Did you know that money you have in a savings or checking account is losing money every year? Once you consider the average rate of inflation in the United States is 2%, your money in these accounts lose value over time. This post will teach you how you can prevent this from happening and actually make your money work for you.

The secret to becoming a millionaire may be as simple as math and some planning. This post will take you through the math of becoming a millionaire, making money, and building long-term wealth. If you hate math, keep reading. Don’t worry, I promise I will do all the math for you.

Please note: The content in this post is personal opinion based on research and math. It is NOT financial advice. Every individual is unique and accordingly will have varying results. Always do your own research before making any decision.

Meaning of Wealth

Before jumping into how to become a millionaire, first we must establish what wealth means. Often the terms rich and wealthy are used interchangeably, but there’s a big difference. Rich is defined as the life of luxury with branded clothing, sports cars, foreign vacations, etc. Being rich is not the same thing as being wealthy. Wealth is defined as how long your assets could support you if you lost your main source of income.

Even if someone looks rich with the luxuries they have, they may not be wealthy if they are dependent on their main source of income to live that lifestyle. For example, let’s say that one Person A makes $500,000 a year and Person B makes $50,000 a year. Person A spends the majority of their income on luxuries and looking rich, while Person B saves half their income for investments.

See the table for a hypothetical breakdown. If you met both Person A and Person B on the street, you would think Person A is the wealthy one. However, in 10 years, Person B will have over double the wealth as Person A.

| A | B | |

| Salary | $500k | $50k |

| Expenses | $490k | $25k |

| Annual Savings | $10k | $25k |

| Wealth in 10 Years | $140k | $345k |

If the people in this scenario save their money in savings or checking accounts, they will still be losing money over time because of inflation. This post is about building wealth for the long term and this example proves it doesn’t matter what your salary is. What matters is how much you invest.

Long-Term Wealth

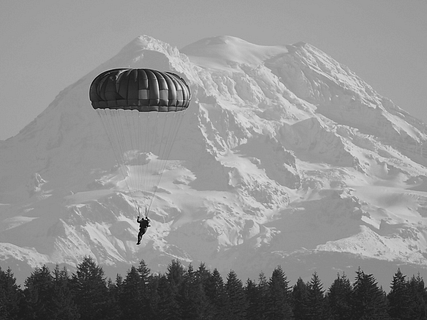

Long-term is an important keyword worth diving into. The methods discussed on this blog will be effective over the long term. Unlike #stocktok* or anyone else on the Internet who promises to make you rich immediately, this is a strategic long-term play designed to maximize your future wealth.

*#stocktok is a place where young retail traders on Tik Tok give specific recommendations for how to day trade, sometimes using a screenshot of Robinhood account returns to “prove” it. Do your own research before investing. A lot of those people make money by telling people to buy the stock they just purchased. When more people buy the stock, then the stock price goes up. Now the person who recommended that stock can sell their stock at a profit.

Why Money Matters

To a certain extent, I think everyone cares about the same thing: the freedom to spend your time however you please. Everyone will likely want to spend that time differently, but that freedom appeals to everyone. Money is the tool required to acquire the freedom of spending your time exactly as you choose. That’s why building wealth matters.

Wealth gives you the freedom to spend your time however you desire.

If you aren’t quite convinced yet to stop losing your money, I will do the math to prove to you that strategizing to build long-term wealth now will “buy” you freedom in the future.

Anyone could apply these principles, but the younger you are, the greater the advantage you have. Especially if you are in your twenties or younger, you can take advantage of compound interest to multiply your money.

The Math – Already Done For You

Scenario 1: Investing in Your Twenties

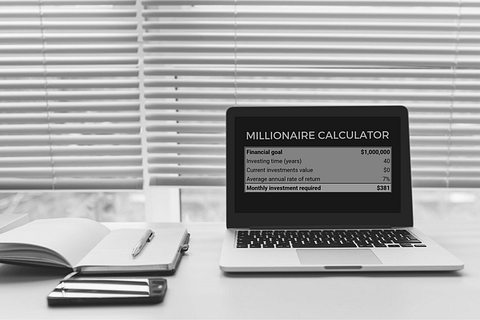

Let’s say your salary is $50,000 (the average for a college graduate). It is recommended that 10-15% of your salary should go towards savings/investments.* By investing the money, it’s gaining an average of 7% each year instead of losing value due to inflation. In forty years, you could have over a million dollars. The majority of that money was the growth of your initial contributions.

The chart below summarizes potential investing outcomes if you start in your twenties. This is just a general model, see the assumptions below.**

Essentially, the more you invest now, the more it will be worth in the long run because the interest compounds. That means your money is making more money for you.

| A | B | |

| Salary | $50k | $50k |

| Investments (% of salary) | 15% | 30% |

| Annual Investment | $7.5k | $15k |

| Average Annual Rate of Return | 7% | 7% |

| Value in 40 years | $1.5 mil | $3 mil |

| Amount Invested | $300k | $600k |

| Investing Profit | $1.2 mil | $2.4 mil |

*Note: every individual has a unique situation and this amount will change depending on individual circumstances. The next post on allocating your money to maximize wealth will go into more detail.

**Assumptions: This model predicts the growth of an annual investment (% of salary) over 40 years, assuming a 7% rate of return. This model does not consider the rate of inflation, potential raises, or 401(k) match funds.

Scenario 2: Waiting to Invest

Now let’s say these same two people didn’t start investing when they were in their 20s, instead they waited until their 30s. Let’s also assume they still plan to retire at the same time, so now their money only has 30 years to grow instead of 40. Compare this chart with the previous one to see how much money they are losing by waiting to invest.

| C | D | |

| Salary | $50k | $50k |

| Investments (% of salary) | 15% | 30% |

| Annual Investment | $7.5k | $15k |

| Average Annual Rate of Return | 7% | 7% |

| Value in 30 years | $700k | $1.4 mil |

| Amount Invested | $225k | $450k |

| Investing Profit | $475k | $950k |

By waiting 10 years to invest, Person C and D will have less than half the amount the people in the first scenario had. They missed out on millions of dollars by waiting longer and losing time for their investments to grow. These two examples illustrate the power of investing in the long run.

Over time, your money makes money for you with minimal effort required of you. The biggest advantage you have right now is time.

The best time to start investing was 10 years ago, the second-best time is today.

Final Thoughts

I hope from these examples, the math demonstrates why it is so important to begin investing as soon as you can. This math is so important because it creates a roadmap for building wealth. You want to live the life you most desire, and wealth will be the tool to help you do exactly that.

If you want to learn how to invest, here’s a free 10-day investing challenge to help you get started.

[…] is how much to allocate towards investments. The payoff of investing early is exponential, so consult this post when you’re deciding how much to allocate towards investments. Experts often recommend investing at least 10 – 15% of your […]

[…] If you want to learn more about the power of investing early, read this post. […]