Do you worry every month wondering if you’re going to have enough money left in your bank account to pay your bills? Or do you wish you could spend as little time as possible thinking about bills? If you answered yes to either of those questions, you may benefit from automating your finances. When you automate finances, you will get peace of mind knowing you’ve set yourself up for financial success.

Automate finances to set yourself up for success

Automating your finances gets you on track to reach your financial goals, effortlessly. It keeps you from paying overdraft fees or late fees on bills. The best part is that you set it up once and you can have peace of mind going forward.

You’ll no longer have to agonize over whether or not you’ll have enough money to pay your bills each month. This method allows you to set a plan that works for you and stick with it.

Elements Involved to Automate Finances

Here are some common aspects of a typical financial system. You don’t need all of these, and you may have some aspects that are not on this list.

- Paycheck/income

- Checking account

- Savings account

- Investment accounts (e.g., 401(k), IRA, HSA, brokerage, etc.)

- Credit card/debit card

- Bills (e.g., rent/mortgage, utilities, phone, subscriptions, etc.)

Think about your own financial landscape. What is a part of your current financial system?

Tips for Making Automation Easier

There are few things that make automation easier.

- Having a consistent paycheck or income.

- Having all bills due on the same day.

- Understanding your money habits.

Consistent Income

Having a consistent income makes automation easier because you can anticipate how much money you’ll earn each month. If your income isn’t consistent, we will go over what you can do to set yourself up for success. Depending on your unique situation, you may decide to use less automation than someone with a consistent paycheck.

Consistent Bill Due Date

Having all your bills due on the same day is a game changer for automation. This reduces the time you have to spend thinking about money each month. It also makes it a million times easier to successfully automate finances.

If your bills are not all due at the same time, you can contact the company to adjust when your bills are due. I personally have all my bills due on the 1st each month, which makes it easier for me to automate payments.

Understand your money habits

Understanding your money habits also helps you create an automate finances in a way that works for you. For example, I know exactly how much money I spend on a typical month and what I spend it on. That’s because I’ve been tracking my spending habits for years. This is helpful because I can predict how much I will spend next month too.

If you don’t currently track your habits or if they vary greatly from month to month, I will share tips on how to make automation work for you.

Automate Your Finances

There’s more than one way to automate finances. The most important thing is to understand your own money habits. This will ensure you create a system that works for you. I’m going to share the way that works for me.

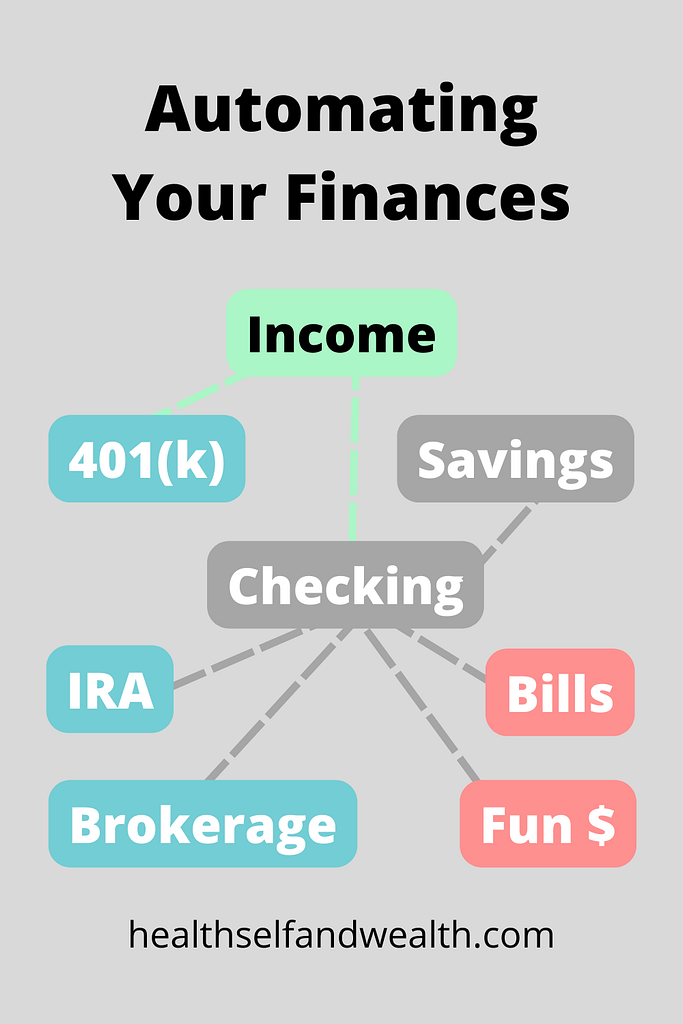

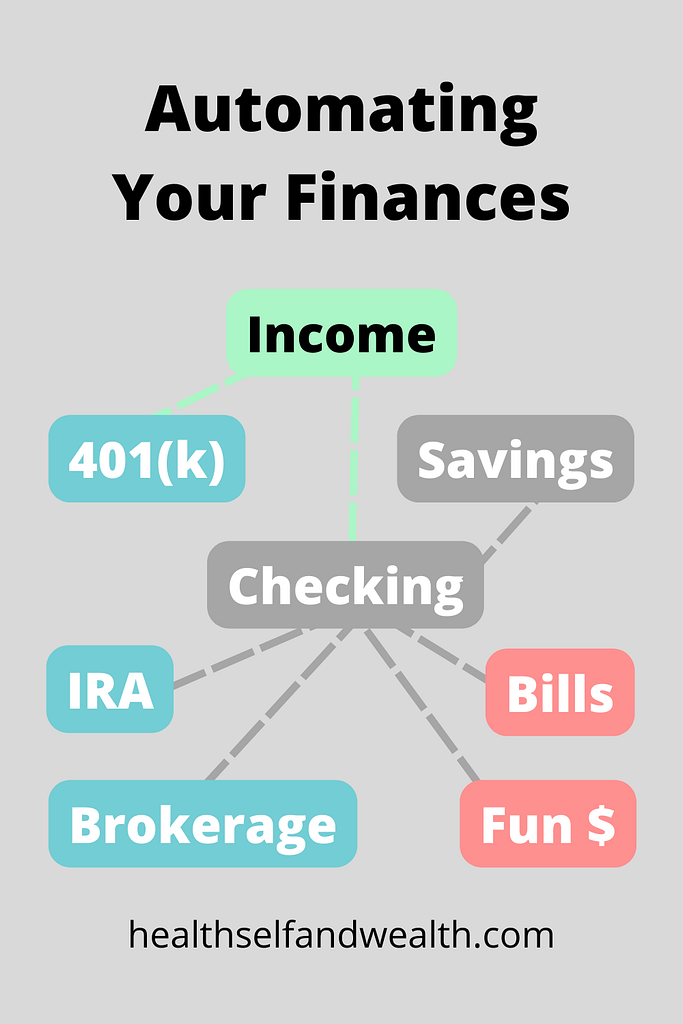

At a high level, this is how my money flows. It starts with my paycheck. I automatically invest a % into my 401(k) and the rest goes into my checking account. My checking account is at the center of my automation system.

From the checking account, it goes several places: investment accounts, savings account (AKA my emergency fund), and bills.

A Buffer

I always keep a buffer in my checking account. This ensures I have enough money in the account to pay the bills and fund my investment accounts. This prevents me from paying overdraft fees if I’d spend more money than I have in the account.

How much money you keep as a buffer will depend on your financial situation. I spend very consistently month to month and I earn consistently month to month. Accordingly, since my situation is highly predictable, I don’t need as much of a buffer. I keep about half of my monthly expenses as an extra buffer in the account to ensure I don’t pay overdraft fees.

If your income or expenses vary greatly, keep more money as a buffer. You may want to keep a whole month of expenses or even more as a buffer. The buffer should be large enough that you never worry about not having enough money to pay your bills.

The buffer will give you peace of mind to confidently know each month you’ll have enough money to pay the bills.

A buffer is different from an emergency fund. An emergency fund is money that is set aside in case of an emergency. Typically you’d keep your emergency fund in a savings account, which is what I do.

The buffer is just extra money I keep in my checking account to ensure I always have enough to pay my bills each month. An emergency fund is for true emergencies only (medical, car repairs, etc.) and stays in a separate account. You can learn more about an emergency fund here.

How to Automate Finances

There are a few key dates when I schedule money to move where it belongs. I get paid twice a month and I pay bills once a month. For example, I get paid on the 15th and 30th. My bills are due on the first each month.

I have all my bills on autopay. The amounts automatically come out of my checking account on the first each month.

I would NEVER have to look at my bank accounts or bills every month. (Not that I’d recommend that, but you don’t have to worry about forgetting to pay a bill.) It’s all automated and taken care of.

I also have my investments automated too. Every month on the first, money transfers from my checking account to my investment account.

Then from my investment account, I have automatic investments setup. That means once the money goes into the account, it automatically purchases investments.

Remember, you have to buy investments with the money you transfer over to invest. (Otherwise you just have cash in an investment account.)

Bonus automation tip to help with intentional spending

One thing that can be difficult for people is not to see the money in your checking account and think that’s all available for you to spend. If you relate to that, you can set up additional automation to set yourself up for success.

My number one tip for you would be to get a second checking account, one that is specifically for your fun money only. (As long as there are no monthly fees with having this account or minimum balances.)

When you schedule your bills to pay, also schedule your fun money to transfer into this new checking account. That way each month you can see exactly how much money you have available to spend on fun things for yourself.

By keeping it in a separate account, you will give yourself peace of mind knowing exactly how much you have available. Then you don’t have to worry about spending money that you needed for paying bills instead.

Conclusion

Automating your finances can give you peace of mind, help you reach your money goals, and make your life easier. You can automate finances based on what works for you based on your unique situation.

Ensure you automate finances in alignment with your habits to make reaching your goals effortless.

Even though I automate finances, I monitor the system once a month. I track my incomes, expenses, investments, and net worth to ensure I’m making the progress I want towards my money goals. You can steal the exact template I use each month for this here.

What can you automate today to give yourself a greater sense of financial peace?