence before making any financial decision.

Why does money matter to you?

Money doesn’t matter. Hot take from a personal finance writer, I know. It’s not the number in the bank account that’s important. Instead what money provides matters.

For me, money matters because it’s my freedom. It gives me complete control over my own life. Money matters to me because it’s how I have the means to spend my time however I want.

The opposite of freedom is dependence. In the past, I relied on other people to support me financially. It gave them control over me.

I still depend on an employer to give me permission to take time off, pay my bills, and provide health insurance.

Although as I mentioned earlier, I made it my metaphorical private island. It’s what the kids on TikTok would call, “f*ck you” money.

It means I choose to go into work every day. I don’t have to.

I feel guilty and privileged confessing this but at age 23, I could stop investing today and still have enough money to retire at the traditional age, 62.

If I continue on my current trajectory of funneling over 50% of my income into investments, I could retire early, permanently, in 14 years.

If I wanted to pack a backpack and travel the world, I could sustain myself for the next 4 years without making any more money during that time.

I only share this to inspire you, as money used to have me in a constant state of flight or fight and now it’s the single greatest source of my freedom.

Why does money matter to you?

It’s more than just a number in a bank account. It’s peace of mind. It’s freedom. It’s fun. It’s comfort. It’s convenience. It’s whatever you need it to be.

It’s important to understand why money matters to you because you’ll have to make hard choices. Building wealth is hard, but so is being broke. You get to choose your hard.

If you have a strong why, it can help you make the decision that aligns with your goals.

It also helps you avoid the common pitfall high achievers fall into: setting a new goal and never feeling satisfied with your achievements.

How can money equip you to live the life you want?

I strongly believe all financial goals should serve your ultimate life goals.

Read how to set financial goals using the million dollar question here.

The formula for building wealth

Now that you understand why money matters to you and you’ve defined your financial goals, I’ll share the proven formula for building wealth.

But first we have to distinguish between rich and wealthy with the short stories of Blair, Elena, and Rebecca. See if you can guess who’s rich and who’s wealthy.

Blair

She drives a midnight black Lamborghini Aventador to her mansion in the Hills wearing an all black power suit and stilettos paired with a one-of-a-kind designer purse that costs more than most people’s cars. She’s the CEO of a tech company earning over 7-figures a year and on the short list for Forbes 30 under 30.

Elena

She drives a beat up car from ‘05, hasn’t bought any new clothes in the last 5 years, unless you count her thrifting finds. She lives in a one bedroom apartment an hour away from the Gulf and earns a modest 5-figure income working in marketing.

Rebecca

She drives a caviar black Lexus RX with heated leather seats, lives in a 3-bedroom starter home in a Midwest suburb with a recently upgraded modernized kitchen, and makes 6-figures on her consulting salary.

Who is rich and who is wealthy?

Rich is what usually comes to mind when you think of someone with money. Blair is our rich woman in this example. She earns a lot of money, but her spending keeps up with that. Despite her luxe lifestyle and high earnings, she lives paycheck to paycheck. If something happened to her primary source of 7-figure income, Blair would be broke in seconds, unable to pay her bills.

When you hear wealthy, you may envision the same thing as rich. That’s a misconception. Wealth is often invisible. Elena, the thrifter, is our wealthy woman. Does this surprise you?

Looking at Elena, you’d never know she has 6-figures invested. Though she’s never had a high income, she always spends less than she earns and invests the rest. No, she doesn’t spend on luxury cars, but she has enough money to spend on what matters to her: traveling and experiences.

Money doesn’t own her. Instead money provides her complete control over her own life.

What about Rebecca? She’s actually not rich or wealthy. She’s broke.

While Rebecca has a high salary, she spends more than she earns to keep up with her friends, using her secret weapon: a credit card. While she earns over six-figures, she’s racked up six-figures in credit card debt.

Wealth means having enough money in the bank account that money is a source of peace, not anxiety.

Here’s the formula for building long-term wealth: Spend less than you earn and invest the rest.

Sounds simple, right? Although it’s certainly easier in theory than in practice.

Let’s break it down into its core components: budgeting, making money, and investing.

Personal finance 101: Budgeting

Why budgeting matters

Regardless of your income, spending intentionally is a critical, foundational skill. You will NEVER build long-term wealth without it.

Take Michael Jackson as an example of temporary riches, but never wealth.

How did that happen? He didn’t follow the formula for building wealth. He spent more than he earned. To keep up with the luxe lifestyle, he borrowed $380 million dollars and quickly blew through it.

More money doesn’t make you good with money. Instead it amplifies your current habits.

That’s why building good spending habits is a foundational personal finance skill for everyone, regardless of your income.

We’ll call this skill budgeting, or spending intentionally, throughout.

Emergency fund

The purpose of budgeting AKA spending intentionally is to provide financial peace of mind.

Having a financial safety net provides peace of mind.

In the personal finance world, your emergency fund is your safety net, like a skydiver’s parachute.

Experts typically recommend having 3-6 months of expenses saved in case of a financial emergency, like losing your primary source of income.

If that number doesn’t seem realistic for you right now, here’s how I would approach building an emergency fund when living paycheck to paycheck, or very close to it.

Decide what financial goals to prioritize in your budget

A spending plan starts with your financial (and lifestyle goals). Then you’ll create a spending plan that equips you to reach those financial goals while living the life you want.

As you create your spending plan keep in mind it’s not about minimizing your spending.

Instead it’s saving what you can for building an emergency fund, paying off debt, and investing.

Because these decisions build your wealth.

If you aren’t sure which financial goal should be your first priority, here’s what I’d consider:

- Paying off high interest debt (interest rates greater than 7%) would be my first priority because interest adds up quickly! Not to be dramatic but this is like a snowball rolling down Mount Kilimanjaro. Stop it before it snowballs out of control!

I’m not the expert on debt. Instead check out livingthatdebtfreelife.com for specific debt payoff information.

Typically high interest debt goes along with credit cards and spending beyond your means. The rest of this blog post will help with that!

- Build an emergency fund because it’s your safety net! If you’re not convinced yet, read more about why this is THE best financial decision.

- Invest/make minimum payments on low interest debt because if you’re running your finances like a savvy business woman, you intend to maximize your profit.

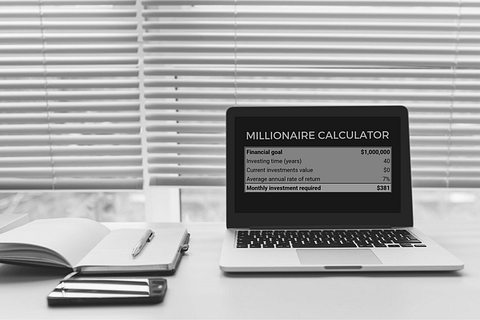

Investments typically earn a 7% average annual rate of return. This estimate is based on the S&P 500, or the 500 biggest companies in the U.S. Think Apple, Google, Amazon, Walmart, etc.

If your low interest debt is less than 7%, you’ll likely come out ahead by investing extra money instead of putting it towards your debt.

That said, personal finance is personal and it can feel like a bigger win to be completely debt free!

Ultimately, do what feels right to you because the best financial decision you make is the one that helps you sleep peacefully at night.

How to create a budget

The best approach for creating your first budget, AKA spending plan, is understanding your current spending habits.

Review the last month from your credit card/debit card/or wherever else you make transactions.

Pay attention to the overall types of things you spend money on, like housing, food, insurance, health, entertainment, etc.

Then, start tracking your money decisions each month. This includes your incomes, expenses/debt payoff, savings/investments, and net worth.

You can do this in a bullet journal or digitally in a spreadsheet. If creating your own spreadsheet sounds daunting, you can download the one I use here.

I’m not suggesting you restrict your spending with your budget. Instead track all the financial decisions that matter, so you can have an understanding of your current financial landscape.

As you do this, you’ll learn about your financial habits and what you truly value. As you learn, you can create your spending plan and let it evolve as you do.

The template I use makes this process easy with automatic visual summaries that only show you the decisions that have the biggest impact on your progress to your financial goals so you never have to feel guilty for getting the guac.

It also has automated and built-in prompts for reflecting on the month so you can figure out how you’ll get closer to your goals next month, while still enjoying life today.

Want more guidance on creating your first budget? Join the free 10-day budgeting challenge where you’ll take one step daily and end with your first draft of your first budget.Because budgets should evolve as you do!

Personal Finance 101: Investing

Why investing matters

Investing is really the only decision that moves the needle when it comes to building long-term wealth. By investing, I mean any financial decision that increases your net worth. This would include paying off debt, building your emergency fund, and of course investing in the traditional sense, like in the stock market.

Maybe I should back up. What is investing? It’s purchasing an asset that you expect to increase in value over time.

For example, if I had taken up investing as a hobby when I was in Kindergarten, I could have invested in Apple stock for 94 cents. Instead I kept that dollar in my bank account and it will barely buy me a Red Delicious apple now. Thanks, inflation.

If I had invested that $1 in Apple stock 18 years ago, it would be worth $148 now. That’s the power of investing.

Granted, I didn’t know about Apple stock or investing then. (I blame pre-school, teaching me the planets, including Pluto, instead of personal finance.)

But hypothetically, even if I did know about investing, how would I have known to pick Apple?

Well, I wouldn’t have known.

Even now with a few years of investing experience, I couldn’t pick a winner from a loser, much like my taste in men.

I know with certainty some stocks will win and some will lose, but if you made me guess which ones, I’d have as much accuracy as a blinded monkey throwing darts at a target while eating a banana.

That’s why I buy them all the stocks, knowing I’ll get some winners and some losers. This approach is called index fund investing. Index fund investing is the easiest and most effective way to invest, although your financial advisor probably wouldn’t tell ya.

But Business Insider reveals S&P 500 index funds outperform 90% of PROFESSIONAL FINANCE BROS over a 15 year period.

You can learn everything you need to know about index fund investing here, with the Ultimate Index Fund Investing Guide written for women by a woman. (Because learning about investing is more fun when we poke fun at the finance bros.)

Common investing myths preventing you from building wealth

If your personal finance journey was a Harry Potter story, the patriarchy is “he who shall not be named.”

Traditional personal finance advice shames women for spending money, even though men spend more money on average. (As they should because they make more so they have more to spend.)

You don’t usually hear experts shame men for spending on hobbies like playing golf, sports betting, beer, etc.

But god-forbid a woman buys new shoes, gets her nails dipped, or goes to Starbucks.

That misdirection is an intentional aspect required to keep the patriarchy in order. They don’t tell men to spend less because as long as you live below your means, it makes a negligible difference. Investing is what really matters. That’s what they tell men to focus on.

Because society doesn’t typically encourage women to invest, I often find these common investing myths disproportionately hold women back from investing.

If I sound frustrated, I am. Even after I had been learning about personal finance for 2 years, I still waited another 6 months after deciding to invest because I was so afraid I’d make a mistake.

So I’m going to debunk the most common investing myths I hear so you can have more information to make financial decisions with more confidence.

- Investing is risky! —> Keeping money in a bank account is a guaranteed way to lose money.

- I don’t have enough money to invest. → With low cost brokers, like Charles Schwab, you can begin investing with as little as $1.

- I could lose money! → You could, but the S&P 500 has always had positive returns over periods 15 years or longer. Here’s how I minimize investing risk.

- I don’t know where to start. → Join the free 10-day investing challenge to take learning one step at a time.

- I should just hire a financial advisor because they’ll do a better job than me. → Not necessarily… TLDR: financial advisors typically cost more for worse outcomes.

- I’ll just let my significant other manage this. → HELL NO!!! Money is freedom and money is control. Don’t give yours up. And if that’s not compelling enough, they may die one day and then where does that leave you?

Do you have any more questions about investing? Ask me them here and join the free Wealthy Women Club to see the answers published in our weekly email newsletters.

It’s like the Wall Street Journal, but if it came from your friends’ groupchat.

Personal Finance 101: Making Money

Now this is where we get to have some fun. There’s a limit on how much you can cut your spending, but there’s no limit to how much you can earn. (Have to say, that’s what appeals to me about entrepreneurship. As Cardi B would say, no limit.)

I’m a big proponent of diversifying whenever possible, including your income. If you only depend on one source of income, like most people do, you have more to lose in the event that income stream dries up.

I’m 23 and have 4 sources of income, although I largely still depend on my salary to cover my expenses.

I make the most of my 9 to 5 leveraging what I call my money making loop. I invest 50%+ of my income into the stock market for my income stream #2. Then my money continues to grow and work for me.

While I think it’s great to have a side hustle, it’s also not for everyone. Even “passive income” doesn’t truly start out as passive as it often requires initial work and trial and error.

If ownership calls to you like it did for me, check out these 99 passive income ideas.

Sometimes the easier path can be missed. That’s why it’s important to get all you can from your day job. Advocate for yourself. Ask for raises that align with your market value.

Job hop if needed to get your market value. Forbes found that staying at a job for longer than 2 years can cause you to miss out on half your lifetime earnings because many companies keep current employees wages behind market rates.

Write a compelling resume that positions you to win in a competitive labor market. Here are 3 tips to write a resume like Google’s CEO so you can land roles at your top companies, even in competitive job markets.

To summarize, here are 5 ways to increase your income.

- Negotiate a raise

- Accept a new higher paying job

- Work a second job

- Start a side hustle/business

- Make money while you sleep (invest)

Put your financial well-being in your routine

Make building strong financial habits a part of your routine.

1) Start tracking your financial decisions, with the Personal Finance Planner, bullet journal, or another method of your choosing.

2) Join a free community dedicated to reaching financial goals while living our best lives so you have support on your financial journey. (Yes it’s called the Wealthy Women Club, but all genders are welcome.)3) Follow Health Self and Wealth on TikTok, Instagram, and Pinterest to make reaching financial peace a part of your daily routine