This is your financial journey, and you are exactly where you need to be. This guide will show how the Personal Finance Planner will help you achieve your financial goals. You can use the planner to achieve any of these goals that are relevant to you.

Most personal finance information for women focuses on spending less money. However, you can’t save your way to wealth. Paying off debt and investing are the actions that will help you build long-term wealth.

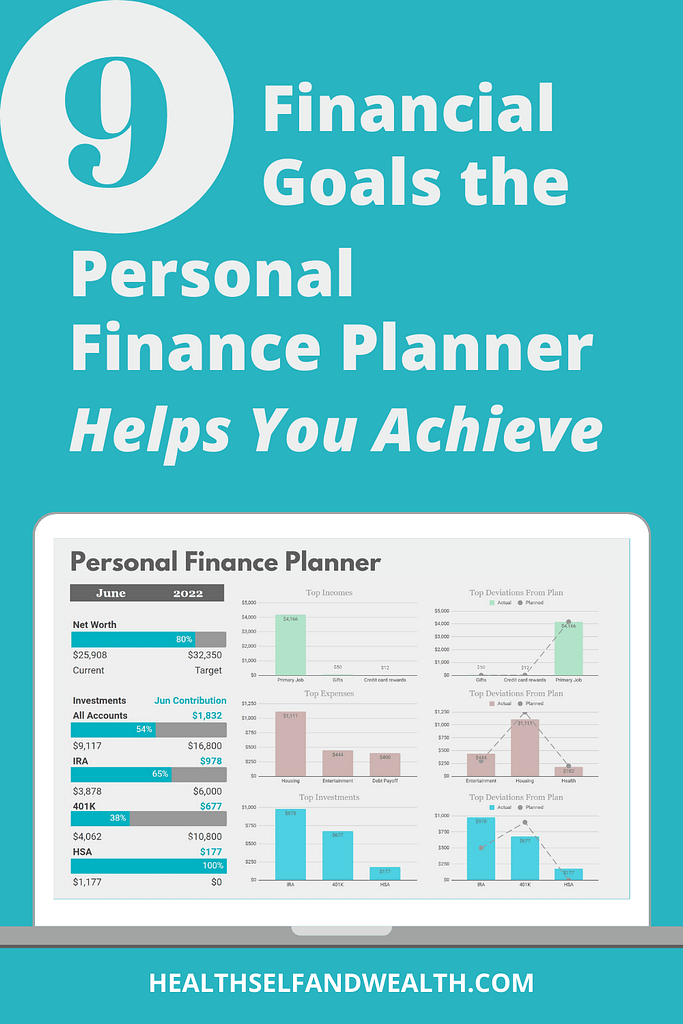

The Personal Finance Planner will track your incomes, expenses, and investments. You will understand what has the greatest impact on your progress towards your goals. This is the planner to help you achieve your financial goals.

Here are 9 financial goals the Personal Finance Planner can help you achieve.

- Reaching your investing contribution goals

- Building an emergency fund

- Achieving net worth goals

- Tracking progress towards financial independence

- Saving for retirement

- Saving for an upcoming expense

- Buying a home

- Lowering your spending, painlessly

- Paying off debt

Reaching your investing contribution goals

Do you have investing goals? With the Personal Finance Planner, you can set your monthly investment contribution goals. You can also see your progress towards those goals.

For example, let’s say Ally wants to max out her IRA and contribute enough to her 401(k) to get the full employer match. To achieve these goals, she needs to contribute a total of $6,000 to her IRA and $2,400 to her 401(k).

Now that she’s defined her goals, she will enter them on the Goal Definition sheet of her Personal Finance Planner. More specifically, she will set them in the “Investment Contributions” section (image below).

She will enter her contribution goals for each month. So, $6,000/12 = $500 a month to her IRA and $2,400/12 = $200 a month to her 401(k).

Ally can see her progress towards her overall goal (image below). For example, Ally invested according to her plan, so in August, she’s ⅔ of the way to her goals.

Building an emergency fund

If you want to build an emergency fund, you can use the Personal Finance Planner to set your emergency fund goal and track your progress towards it.

For example, let’s say Bella wants at least $6,000 in her emergency fund. Experts suggest an emergency fund should cover between 3-6 months of expenses.

Since the Personal Finance Planner is fully customizable, Bella will create an Emergency Fund category. She creates the Emergency Fund category in the “Investment Contributions” section of the Goal Definition sheet (image below).

She will enter her contribution goals for each month. So, $6,000/12 = $500 a month to her Emergency Fund.

What if you aren’t starting in January? Let’s say you are starting in March. That means there are 9 months left in the year, so you would divide the total by 9 instead of 12.

Now Bella will track her progress on the Monthly Summary sheet. In April, she is closer to her goals than she had planned.

Using the planner, she found a way to contribute more than $500 in April. You can see her April contribution and her progress towards her overall goal in the image below.

Achieving net worth goals

Are you working towards a net worth goal? It could be your financial independence number, a retirement savings goal, or a debt-free life! The Personal Finance Planner will track your progress towards your financial goals to help you achieve them.

Let’s say Cassie’s net worth goal is $100,000 by the end of the year. She will set this goal on the Goal Definition sheet of her Personal Finance Planner. More specifically, she will set them in the “Net Worth” section.

She will enter the category names of all her assets and liabilities. Here’s a list of the most common assets and liabilities.

Assets

- Cash/Cash equivalents (e.g., checking, savings, high-yield savings, etc.)

- Investment accounts (e.g., IRA, 401(k), HSA, Brokerage, etc.)

Liabilities

- Debt (e.g., credit card debt, mortgage, student loans, car payment etc.)

Cassie doesn’t care about the balances each asset/liability account has at the end of the year. She really only cares that the total is at least $100,000, so she sets the total to $100,000. See the image below for how this looks in the Personal Finance Planner.

Cassie can see her progress towards her net worth goals in two ways. She can see her progress on the Monthly Summary sheet.

She can also see a month-by-month breakdown of her progress on the Annual Summary sheet.

Tracking progress towards financial independence

Financial independence (FI) means you have enough income-producing assets to support your lifestyle. (You’d never have to work again if you didn’t want to.)

There’s a movement called FI/RE (Financial Independence/Retire Early). It’s based on the principle that retirement is a number in your investment accounts, not an age.

You can estimate your FI number using the Rule of 25. To apply the rule, multiply your annual expenses by 25. This is a rough estimate assuming you will be retired for 30 years and withdraw no more than 4% each year.

Let’s say Destiny wants to spend $100,000 per year in retirement. She applies the Rule of 25 and estimates her FI number is $2.5 million.

Now that she’s defined her goals, she will set them on the Goal Definition sheet of her Personal Finance Planner. More specifically, she will set them in the “Net Worth” section.

She will enter the category names of all her assets and liabilities. The section above has a list of the most common assets and liabilities.

Destiny doesn’t care about the balances each asset/liability account has at the end of the year. She really only cares that the total is at least $2.5 million, so she sets the total to $2.5 million.

See the image below for how this looks in the Personal Finance Planner.

Destiny can track her progress towards her net worth goals in two ways. She can see her progress on the Monthly Summary sheet.

She can also see a month-by-month breakdown of her progress on the Annual Summary sheet.

The information in the Personal Finance Planner will help Destiny achieve her financial goals faster.

Saving for Retirement

You can also estimate your required retirement savings using the Rule of 25. To apply the rule, multiply your annual expenses by 25. This is a rough estimate assuming you will be retired for 30 years and withdraw no more than 4% each year.

Let’s say Ellie wants to spend $50,000 per year in retirement. She applies the Rule of 25 and estimates she needs $1.25 million. Now that she’s defined her goals, she will set them on the Goal Definition sheet of her Personal Finance Planner. More specifically, she will set them in the “Net Worth” section.

She will enter the category names of all her assets and liabilities. The section above has a list of the most common assets and liabilities.

Ellie doesn’t care about the balances each asset/liability account has at the end of the year. She really only cares that the total is at least $1.25 million, so she sets the total to $1.25 million.

See the image below for how this looks in the Personal Finance Planner.

Ellie can track her progress towards her net worth goals in two ways. She can see her progress on the Monthly Summary sheet.

She can also see a month-by-month breakdown of her progress on the Annual Summary sheet.

Saving for an upcoming expense

If you want to save for an upcoming expense, this method could be a good fit for you. The expense could be anything from a downpayment on a home to a big vacation to saving for your child’s college fund.

Let’s say, Francesca wants to save $3,500 for an international trip with her friends. She plans to save ~$300 per month this year to reach her goal of $3,500.

Here’s how she sets that up in her Personal Finance Planner. She uses the “Investment Contributions” section to track her savings.

The planner tracks her monthly contributions and progress towards her overall trip goal. She sees this information on the Monthly Summary sheet, as shown in the image below.

Buying a home

If you plan to buy a home in the future, you may have a goal to save the down payment.

Let’s say, Georgina wants to save $20,000 within the next 2 years for her first home’s down payment. She estimates that’s saving about $830 a month.

Here’s how she sets that up in her Personal Finance Planner. She uses the “Investment Contribution” section to set her goal of $830 per month.

The planner will track Francesca’s monthly savings contribution for the down payment. She sees this information on the Monthly Summary sheet, as shown in the image below.

The planner tracks Francesca’s progress for this year. Accordingly, you can see the overall goal is based on the total for this year. Georgina will use next year’s financial plan to track the second half.

Lowering your spending, painlessly

Perhaps you want to lower your spending, for any reason. You may want to lower your spending so you can use the savings for something else.

You may want to stop accumulating debt, pay off debt faster, build an emergency fund, or invest for your future. Or you may want to spend more intentionally to maximize your happiness.

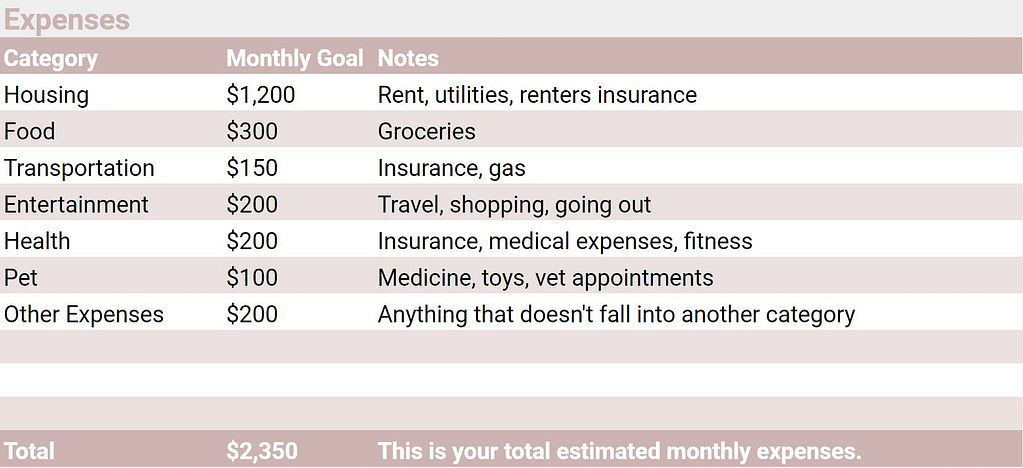

The Personal Finance Planner will track your spending per category each month. You can customize your categories so they fit your unique personal finance journey. You can set category goals based on the amount you’re comfortable spending each month.

To set up your planner, decide what categories you want to track. A good category list will have exactly one category for every expense. It’s a best practice to include an “other” or “miscellaneous” category to account for unexpected expenses.

Here’s an example of how this may look in your planner.

If you want more guidance on defining categories, check out these tips for setting budget categories.

You can compare your spending per category by month on the Progress Tracker sheet. It will highlight any areas that exceeded your target spend. You can use this tool to identify discrepancies between your plan and your habits. You can then adjust either the plan or your habits as you see fit.

Additionally, the Monthly Summary sheet will show you up to 6 expenses each month that had the biggest impact. It will highlight your top 3 expenses and the expenses with the biggest gap from your goal.

The annual summary will show your spending against your plan by month.

With the Progress Tracker, Monthly Summary, and Annual Summary views, you can determine how to spend more intentionally.

Paying off debt

Maybe you have debt (of any kind) that you want to pay off. You can use this method to track your debt payoff progress.

Let’s say Hallie has $5,000 of credit card debt. She has a high-interest rate, so she’s eager to pay off the balance by the end of the year. She aims to make at least a $500 payment each month until her debt is gone.

Since debt repayments are an expense, Hallie will track this in her Personal Finance Planner within the expenses section.

Hallie uses the Progress Tracker sheet to monitor her progress towards her debt repayment. Based on the example below, you can see by October, she reached her goal to repay $5,000 towards her credit card debt.

It also allows Hallie to compare her debt repayment decisions month by month. She also notices that when she spent less in other categories, she was able to repay more towards her debt.

This view helped her pay off her debt several months before the year ended. She could see how to re-allocate her spending to reach her financial goals faster.

Next Steps

You can mix and match the approaches above to customize your planner. Your Personal Finance Planner is customizable to help you achieve your financial goals on your unique journey.

If you have another goal you want help incorporating into your Personal Finance Planner, send us a message.

If you don’t have your Personal Finance Planner yet, download yours here.

[…] This tool is great for tracking your progress to FI or any of these other 9 financial goals. […]