What if there was an unconventional, legal way to invest money completely tax free?

The Health Savings Account (HSA) is triple-tax advantaged, making it the BEST retirement account. If you can use your HSA for retirement, you may just be a genius.

Please note I am not a licensed financial advisor. This information is for education purposes only. Every person has a unique financial situation. The best approach will be different for everyone. Accordingly, do your own due diligence before making any financial decision.

What is a HSA?

A HSA is a Health Savings Account. Like the name suggests, it’s a special savings account for qualified health related expenses.

The HSA is old enough to vote and buy a lottery ticket, but not old enough to get a drink. The HSA is a young account, born in December of ‘03.

The government created the account to combat rising health costs. It is compatible with high deductible health insurance plans.

As of writing in 2022, single member households can contribute $3,650 while families can contribute $7,300. Individuals older than 55 can contribute $1,000 extra with what they call catch up contributions.

Most people typically use these accounts to pay for medical expenses, tax free. AND they can also serve as powerful retirement accounts.

Why a HSA is the BEST retirement account

The HSA is all the hype, like a Gen-Z TikTok star, for these 3 main reasons.

- It’s triple tax advantaged. Your HSA contributions are tax free. Your withdrawals are tax free, for qualified medical expenses. You can also invest the money within your account and withdraw your investing gains tax free, for qualified medical expenses. (This would be like shopping with a gift card, using a promo code to get 25% off, and then getting another gift card.)

This matters because the HSA is a legal way to reduce your tax bill by ~$600 to $3000 annually, depending on your tax bracket and contribution amounts. Money with Katie has a great breakdown of these estimates.

Bank of America has a free calculator that allows you to run different scenarios with your unique financial situation so you can understand future account balances and lifetime tax savings.

- The money never expires. (There’s no “use it or lose it” policy like a Flexible Spending Account, or FSA.)

Health care is the single greatest expense in retirement. According to the Fidelity Retiree Health Care Cost Estimate, retired individuals pay an average of $157,500 throughout retirement for medical expenses excluding long-term care.

If you use your HSA to pay for over ~6-figures of qualified medical expenses during retirement, then you successfully, legally avoided paying taxes on 6-figures. (This is back of the napkin math, but if you earned 6 figures in a year, you would pay ~$25,000 or so in taxes.*)

*This is a major oversimplification of taxes, but the takeaway is the HSA can offer HUGE tax savings over time.

It’s worth noting that women tend to have higher healthcare expenses, as we often outlive men.

Fidelity has a free tool you can use to estimate your healthcare expenses, as this will vary based on so many factors unique to you.

Since retirement typically comes with high healthcare expenses, it’s a huge advantage that your HSA money never expires.

- You can reimburse yourself for any qualified medical expense at any time, as long as you had a HSA at the time of the expense and you have your receipt. For example, in 27 years, I could reimburse myself for the dentist appointment I had this year, as long as I keep proof of my receipts.

This matters because it allows you to avoid unnecessarily interrupting your HSA investment growth.

Now that you know what makes an HSA so great, let’s talk about how to use an HSA for retirement.

How to use your HSA for retirement

Many people use their HSA immediately to pay for qualified medical expenses. Which is good, you are getting some tax savings!

To get the most out of your HSA, contribute and invest as much as you can every year. If you can pay for medical expenses out of pocket instead of using your HSA, this maximizes your HSA account balance because the money stays invested growing exponentially in your HSA.

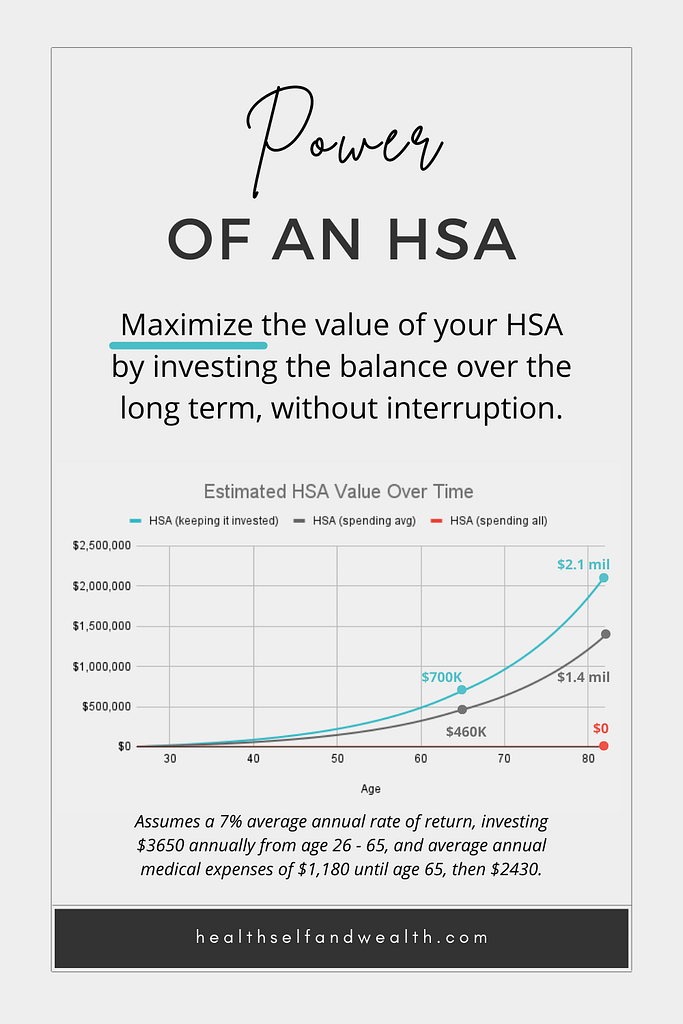

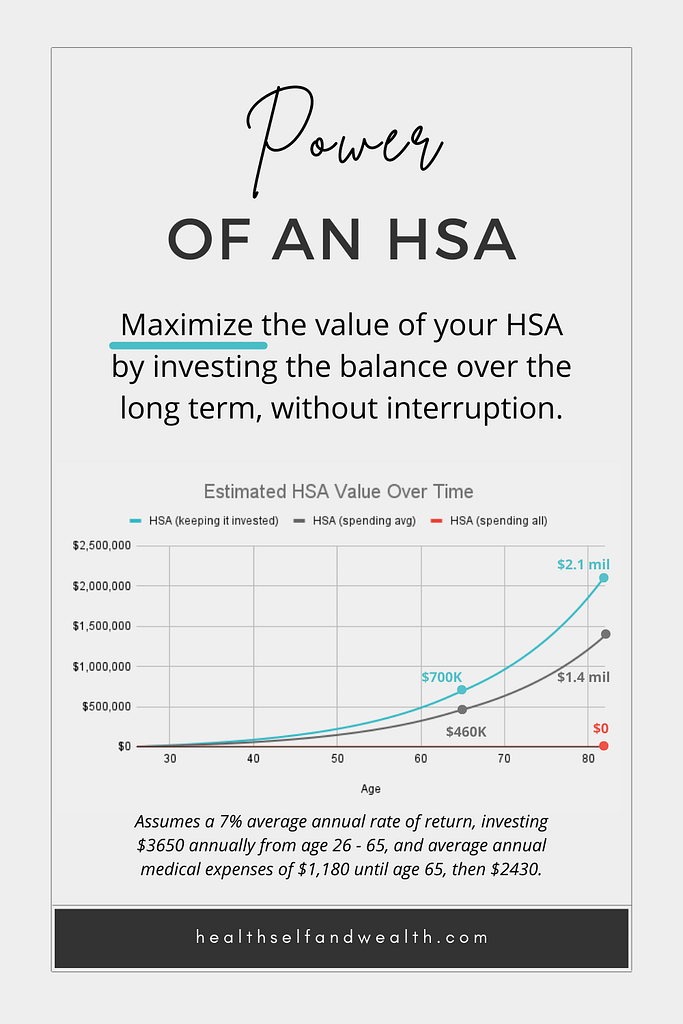

Let’s look at three scenarios to illustrate this concept:

- Contributing the max to your HSA and not withdrawing any money from it until you turn 65

- Contributing the max to your HSA and withdrawing the average amount spent out of pocket on medical expenses annually ($1,180)

- Not saving any money in an HSA (either not using one or spending all that was contributed)

Anyone who invests money in an HSA over time benefits because of compound interest. Those who want the maximum benefit will pay medical expenses out of pocket whenever possible. (Although high medical expenses in the U.S. may make that unrealistic.)

Even if you max out your HSA every year and spend the entire amount, you still benefit because you will pay fewer taxes.

If you contribute the maximum, especially if you start investing in an HSA in your twenties/thirties, you may retire with more money than you need for medical expenses. What a great scenario!

But what if you have more than you need for medical expenses? What happens to the money?

The rules for an HSA change when you turn 65. Most notably, the 20% penalty charged for using the HSA money for non-qualified expenses is eliminated.

That means once you turn 65, you can withdraw the money for non-medical expenses penalty free. You do have to pay taxes on the withdrawal though if it’s not used for medical expenses.

That said, after you turn 65, your HSA takes on a new role: it is basically a traditional retirement account, like the traditional 401(k) or traditional IRA.

However, let’s say you paid for your medical expenses out of pocket and kept the receipts. You can reimburse yourself for them anytime, tax free. The benefit of doing this is you let that money compound, so it’s worth exponentially more now.

For example, in the scenario above, keeping the money invested earned ~$250,000 more at age 65 than the person who withdrew the average annual medical expenses as they occurred. In other words, by paying ~$1,000 of medical expenses out of pocket annually for 39 years, that ~$39,000 grew to ~$250,000.

That’s the power of an HSA, compound interest, and long-term investing.

Conclusion

If you want to legally reduce the taxes you owe, the HSA is a powerful option to invest in your health and financial future.

It’s triple tax advantaged making it one of the best investment accounts.

- In a year, it could reduce your tax bill starting at $600 to $3000 because HSA contributions are deductible.

- You can withdraw the money tax free for qualified medical expenses.

- You can invest your contributions and withdraw investing gains tax free for qualified medical expenses.

If you have more money than you could ever use for medical expenses, once you turn 65, you can use the money for anything, without paying penalty fees. (Although withdrawals for non-qualified medical expenses are subject to taxation.)

You can review qualified medical expenses for tax year 2021 on the IRIS website, linked here.

If you are using an HSA at all, smart. If you are using an HSA for retirement, genius.

Want more content like this? Stay in the loop by checking out our weekly newsletter here.