We may be adults now, but that doesn’t mean we automatically know how to invest our money, especially when most of us have never been taught.

Even if our parents did teach us, it’s not always relevant guidance anymore in this current economic landscape as today’s real wages have the same purchasing power as our parent’s had in their teens. Not to mention the impending climate crisis and other societal problems we’ll address in our lifetimes.

All we want is to learn how to invest so we can reach our life and financial goals, but we don’t know how to plan for all the unprecedented uncertainty our futures may hold.

I’m in the same boat, which is why I’m sharing how you can reach short and long term financial goals without needing to predict the future by investing strategically in the best investment accounts for young adults.

- Learn fundamental investing terms

- Investing for short term and long term financial goals

- How to plan for uncertainty

- Best investment accounts for young adults

- Conclusion

Please note I am not a licensed financial advisor. This information is for education purposes only. Every person has a unique financial situation. The best approach will be different for everyone. Accordingly, do your own due diligence before making any financial decision.

Learn fundamental investing terms

While no one can predict precisely what the future holds, there are two financial certainties.

1. You will NOT reach your long term financial goals without investing. I can just hear you thinking, “what about lottery winners?” Well, over 2 out of 3 winners run out of money in 5 years or less, even if they win $1 million.

This proves even if you accidentally come across a big sum of money that doesn’t mean you’ll know how to keep it. That’s why it’s so important to learn how to invest successfully. But you’re here learning, which already makes you above average.

2. Money in a savings account will lose its value over time due to inflation. That means a dollar tomorrow is not worth as much as a dollar today.

Investing combats inflation. See the example below comparing saving or investing the same amount of money every year for 40 years.

| Savings | Investing | |

| Annual amount | $6,000 | $6,000 |

| Time | 40 years | 40 years |

| Total amount saved over time period | $240,000 | $240,000 |

| Average annual rate of return | 0% | 10% |

| Future value | $240,000 | $3 million |

| Average annual inflation rate | 3% | 3% |

| Inflation adjusted future value | $140,000 | $1.3 million |

Inflation will steal your wealth, but you won’t let it since you’re learning how to invest. It all starts with selecting an investment account.

What is an investment account?

Think of an investment account as a purse. A purse holds your items like an investment account holds your investments.

To invest successfully, you will need both an investment account and investments.

What’s the difference between Roth and Traditional investment accounts?

Roth and Traditional describe how specific investment accounts get taxed, particularly the IRA and 401k.

Said another way, Roth and Traditional are NOT investing accounts, they just describe how investment accounts get taxed.

For example, if you said, “I maxed out my Roth this year,” it would be like saying “I bought a gray this year.”

Instead you would say, “I maxed out my Roth IRA this year!” or “I bought a gray purse this year!”

This nuance matters so you can effectively speak the language of investing.

Investing for short term and long term financial goals

We invest differently for our financial goals depending on how much time we have until we need the money again.

For example, we’ll choose a different account for a home down payment we’ll use within the next 2 years than we will for retirement in the next 40 years.

Short term financial goals

Short term financial goals would include large purchases you expect to happen within the next 1-2 years. This could include a trip to Europe, a new car, etc.

When the time comes to use the money, you need easy access to the funds and peace of mind that the money will have the same value (or greater value) than it does today.

Long term financial goals

Long term financial goals would include events that are 10-15+ years away like retirement, financial freedom, etc.

It’s not as important that you can instantly access this money because you plan to invest money for the long term like Dumbledore making a deposit at Gringotts.

You want this money to grow significantly for as long as you can to take advantage of compound interest, or as Albert Einstein would say, “the eighth wonder of the world.”

Mid term financial goals

Mid term financial goals would include large purchases you expect to happen sometime between the short and long term goals. This could include buying a home, acquiring a small business, etc.

Considering time horizons

These time periods are not set rules as investing inherently has uncertainty. The point with investing is to have more money than you started with at the end of your investing time period.

I think about my time horizons knowing the S&P 500 has had positive returns for every 15 year period in history.

The S&P 500 consists of the 500 largest U.S. companies and benchmarks the market. Think Amazon, Google, Microsoft, etc.

If you plan to invest for 15+ years over the long term, historical data suggests a high likelihood of positive returns. However, historical outcomes do not guarantee future outcomes.

Investing is managing risk. You get rewarded when you take a risk and it pays off.

For shorter term goals, also consider when you’ll need the money. Do you need it exactly on April 29th, 2025?

If so, you may not feel comfortable investing that money. I personally wouldn’t. I’d feel more comfortable putting it in a high yield savings account or something with basically no risk of losing money (unless we consider losing value to inflation).

However, if you need the money in 2 ish years, but you have flexibility, then maybe you feel comfortable with a little more risk.

For example, maybe Ashley wants to buy a home in 2 ish years, so she’ll need money for a down payment. However, she doesn’t need to buy the home at a certain time. She also doesn’t want to miss out on investing gains from the lump sum sitting in a savings account earning 0.00002671% interest.

Ashley knows she only loses money in the stock market if she sells her investments at a loss. (Or individual stocks and crypto could go to zero, but that’s why Ashley and I like index funds because they don’t have that risk.)

Ashley may feel comfortable investing her home down payment, if she feels okay with waiting, potentially 15 years if needed so she doesn’t have to sell investments at a loss. If she doesn’t feel comfortable waiting that long, then she may decide not to invest the money.

I don’t consider a high yield savings account to be an investment account, but again that’s where I personally would feel comfortable with money in this example.

Cash you need ready to deploy within a short time frame, 1-2 years, maybe more, consider a high yield savings account or something similar.

You have your own unique risk tolerance, so you’ll have to evaluate what feels comfortable for you.

How to plan for uncertainty

The challenging thing is we are young adults! If you’re like me, your future dreams may evolve as you do.

For example, when I was 5, I always pictured moving to L.A. I never could’ve guessed I would learn how taxes work, realize I value financial freedom more than warm weather year round, and move to a low cost of living city instead.

I love the life I created and continue to create for myself. But even 5 years ago, I never would have guessed I would want to be in a midwest low cost of living city.

The point is we don’t always know what we’re going to want tomorrow, let alone 5 or 15 years from now.

That’s why we must build flexible financial plans that can adapt as we do.

Take a moment to think about your own financial goals. Based on how you feel today, what financial goals do you have? Make sure you remember to include retirement! (Unless you want to work forever…)

Write them down, on paper or your phone.

There’s something powerful about translating the dreams in your heart into manifested words on paper (or your Notes App).

As you read through the next section about investment accounts, consider if the investment account could help you reach any of your goals.

Best investment accounts for young adults

The most common investment accounts include the IRA, 401k, Brokerage, and HSA. Here’s a high level overview of what I call the superpowers and Achilles’ heels of each.

I’m also including a high yield savings account, even though I don’t consider it an investment account because it’s a viable option for reaching short term financial goals.

| Account | Superpower | Achilles’ heel |

| IRA | Tax-advantaged | Annual maximum contribution |

| 401k | Employer match | Rules dictating when you can withdraw the money penalty free |

| Health Savings Account (HSA) | Triple tax-advantaged | Requires a compatible high deductible health plan, which is not accessible to everyone |

| Brokerage | No rules baby! (no contribution limits or rules on when you can withdraw the money) | Not inherently tax advantaged |

| High yield savings account (HYSA) | No losses* | *except to inflation |

The best investment accounts for young adults will certainly depend on your unique financial situation.

However here is some additional context to help you consider what investment accounts best fit your needs.

As always do your own research before making any financial decision because you must feel comfortable with your decision to stick with it.

High Yield Savings Account (HYSA)

For me, this is the only account I’d consider for short term goals, unless I felt okay with NOT fulfilling the short term goal in the event I’d have to sell my investments at a loss.

Health Savings Account (HSA)

If you have a high deductible health plan, consider an HSA. No one ever wants to anticipate having high medicinal expenses in the future, but in America, medical expenses are a leading cause of bankruptcy.

Qualified single young adults can contribute $3,850 a year. You can then withdraw the money tax free anytime for qualified medical expenses.

This account is debatably the best undercover retirement account because you can invest the money in this triple tax advantaged account.

I intend to max this out every year I’m eligible in my 20s by contributing $3,850 every year for a total of $154K over my lifetime. I also pay for my medical expenses out of pocket, but save the receipts.

I do this for 2 reasons:

- I don’t want to disrupt my growing investments.

- You can reimburse yourself for qualified medical expenses anytime after you open your HSA.

So the eye doc appointment I had this year? I can pay myself back when I’m 50.

But because I’ll leave thousands of dollars growing in this account, I’ll expect to retire with ~$800K in this account, assuming a 7% annual rate of return.

Hopefully that’s enough to cover my medical expenses for life. If it’s more than I need for medical expenses, I will use it in retirement and just pay taxes on the withdrawals.

The HSA works well for short, mid, and long term medical expenses, as well as long term financial goals like retirement.

401k

If you have an employer match, this gets factored into your total compensation and you miss out if you don’t get it! However, you usually aren’t fully vested in this match until a certain number of years. Look into your 401k policy and evaluate if it’s right for you.

Even if you end up leaving before you’re fully vested in the match, the 401k is still a great option because it provides tax advantages. Put a fun way, while the employer match is icing, I’d still eat the damn cake if it didn’t have icing on it.

Last year, I invested in a traditional 401k so I could get my max match, reduce my tax bill, and invest the tax savings.

Now I have a new job and a Roth 401k. My new employer does not have a 401k match, but I still plan to contribute the max I can to take advantage of the tax-advantaged investment account.

To this day, I’ve read a lot of analysis on Roth vs. Traditional 401ks and I still don’t have a strong opinion about the superior account. Typically experts recommend a Roth 401k for young adults so you have tax free gains in retirement. Traditional accounts may only possibly beat the Roth 401k if you invest the tax savings.

The best account varies greatly depending on your future earnings in retirement and future tax code. It’s an impossible mission to predict that accurately, so some people contribute to both to diversify their investment accounts.

You can’t easily access money in your 401k until your 59.5, so this account fits better with long term financial goals like retirement.

Roth IRA

For single filers who make $6K – $140K a year, the Roth IRA is my favorite investment account.

You have more control over this account than the 401k or HSA because you pick your own broker. This means you have more investment options and can minimize fees, especially if you select a low cost broker like Vanguard, Fidelity, or Schwab.

However, others may prefer the simplicity of having fewer options in a 401k or HSA.

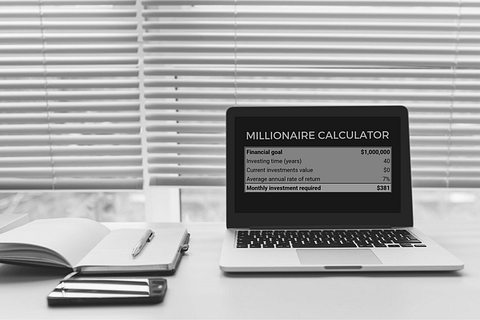

If you max this account out every year in your early 20s and get an average annual rate of return of 7%, you’ll be on track to retire as a millionaire. You can withdraw all that money tax free baby!

If you want to estimate when you’ll become a millionaire, download your free millionaire calculator here.You also can withdraw your contributions 5 years after you first opened the account. This does limit how much your account will grow to but it would still be better to do this than not invest in your Roth IRA at all.

The 5 year rule gives this account more flexibility for uncertainty than the 401k, which is another reason I like it so much for young adults.

You can access the gains tax free when you turn 59.5. This account is best for long term financial goals.

You can only contribute $6,500 to this account in 2023. The government wants to limit the millions of tax free dollars withdrawn in 2063.

I’ve never considered the traditional IRA because a $6,500 tax deduction doesn’t excite me more than having a million tax-free in retirement. I’ve studied personal finance daily for the last 4 years and I’ve never heard anyone suggest a traditional IRA for a young adult.

Brokerage Account

Lastly, the brokerage account appeals to many young adults because we don’t always know what we will want in the future, even when we think we do! This account gives us flexibility, freedom, and more control over our own lives.

You will likely pay taxes on withdrawals but as long as you hold the investment for over a year, it’s less taxes than you pay on your 9 to 5 income. Also so often we get hung up on paying taxes but it’s always better to pay taxes than not invest at all because paying taxes means you made money!

You can withdraw money from this account anytime, making it good for mid and long term goals.

I never plan to contribute anything to my brokerage account. But I impulse buy investments when I have extra money in my savings account instead of going online shopping.

I have the most money in my brokerage account because there’s no limit on how much you can invest in a year.

I like this because maybe 10 years from now I’ll decide to travel the world for a year. Or start a business to rival Musk in the race to space.

This brokerage account will give me the financial freedom to do whatever the f*ck I want.

Investment accounts I prioritize

You know your financial situation better than anyone else so choose the investment accounts that feel right to you! You can’t go wrong as long as you are investing. You can always open another account later if you change your mind.

I personally like to choose at least 1 tax advantaged retirement account (HSA, Roth IRA, 401k) to prioritize for my long term goals like retirement. I also like to contribute to a brokerage account so my financial plan is flexible when inevitably what you want changes. (And if my plan never changes, no harm done!)

For most people, unless you’re in the top 1% class bracket, your biggest expense throughout your lifetime will be taxes. (The wealthy don’t pay taxes, you do.)

That’s why I prioritize tax advantaged investment accounts first because they legally let me keep more money in my pocket instead of getting sucked into Sam’s debt ridden pockets like a black hole.

Summary comparison of best investment accounts for young adults

| Account | IRA | 401K | HSA | Brokerage |

| Tax Advantages | Traditional: don’t pay taxes on your contributions, pay taxes on your withdrawals and investing gains Roth: pay taxes on your contributions, don’t pay taxes on withdrawals or investing gains | Traditional: don’t pay taxes on your contributions, pay taxes on your withdrawals and investing gains Roth: pay taxes on your contributions, don’t pay taxes on withdrawals or investing gains | Never pay taxes on your contributions, gains, or withdrawals as long as the money is used for qualified medical expenses. | Capital gains taxes (link to the brokerage account article) |

| 2023 Contribution limits for young adults | $6,500 | $22,500 | $3,850 | No limit |

| Age funds are easily accessible | Penalty free withdrawals allowed at age 59.5. exceptions for qualified reasons. | Penalty free withdrawals allowed at age 59.5. exceptions for qualified reasons. Otherwise there’s a 10% penalty fee and taxes. | Anytime for qualified medical expenses. | Anytime! |

| Other cool things | Roth IRAs: You can withdraw your contributions anytime after you’ve had the Roth IRA for at least 5 years. | Employer match | At age 65, you can withdraw the money for any reason, penalty free, although you will have to pay taxes on it. (Essentially this makes it comparable to a Traditional IRA or 401k) | You have more options with a brokerage account: the investments available, when and how you use the money, what brokerage you decide to use, etc. |

| Where would this account be? | Brokerage of your choice | Your employer | Your employer, most likely | Brokerage of your choice |

This is not a comprehensive list of all investment accounts and their rules. Please visit the IRS website for more details.

Conclusion: Best investment accounts for young adults

As long as you’re investing, the best investment accounts for young adults could be any of them! However if you choose to prioritize tax advantaged accounts for your long term goals in your 20s, over time that could save you a million or so in taxes compared to a brokerage account.

The main con with the taxed advantaged accounts is it ties up your money more so than a brokerage account. Think of tax advantaged accounts as being for your retirement. Think of the brokerage account for mid-long term goals before you turn 59.5.

For short term goals, consider keeping the money in a high yield savings account instead of an investment account! You never know what the market will be doing and the guaranteed way to lose money in the stock market is selling at a loss.

You can also choose multiple investment accounts based on what best equips you to reach your financial goals. Having a variety of accounts gives you more flexibility and protection against uncertainty.

Once you decide what investment accounts to use, you’ll need to select a broker if you’ve chosen a IRA or brokerage account. I like low cost brokers like Vangaurd, Fidelity, and Schwab because they tend to have the lowest fees, which means more money stays in your pocket instead of going to a big financial institution.

Once you have your investment account, you’ll have to transfer the money and buy investments. (Remember the investment account is the purse, the investments are what you put in the purse.)

I personally like index funds because they have less risk than individual stocks and compared to mutual funds tend to have lower fees and higher returns over the long term. Here’s a complete index fund investing guide plus 3 metrics I use to evaluate funds.

I’m so excited you are on a journey to improve your financial well-being with investing. If this was helpful for you, you may like our other personal finance resources all aimed at making you a wealthy woman in your 20s.

The best place to start is by making your financial well-being a part of your routine by joining our free wealthy woman club. You’ll get weekly emails summarizing the best personal finance news you can use so you won’t miss out on information that will build your wealth.

It’s completely free, no spam, and we won’t share your email with anyone else. Sign up here to check it out.If you decide it’s not for you, you may unsubscribe anytime. Although 99% of our Wealthy Women Club community stays!