What do you know about investing? With this strategy, you don’t need to know much. This strategy is easy and effective. This long-term investing strategy tends to outperform about 90% of professional fund managers. This post walks you through index fund investing for beginners.

Please note: I am not a licensed financial advisor, so this is NOT financial advice. The content in this post is personal opinion based on research and math. Every individual is unique and accordingly will have varying results. Always do your own research before making any decision.

What Is The Investing Strategy

This investing strategy is simple. Since you don’t know which stocks will be winners (or losers), why not buy all of the top performers? When you decide to buy a fund of stocks instead of individual stocks, you diversify your portfolio and mitigate risk.

The S&P 500 is a benchmark for evaluating market performance. It consists of the 500 biggest US companies like Apple, Amazon, Google, Facebook, Microsoft, Tesla, and more.

S&P 500 index funds mimic the S&P 500. That means if you invest in an S&P 500 index fund, you will own a part of all the 500 biggest US companies.

This index fund investing strategy will position even beginners to outperform the vast majority of professionals.

Why S&P 500 Index Fund Investing

High Returns

Over the past 50 years, the S&P 500 has had an average annual return of 10%. Each year will have a different return ranging from upwards of 50% to even -50%. The negative years sometimes scare people, but if you are investing for the long-term (10+ years), then it’s not as concerning to you.

Regardless of what the market is doing at any specific time, you can see the long-term vision. When you’re investing for the long term, it doesn’t really matter that market goes up and down in the short term. What you care about is that you can estimate you’ll gain 10% per year on average (before taxes).

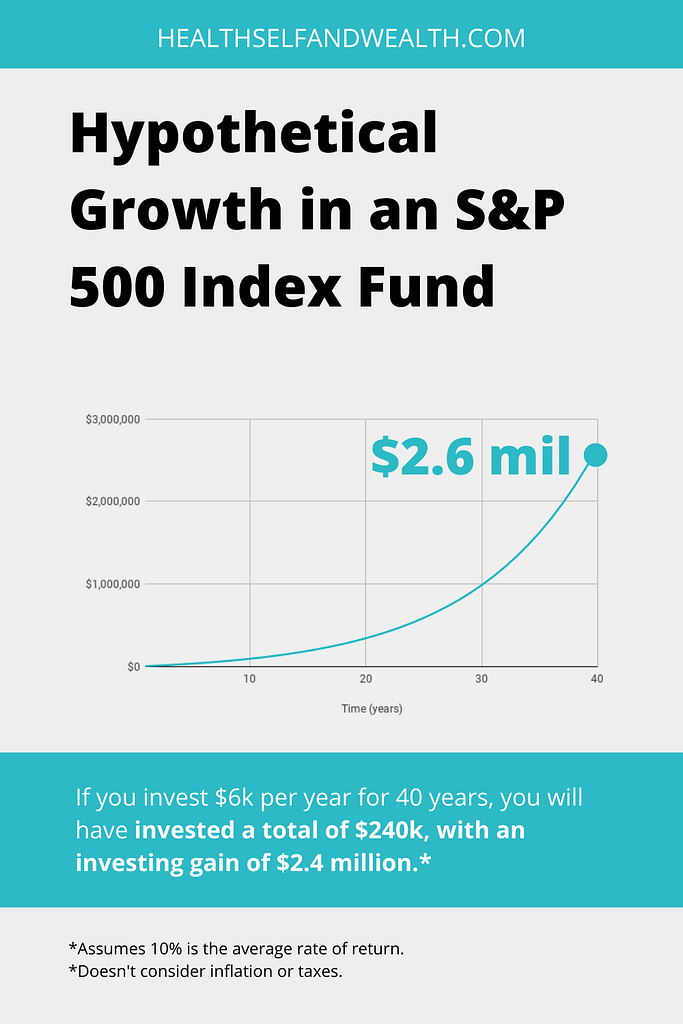

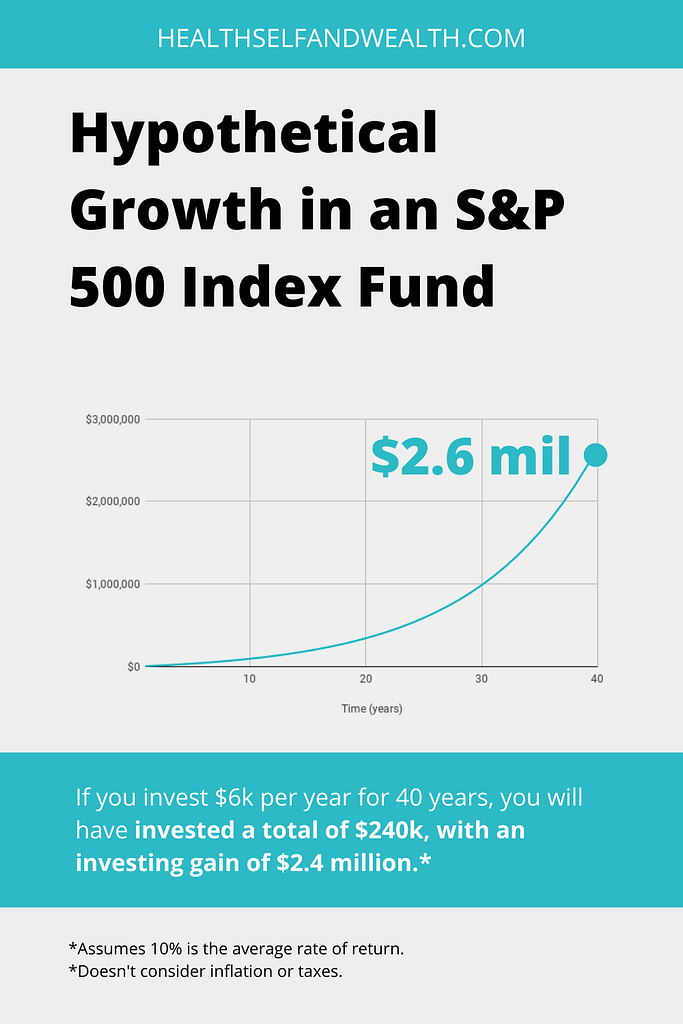

When you invest for the long-term, those gains compound. Even if you only invest $6,000 per year in a S&P 500 index fund, in 40 years you could have millions. The best part is that you only invested $240,000 of that. The millions come from your investing gains.

It’s nearly impossible to trade individual stocks and consistently beat the S&P 500. According to Business Insider, even 90% of professionals failed to consistently beat the S&P 500 over a 15 year period.

Robinhood gamifies investing and makes people think they can, even though research shows most professionals who trade stocks full time cannot.

Opportunity Cost of Time

Not only are the returns better with an index fund, but you will only spend a fraction of your time contemplating your investments. Professionals could spend up to 80 hours a week researching and making decisions.

Once you consider the value of your time, the attractiveness of the S&P 500 index fund increases. If you spend your extra free time trying to guess which stocks will make you money, that’s time you couldn’t be doing something that will actually give you money immediately.

I found one source that said it’s not worth your time to handpick stocks unless you make over $200,000 per year. The reasoning was that you’re better off spending that time making more money through a side hustle or second job. Then to maximize your return, invest that extra money in your index fund.

Average Risk

In addition to high returns, the S&P 500 index fund investment strategy has average risk. That means you are taking exactly as much risk everything in the market has, no more or less. This means that when the market is up, so is your investment. Conversely, when the market is down, so is your investment.

The biggest risk of owning an individual stock is the company going out of business. You would lose your entire investment. That will never happen with the S&P 500 index fund.

For your investment to drop to $0, every single one of the 500 biggest companies in the US would have to go out of business at the same time.

If that were to happen, you’ll likely have bigger problems than your investment (imagine something out of a science fiction movie).

Additionally, your fund will be updated as the 500 biggest companies change. Underperforming companies will automatically be replaced with better ones.

Low Costs

Finally, since index funds are passive (meaning fund managers don’t have to trade stocks for you all day), they are the cheapest funds you can have.

To recap, the S&P 500 index fund has a high average annual return, average risk, low time commitment, and low costs. It’s an easy and powerful investing strategy that can position even those who don’t know anything else about the market can beat the majority of professional fund managers.

How to Begin Index Fund Investing

If you want to invest in an index fund, you have to determine what type of investment account is best for you. Read this post to determine which investment account(s) you should prioritize.

Once you’ve decided on the account type, your next step is to open an investing account if you don’t already have one. Low-cost brokerage firms are advantageous because they typically have lower fees and lower minimum investment requirements. Some popular low-cost brokers are Fidelity, Vanguard, and Charles Schwab.

When you are comparing low-cost brokers, you also want to look at their index funds. Specifically, look for:

- A low expense ratio. Ideally, an expense ratio less than .25%, but really good ones could be as low as .05% or less.

- Minimal fees. You want to avoid as many fees as possible, especially transaction fees, front load, and back load.

- A low minimum investment requirement and low subsequent investment requirements. For example the index fund I bought required $100 for the first investment, and then at least $1 for everything after that initial investment.

- An automatic investing plan. You can automate your investments to make investing an effortless habit. Read how to automate your finances here. Also, check the auto investing minimums and fees associated with automating. Again, you want to minimize fees and the investment required.

Best Practices For Index Fund Investing

The most important requirement for this index fund investing strategy to be successful is that you leave your investment alone. Once you’ve invested your money, keep it invested for the long term.

If you know for certain you will need this money in exactly 5 years at a specific time, this may not be the investment for you. In 5 years, you don’t know if the market will be up or down. If it’s down and you have to pull your money out, you will lose money.

If you don’t need your money at a specific time and could wait until the market is up again to remove it, then this would make this a safer option.

Again, the best practice here is to put your money in your investment and plan to live without it for the foreseeable future. Then when you come back to it, many years later, you will see how much your money multiplied.

Your future self thanks you for reading this and starting to invest as soon as you can. Let your friends’ future selves thank you too, so share this with your friends!

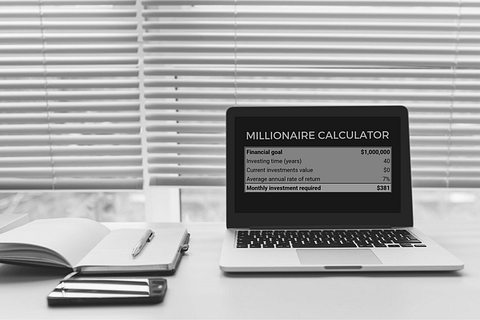

Bonus: Want to Achieve Your Goals Faster?

If you want to accelerate your progress towards your financial goals, here’s your guide.

[…] Learn more about the benefits of index fund investing here. (Spoiler alert: it’s an easy approach that typically outperforms 90% of investing professionals over the long term.) […]