Think of diversification the way that guy thinks about “dating.” If he’s only talking to Blair, then he has a high risk he may not get a response to his 2am “u up?” text. That’s why he diversifies his “investments” into Blair, Serena, Jenny, and Vanessa.

Diversification lowers that guy’s risk of not getting laid, and as an investor, it lowers your risk of not getting paid.

When you don’t have diversified investments, your investing strategy relies on perfection. I personally like to create plans that will allow me to reach my goals even if the unexpected happens.

Keep reading to learn why diversification matters, how I use it to increase my odds of “winning”, and how I built a diversified index fund portfolio.

Please note I am not a licensed financial advisor. This information is for education purposes only. Every person has a unique financial situation. The best approach will be different for everyone. Accordingly, do your own due diligence before making any financial decision.

- What is diversification and why does it matter?

- The role diversification plays in my investing strategy

- How I built a diversified index fund portfolio

What is diversification and why does it matter?

So what is investing diversification? Diversification means owning a variety of investments with fundamental differences. For example, stocks and bonds, U.S. investments and international investments, large companies and small companies, etc.

Diversification takes many forms, but it’s essentially the financial execution of “not putting your eggs all in one basket.”

Often when you hear people talk about investing and diversification, you will hear conversations about the S&P 500.

Sometimes people will refer to S&P 500 index funds as diversified. It is, compared to individual stock investing. That’s because the S&P 500 contains the top 500 companies in the U.S. across all industries from big tech to energy.

You now have 500 eggs in your basket, as opposed to a handful with individual stock investing.

But is this diversified enough? Well only you can answer that question for yourself, but for me it’s not.

The role diversification plays in my investing strategy

I share my approach so you can see how I evaluated my risk tolerance and goals to develop my investing strategy.

Your own investing strategy will likely be different since every individual has a unique goal and risk tolerance. I also should mention your age/time until retirement will also impact how you decide to diversify.

My investing strategy: consistent long term investments into low cost index funds.

Diversification plays a crucial role in my investing strategy. My diversified index fund portfolio is one of the reasons why the panic in the stock doesn’t keep me up at night.

I use diversification for two reasons:

- Managing risk

- Leaving room for error over the long term

Now my super savvy readers may have noticed, I didn’t include maximizing my return as a reason. That’s because historical data suggests this approach will get lower returns than the S&P 500.

Instead, it will reduce my risk and allow room for error. My goal isn’t to “win” with the maximum returns every time. It’s to ensure I reach my goals and have a plan that doesn’t rely on everything going perfectly.

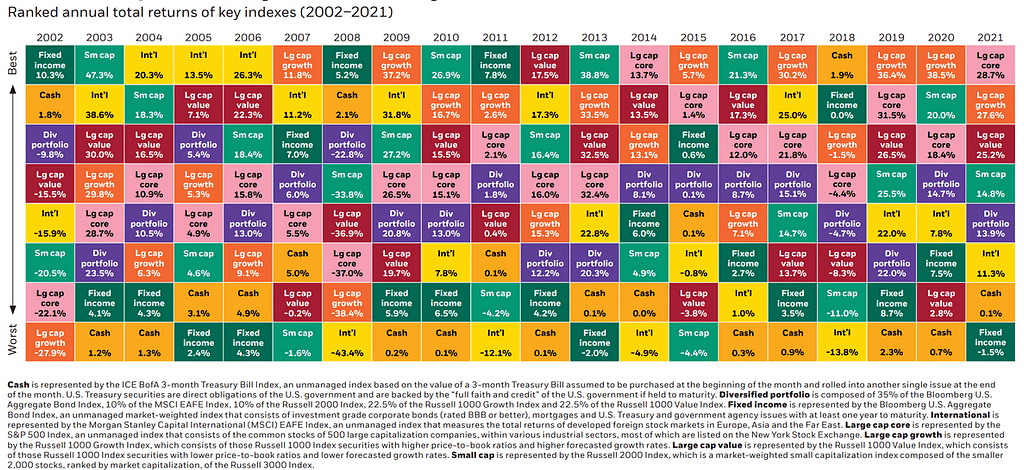

First, diversification helps me minimize risk. The chart from BlackRock below has the annual performance of various asset classes over the last 20 years. The first time I saw a chart like this, I decided to diversify my investments.

As you can see from this chart, the S&P 500 (large cap core) had the best performance only 2 out of 20 years!

This visual helped me see how having more index funds would reduce my portfolio’s dependence on 1 asset: the S&P 500.

I’m uncomfortable depending on one thing for my financial well-being, so I explored ways to diversify.

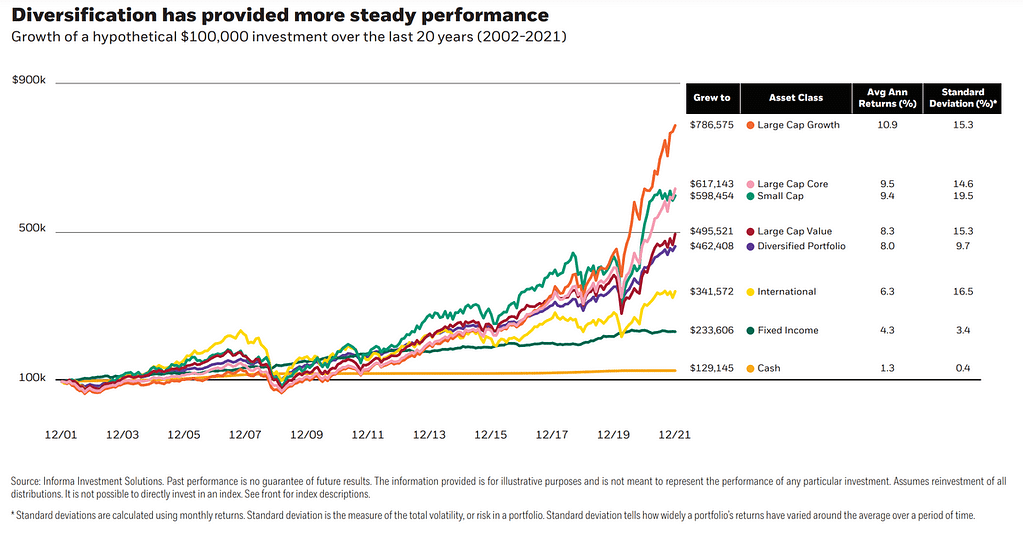

The next chart from Blackrock below shows how investments grow over the long term, despite short term volatility. (Volatility refers to the up and down nature of the stock market.)

Anyone who had invested $100,000 in 2002 would “win” in 20 years. By win, they would have significantly more money than when they started. (Except those who did not invest because inflation outpaces cash value.)

As long as you play the long term investing game, you will build wealth with compound interest over time, based on the data. A diversified investing strategy may appeal to those who want to further manage risk.

Despite more volatility, historical data suggests the all S&P 500 portfolio will experience the most growth. But as any good investor knows, historical data doesn’t guarantee future performance.

A diversified investing strategy may appeal to those who want to further manage risk.

I also think about diversification as leaving room for error. It’s a way to decide what investing “game” you will play.

I’m going to share two hypothetical examples of investing games: pilot vs. tic tac toe.

Pilot

When a pilot takes off, the plane must take off perfectly to reach its destination. For example, if a plane going from L.A. to Italy is just one degree off, it will land in Africa.

Without diversification, your investments must perform perfectly to reach your target.

For an extreme investing example, let’s say 20 years ago Jake invested 100% into Blockbuster stock. Jake’s financial well-being entirely rests on that one stock’s performance. When the company went under in 2014, Jake’s investing plan would have failed as he lost all his money.

Tic Tac Toe

It’s nearly impossible to consistently win at tic tac toe because typically the first player wins or it’s a tie.

Even if you stack the board perfectly, it’s unlikely you will win every time, assuming you take turns going first. BUT if you stack the board just right, you can ensure you never lose a game of tic tac toe.

I’m not investing like a pilot, I’m investing like a tic tac toe player. My success criteria is not perfection or winning every time. Instead my goal with investing is not to lose!

I’m setting myself up on the tic tac toe board to “win” every time I tie or better. I’m very confident in my ability to do that.

My diversified index fund portfolio plays a huge part in that confidence. I know not every company in the S&P 500 will win every year, but the whole fund will over the long term. Now the S&P 500 won’t “win” every year either, but that’s okay because I have other funds too.

How I built a diversified index fund portfolio

My first rule of investing for myself: never invest in an asset I couldn’t explain to a 5 year old. In other words, I must understand exactly what I invest in and how I will get my money back, multiplied.

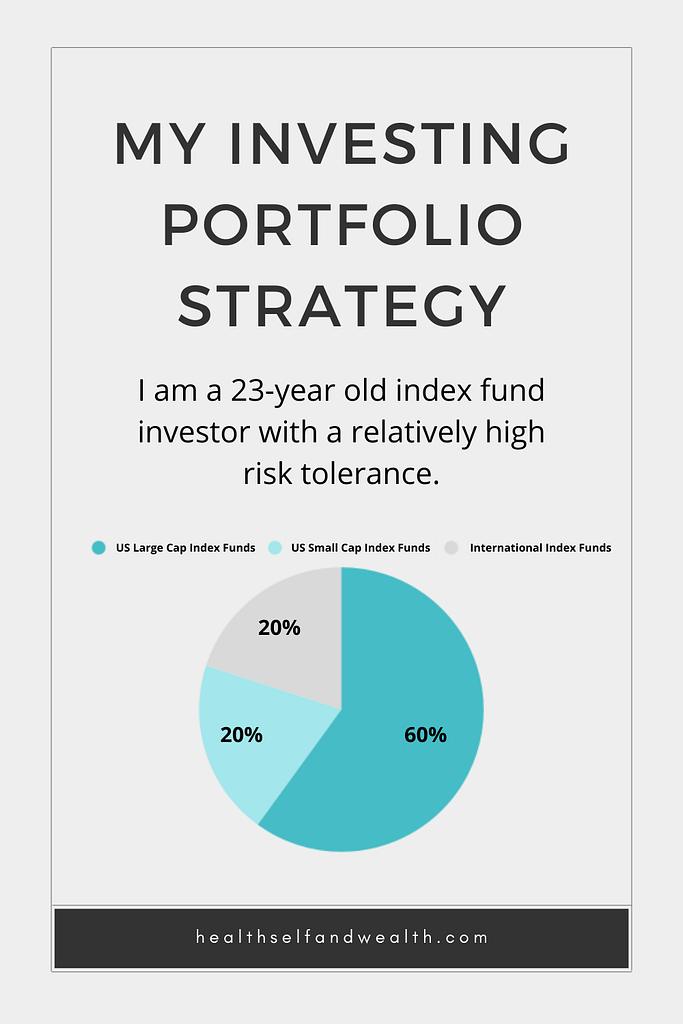

That said, I did a lot of research for myself to determine what index funds beyond the S&P 500 fit into my portfolio. When I invest, I now contribute…

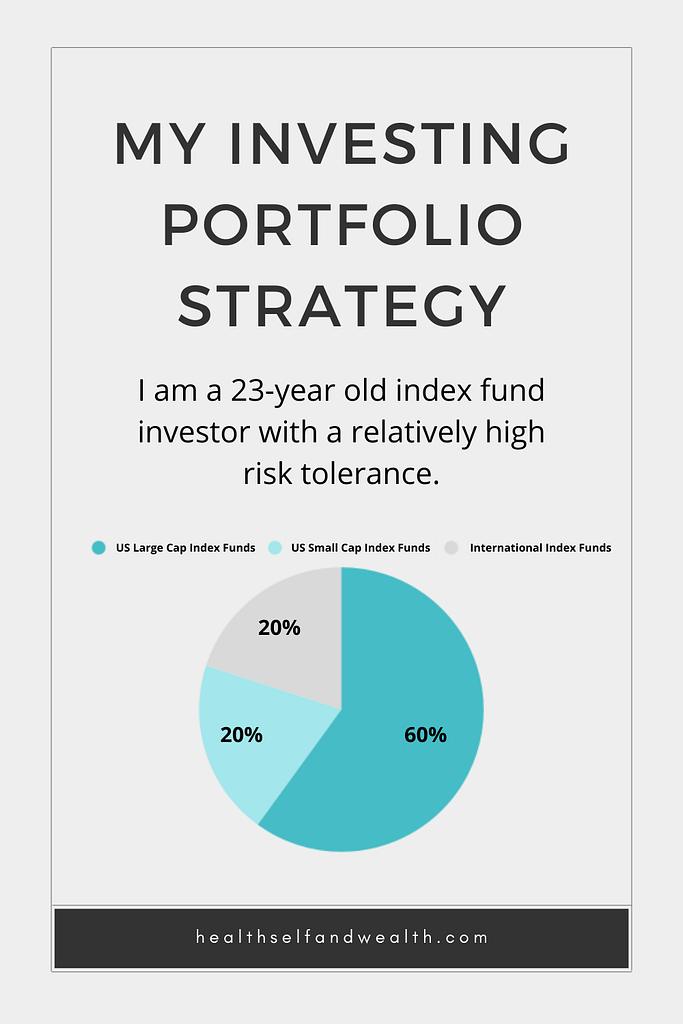

- 60% U.S. large cap index fund (S&P 500 index)

- 20% U.S. small cap index fund (Russel 2000 index)

- 20% International index funds

- 15% International developed index fund (FTSE Developed All Cap ex US index)

- 5% Emerging markets index fund (FTSE Emerging Markets All Cap index)

All the assets I invest in outside the S&P 500 have more volatility than the S&P 500. Volatility is often how investors discuss risk. In other words, all my investments outside the S&P 500 have more risk than the S&P 500. Emerging markets have high risk, which is why I only invest a small fraction of my portfolio.

This diversified index fund portfolio approach is NOT for everyone. I am a 23 year old investor, investing for the long term (40+ years) with a relatively high risk tolerance. I am NOT a financial advisor. I am only sharing this for education purposes. You should do your own research to understand your investment options and determine for yourself what aligns with your risk tolerance and financial goals.

I have not made any gains on any of my investments outside the S&P 500 over the last year since I started investing in them. Like I confessed earlier, diversification is not my attempt at higher returns.

It’s mostly for the nights where my dystopian science fiction loving brain begins a nightmare spiral into the downfall of the U.S. empire. That’s why 20% of my diversified index fund portfolio consists of international stocks.

How did I pick the percentages? Well, the US accounts for 40% of the world market. I didn’t feel comfortable with 60% international stock though.

I felt comfortable using the 80/20 rule for my US/international split. In retrospect, I put thought into these percentages, but they are primarily based on my gut.

I don’t want to present a false level of precision I used to get these percentages.

I also do something else traditional financial advisors would look at me weird for. At this time in my life, at age 23, I don’t see rebalancing as playing a role in my investing strategy.

Rebalancing means trading, usually once a year, to ensure your investments match your targets.

Now, I may change my mind about rebalancing over time as my portfolio gets out of whack based on growth.

The S&P 500 currently makes up 80%+ of my portfolio or more for two reasons.

- When I started investing, I only invested in the S&P 500.

- The S&P 500 is the only investment that has grown for me, and all the others have decreased.

I don’t have any intentions of selling my S&P 500 index funds to maintain the target fund percentages. I call this my “natural selection portfolio.”

Winning funds will grow and account for more of my portfolio, naturally as time goes on. That’s when experts may say to rebalance to manage your risk.

BUT if it’s doing well, I want to let it keep growing.

Now hypothetically, let’s say my emerging markets fund took off and for some crazy reason, it’s now 50% of my portfolio. I would probably resell and rebalance at that point because I see the emerging markets as risky.

I wouldn’t want that much risk in my portfolio. Right now the S&P 500 is dominating. I’m the most optimistic about that fund, so I don’t want to hinder its growth, even if I give up some “diversification” for it.

I share the details of my thought process so you can see how emotional it is. Sure I have data points to explain why I did something. However, I let my intuition, combined with my investing knowledge, drive my decisions.

Why? Because it’s most important to feel confident in your investing strategy. If you don’t feel confident in it initially, you probably won’t stick with it when the market drops.

I never want to lay awake in bed wondering, “What’s happening to my stocks in China? Will I lose half my portfolio?”

When you doubt your strategy, you may feel tempted to sell your investments. Selling at a loss is the guaranteed way to lose money while investing.

That’s why it’s so important to have a strategy you believe in. So when the market does not look good, you feel confident sticking with your strategy as you play a long term investing game.

Conclusion

Often you’ll see prescriptive investing advice. “Do this to maximize your return.” My take:

- You maximize your return by staying invested over the long term.

- Do your research and come up with a strategy that you’ll feel comfortable sticking with, even when you lose $10,000 in 10 days as the market tanks. (Yes that happened to me this week, but I’m sticking with it because I trust 20 years from now, I’ll have more money than I did at the height of this month.)

- Assess if diversification could minimize your risk and help you win even if your investments don’t perform “perfectly.”

How does diversification fit into your investing strategy?

P.S. I’ve considered other asset class investments within the stock market and outside it. If you want to learn more about my investing decisions, sign up for the Wealthy Women Club weekly newsletter.