The best tic tac toe players will never lose a game. They may not win every time, but they will never lose. I adopt that philosophy with my financial plan. My plan ensures I will never lose, regardless of the economic situation.

When you know how to prepare for a recession, you can protect yourself against economic uncertainties. The best part, you can stick with a recession-proof strategy even when the economy is healthy.

Here are 5 tips on how to prepare for a recession so you can ensure your financial well-being.

- Have a fully funded emergency fund

- Invest with long term investing strategies

- Spend intentionally

- Diversify your income streams

- Stress test your financial plan

The best part is these strategies yield good results no matter what the economy is doing. They are especially important during a recession to avoid losing money.

Please note I am not a licensed financial advisor. This information is for education purposes only. Every person has a unique financial situation. The best approach will be different for everyone. Accordingly, do your own due diligence before making any financial decision.

Have a fully funded emergency fund

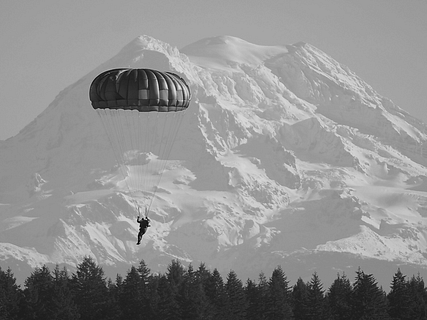

When talking about how to prepare for a recession, having cash on hand is like a skydiver having a parachute. It ensures you have enough money available to survive the unexpected. (And by cash, I mean money in a bank account.)

In a recession, people and businesses tend to cut back on spending, which could mean layoffs. Ideally, your emergency fund should support you for 3-6 months if your main source of income disappeared.

I tend to hold more cash during times of economic uncertainty. (By more cash, I mean saving enough to last me for 6 months.)

Having enough cash on hand also equips me to handle unexpected expenses with ease.

Arguably, it doesn’t make sense to increase the amount of cash I have during a downturn. However, having more cash on hand gives me the peace of mind. The peace of mind gives me the confidence to stick with my plan. Even the fear-inducing headlines in the news can’t shake my financial plan.

If you don’t have enough saved, what happens if you lose your main source of income? For some, this could lead to suboptimal decisions like taking on high-interest credit card debt or withdrawing from long-term investments.

It is never ideal to withdraw from long-term investments early, but it is particularly bad during a downturn. That’s because you may have to sell investments at a loss, which would guarantee losing money.

I’d rather hold more in cash because it’s better than the worst case scenarios for me.

Having a fully funded emergency fund is the most important step you can take to ensure your financial stability during a recession.

Invest with long term investing strategies

It can be scary to open your investment accounts and see red. It’s hard not to panic when you feel like you are losing money!

If you need to withdraw the money tomorrow or within the next few years, then you are dealing with short term investing strategies.

Short term investing strategies are like playing a tic tac toe game where you only have a good outcome if you win. It’s not a good outcome for you if you tie or lose.

(Although I must note that beating the market is harder than winning a game of tic tac toe.)

But a recession doesn’t significantly impact a long term investing strategy. That’s because you haven’t lost any money, until you sell your investments at a loss. You won’t have to sell if you are investing for the long-term and have an emergency fund.

You still have the same number of shares, the value of those shares just fluctuate on a day to day basis.

I personally prefer to play games when I’m certain the outcomes will be good for me, no matter what happens. In this case, that “game” is long-term investing.

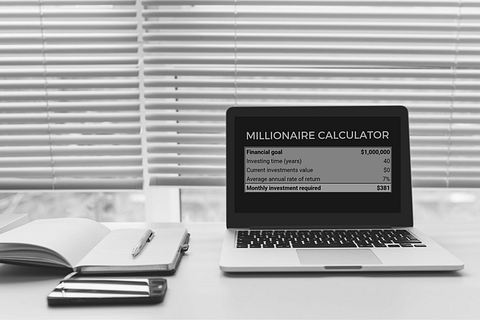

Long-term investing means buying and holding assets for the long term (15+ years).

The tricky piece of this game is that your opponent lives in your head. Uncertainty and doubt creep in. You may wonder if you misjudged something.

Sure, you know the market has always recovered from downturns over time, but what if this time is different? What if you are destroying your family’s future?

Surviving a market downturn requires ignoring the instinctual fear and staying the course.

This is much easier said than done.

Here are two ideas for how to prepare for a recession:

- Learn more so you feel confident your long-term investing strategy is recession proof.

- Outsource this decision to a trusted financial advisor if you aren’t able to resist the urge to sell.

If you can resist emotional impulses, you have a greater chance of winning the investing game. Even if you cannot, you can remove the option so you don’t have to be tempted.

If you are managing your own long term investments, here are some tricks on how to prepare for a recession.

- Delete your investing apps off your phone.

- Don’t check your account balances. Make your password impossible to remember if you have to.

- Ignore the headlines. Stop reading the doom and gloom articles.

This assumes you started with a solid long-term investing strategy. Whatever strategy you use, do your own due diligence to see what is best for your unique circumstances.

Spend intentionally

Spending intentionally means using your money to buy things that add value to your life. It also means saying “no” to buying things that don’t add value to your life.

When it comes to money, your spending is one aspect you have a lot of control over. (No matter how much the red-bottomed shoes are summoning you to the shopping centers.)

When talking about how to prepare for a recession, it’s more important than ever to be intentional with your spending. Particularly in 2022 inflation is high, which makes prices go up.

According to the U.S. Bureau of Labor Statistics, the average household spent about $60,000 in 2020. In 2022, it would take ~$67,000* to buy the exact same things $60K would buy 2 years ago.

*Based on 7% and 8% inflation rates for 2021 and 2022, respectively.

Unless your annual raises trump inflation rates, your money won’t go as far as it would have in the past.

This means any wasteful spending has a magnified impact on your financial situation. How do you know what spending is wasteful and what is worthwhile though?

The best way to know is to track your spending and the value it brings you. I created the Spend Smarter Spreadsheet, a Google Sheets template, to make this process easy for you.

It helps you easily and painlessly identify expenses that aren’t adding any value in your life.

You could also track spending in a journal if you’re more of a pen and paper gal. Some credit cards have tools to help you analyze your spending as well.

Then reflect on your spending to find ways to get the most value out of your money.

However you decide to do it, tracking your spending is the first step to spending intentionally.

Diversify your income streams

A threat during a recession, or even any time, is losing your primary source of income. This is especially devastating if your primary source of income is also your only source of income. To protect yourself against this risk, you can develop secondary sources of income.

There’s virtually an infinite amount of ways to build additional income streams. Here are a few ideas:

- Investment income (from dividends, interest, bond payouts, etc.)

- Rental property income

- Side hustle

- Another job

- A business

If you want more ideas on how to prepare for a recession by diversifying your income, you can check out 99 passive income ideas for 2022 here.

Stress test your financial plan

We all have a friend who jumps to all the negative outcomes that could occur. This is your opportunity to channel that friend today. One of the best tips on how to prepare for a recession is stress testing your financial plan.

Think about your current financial plan and think about the things that could ruin them. Once you have a list of concerns, then come up with a plan to overcome them.

Here are some common examples, although the appropriate plan will vary depending on your unique financial situation.

| Concern | Plan |

| Losing primary source of income | Save 6 months of expenses in an emergency fund |

| Being dependent on only one source of income | Build a passive income stream |

| Losing money if the stock market dips | Hold long-term investments to avoid losing money |

| Should I keep investing if there’s a recession? | Keep investing in long-term investments that you still feel confident in (they are on sale!) |

| Panicking seeing account balances down | Avoid checking your accounts or outsource investing to a trusted financial advisor |

| I need a specific amount of money for a down payment on a home on 5/27/2023 | Keep money you need in the short term in savings account to avoid withdrawing from investments at a loss |

| I want the option to withdraw a large chunk of money in 5-10 years, but there’s flexibility on when I withdraw it | Invest the money since there’s flexibility to wait out any economic downturn |

If you have a plan that ensures your success even if the worst case scenario happens, you will feel more confident in your financial plan. Channel your tic tac toe winner and set up scenarios where you can’t lose, even if things don’t go as expected.

Also give your plan flexibility whenever possible. For example, let’s say you’re finances are like a game of darts. Set it up so that you win anytime a dart lands on the board as opposed to only winning if you hit the bullseye every time.

If your financial plan can survive your stress test, you know how to prepare for a recession.

Conclusion

To recap how to prepare for a recession, the best approach is to have a recession proof financial plan from the start. Recessions can be unpredictable, so the best plans will be prepared from the start.

Some elements of how to prepare for a recession include having a fully stocked emergency fund, using long-term investment strategies, spending intentionally, diversifying your income streams, and testing your financial plan.

If you found this information helpful, you may also like our weekly newsletter. It will provide you with the latest news and actionable tips to help you improve your financial well-being. You can try it out here.