What is the magic number to live your dream life? Maybe it isn’t as far out of reach as you think. Enter financial independence, a state where your assets support your lifestyle, indefinitely.

Today’s post will go over what financial independence is, why it’s important, and how to estimate your magic financial independence number.

Financial Independence

Financial independence, or FI, means you would never have to work another day in your life if you didn’t want to. For that reason, it’s also referred to as financial independence/retire early, or FI/RE.

Why FI

I’ve been the type-A student, work-12-hours-a-day person my entire life. So it may surprise some that I’m pursuing financial independence. I finally saw a path to live my “dream life.”

If I no longer have to work 40+ hours a week, until I’m 65, I can spend that time in more fulfilling ways. I could spend more time helping others, especially other women, reach financial independence.

Financial independence provides the freedom to spend your time however you most desire.

Take a moment and consider, if you were financially independent, what would you do with your time?

Financial independence is a way to regain complete control over your own life. It provides you with options: options to leave unfulfilling jobs, escape toxic relationships, and pursue your dreams without fear.

The opposite of financial independence is financial dependence.

How to Estimate FI

Before we estimate our magic FI number, it’s important to define what our dream lives actually look like. Explore your dream life with these five journal prompts.

Once you have a vision for your dream life (and this vision can of course evolve as you do), you can figure out what it would take to live it. In other words, figure out how much it will cost per year to live this life.

However you dream of spending your time after you reach financial independence is up to you! It’s your life and don’t let anyone else make you feel otherwise.

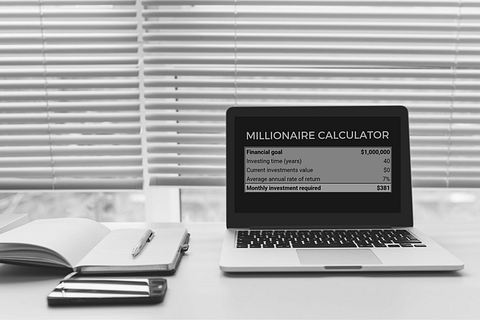

4% Rule AKA the Rule of 25

The Trinity study determined that you need 25 X your annual expenses invested to reach financial independence. Then you can safely withdraw 4% a year for 30 years with a 95% success rate.*

For example, if you want to spend $40,000 per year, your FI number would be $1 million. (40K X 25 = $1 million)

*Now for all my critical thinkers out there, you’re probably wondering, well what if you retire early? Will you run out of money after 30 years? Luckily, there are workarounds – but those details require a post of their own.

Subscribe to receive email updates when new content arrives.Next Steps

Now you know what financial independence/retire early is and how much you will need invested to reach it. The next step is to begin investing, as aggressively as possible, to reach that amount.

Reach your financial goals faster with the Personal Finance Planner. It’s a spreadsheet that tracks your progress to your goals. It also shows you what decisions have the greatest impact on your progress.

This tool is great for tracking your progress to FI or any of these other 9 financial goals.

If you want to track your progress towards your goals, download your planner here.

Here’s what people are saying about the planner:

How could tracking your financial decisions help you reach your goals? Download your planner here.

Thank yourself for taking the time to prioritize your financial well-being today. 🙂

[…] my journey, I’m focused on increasing my earnings. Why? So I can invest more! Why? So I can reach financial independence. Why? So I can live my life on my own terms. Why? I only get one life so I want the freedom to […]