Think about the best advice you’ve ever received. How would you have benefited if you knew that sooner? I interviewed over 100 professionals and asked them what they wished they knew in their twenties. I’m sharing their best advice with you so we can all benefit from knowing these life hacks sooner.

Here are the 21 life hacks for your 20s and 30s:

Health

- Manage your energy.

- Exercise.

- Put your wellbeing first.

- Pursue peace of mind.

- Maintain a consistent sleep schedule.

Self

- Surround yourself with people you admire.

- Live your best life.

- Embrace change.

- Begin as a beginner, not an expert.

- Keep learning.

- Embrace failure.

- Say yes and you also say no.

- Plan using the Pareto rule.

- Listen to understand.

- Diversify your happiness.

- Ask for help.

Wealth

- Begin investing ASAP.

- Pay off high interest debt.

- Invest passively to beat 90% of professionals.

- Prioritize tax advantaged accounts.

- Work a 9 to 5 forever? There’s another way…

Health

Manage your energy.

Instead of only thinking about managing your time, consider managing your energy. Every day you wake up with a renewed supply of energy. As you go about your day thinking and making decisions, your energy starts to drain (based on the widely supported theory of ego depletion).

Instead of trying to pretend your SuperWoman, understand when you have the most energy and schedule your day accordingly. For example, schedule your highest priority tasks when you’re at peak energy levels and schedule lower level tasks when your energy levels are lower.

It doesn’t matter how much motivation you have to complete a task if you don’t have the physical energy to do it. Accordingly, prioritize breaks as much as your work. Breaks re-energize you. When you have higher levels of energy, you can complete more in less time.

You can learn more about energy management here.

Exercise!

There are so many benefits of exercise. It keeps you healthy, it makes you happy. When you are exercising your body releases endorphins, which boost your happiness.

Put your wellbeing first.

You cannot help anyone else if you don’t first take care of yourself.

If you don’t have the energy, you psychically won’t be able to be efficiently productive, regardless of how motivated you are.

Pursue peace of mind.

Peace is in the present moment. Find a way to connect with it. Maybe you like meditating, surrounding yourself in nature or even driving down the highway with the music up and the windows down.

Whatever makes you happy and brings you peace, do more of it.

Maintain a consistent sleep schedule.

There’s an entire book written about the importance of sleep, called Why We Sleep by neuroscientist Mathew Walker. He not only reveals scientifically why sleep is so important, but also how to ensure you are getting those benefits.

Here’s what the Guardian had to say about this book: “A neuroscientist has found a revolutionary way of being cleverer, more attractive, slimmer, happier, healthier and of warding off cancer…”

Self

Surround yourself with those you admire.

Jim Rohn said, “You’re the average of the five people you spend the most time with.” If that’s a compliment, you have great friends! If you don’t love that idea, consider making some new friends. These people could be friends, family, even characters on TV shows. Be intentional about who you surround yourself with.

Live your best life.

Live your life the way you want to, not the way you think other people would want you to. It’s your life and you have the power to change it anytime. If you aren’t sure what your best life would be like, read this post and follow along with prompts to discover it.

Embrace change.

If you don’t know what your best life would be like, that’s okay! You don’t have to have it all figured out right now. Instead, make your best guesses and try to do more things you enjoy. When you find something isn’t for you, that’s where you can embrace change and pivot.

Begin as a beginner, not an expert.

No one starts out as an expert. If you want to become one, stick with it. The ones who become experts are the ones who simply started and refused to give up. Don’t let imposter syndrome or lack of qualifications prevent you from taking the next step forward.

Keep learning.

You can learn about anything you want on the internet. (reading blogs, listening to podcasts, watching youtube videos, engaging with experts on clubhouse, taking courses, watching tiktoks, reading books, etc.) If you want to know more about something, take the initiative to find your own resources.

Embrace failure.

Have a process for moving forward despite obstacles. Woody Allen said, “If you aren’t failing, then you must not be trying anything new.” The most successful people fail more often because they try more things.

Say yes and you also say no.

When you say yes to something, you are saying no to everything else. That means if someone asks you to dinner, then you are saying no to anything else you could be doing with that time. Time is the most precious gift you could give anyone, so be intentional about who you share yours with.

Plan using the Pareto rule.

Prioritize the most important tasks first. The pareto rule is that 80% of the results stem from 20% of the work. That means focus on the 20% of tasks that will drive you closer to the results.

Listen to understand.

When someone is speaking, focus on them and avoid getting distracted by thoughts in your own mind. Really listen to understand what they are saying and what they truly mean. Ask questions to deeply understand what they are talking about.

Try this listening technique to truly understand instead of just responding.

Diversify your happiness.

Refuse to let one aspect of your life become your whole world. Whether it’s a job, a relationship, or a dream, don’t let your happiness become dependent on just one aspect of your life. Refuse to let one thing, especially a temporary thing, define you.

Ask for help.

People, even strangers, will help you achieve your goals. you just have to ask.

Wealth

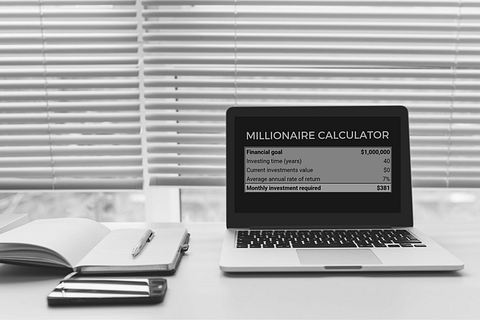

Begin investing ASAP.

The greatest investing advantage you have is time. The longer your money is invested, the more your money will multiply.

The chart below shows two different investors each investing $6,000 a year. The only difference is Person A started in her twenties, 10 years before Person B.

Note: These calculations assume a 7% average annual rate of return. They do not take into account inflation.

If you want to learn more about the power of investing early, read this post.

Pay off high-interest debt.

Conversely, if you have debt, you are the one paying the money on the chart above. Accordingly, pay off your high-interest debt as soon as possible so you can begin investing that money instead.

Invest passively to beat 90% of professionals.

According to Business Insider, the vast majority (90%) of professional investment fund managers fail to consistently beat the S&P 500 over a 15 year period. No one, not you, me, or the professionals can consistently and accurately predict what the market will do in the future. Accordingly, it’s a more lucrative long-term investing strategy to invest in passively managed funds.

It doesn’t make sense to pay fees for a professional to manage your fund (and perform worse than the S&P 500 on average). Over time the combination of high fees and lower returns significantly reduces your investment growth.

Instead, since no one can consistently and accurately predict which individual stocks will be winners or losers, you can buy them all with index funds. They tend to have low expenses (because no one is actively managing them) and have higher rates of return on average.

Some common index funds include the S&P 500, Total Stock Market, and Russel 2000.

Learn more about index fund investing here.

Prioritize tax-advantaged investing accounts.

Maximize your investing profit by minimizing your taxes. There are several tax advantaged retirement accounts to prioritize first. Experts recommend prioritizing the following accounts in this order:

- 401k up to your employer match

- IRA up to the maximum

- 401k up to the maximum

- Brokerage with any extra funds

Read this post for more information on why this approach is optimal.

Work a 9 to 5 forever?

There’s another way, FIRE (financial independence/retire early). Want to learn more about this? Check out my hot take on why financial freedom is for everyone.

Next Steps

Now you know the 21 life hacks people wished they knew sooner. Can you think of a friend who would want to know these life hacks too? Share this post and the life hacks with them!

If you liked this content, you may also like our Wealthy Women Club. Get weekly insights for living your best life in terms of Health, Self and Wealth.

Check it out here, all genders welcome.