Do you want to invest but don’t know where to begin? The finance industry can be confusing and unnecessarily complicated. These barriers have prevented women from investing and building their own wealth.

Without investing, women are more likely to depend on external parties like a man or employer. It’s 2022 and women only own an average of 32 cents for every $1 a man owns. Investing is one factor that can help shift this.

This is index fund investing for women, written by a woman. Learn about investing fundamentals with examples about “that guy” and girl code to make it fun and easy.

Before we jump in, I am not a licensed financial advisor. This information is for educational purposes only and is not advice. Every individual is unique and accordingly will have unique outcomes. Always do your own due diligence before making any financial decision.

- How does investing build wealth

- What is index fund investing

- When to start index fund investing

- How to start index fund investing

- How to make index fund investing a rewarding habit

How does investing build wealth

Investing is purchasing assets that you expect to grow in value over time. Investing can be one of the easiest ways to passively build wealth over time.

It’s so powerful because compound interest grows your money exponentially over time.

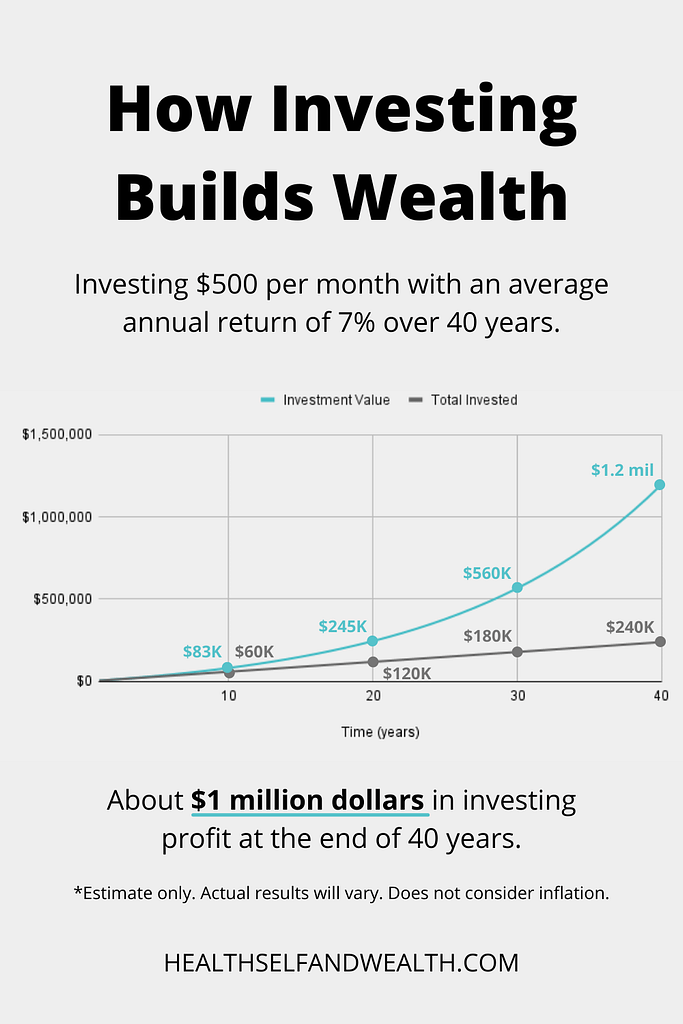

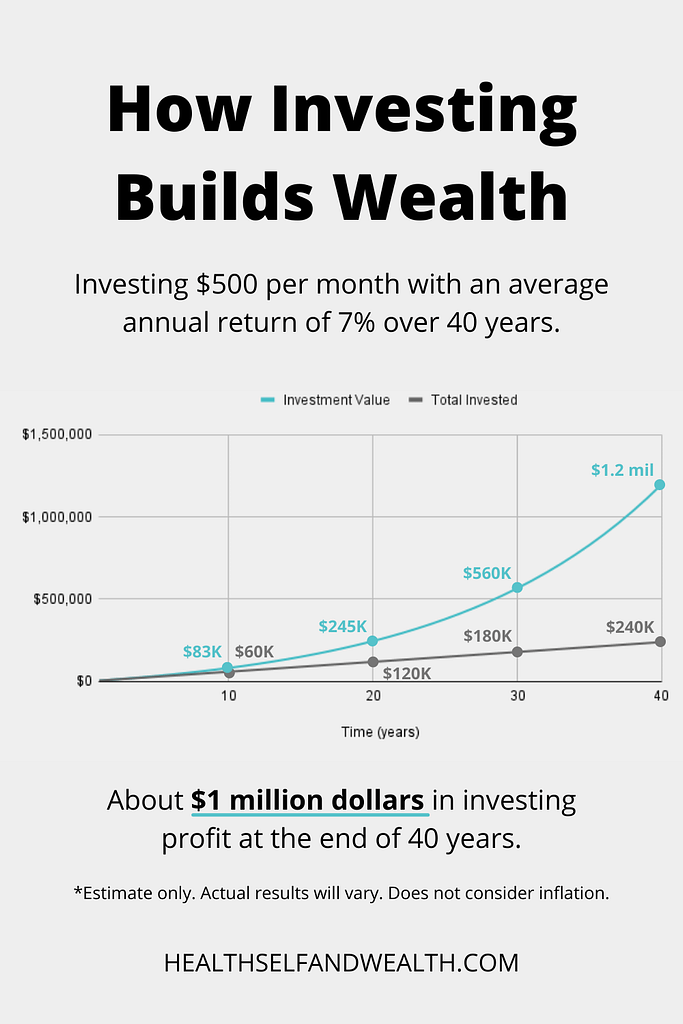

If you start investing $500 a month at age 25, here’s an example of how that may compound over time.

With investing, time and compound interest work together to grow your money exponentially.

What is index fund investing

A common concern with investing is a fear of losing money. This is a legit concern, especially if you you are investing in individual stocks. In other words, investing all your money into one company. If that company goes out of business, you’ll lose all your money.

Conversely, you could choose the next Google before it’s Google and get huge gains. The problem is, how do you know which companies will fail and which will be market leaders?

Even the vast majority of experts cannot successfully predict winners and losers over the long-term. Over a 15-year period, 90% of investing professionals fail to outperform the market.

Now if my name were Chad or Brad, perhaps I’d feel confident overconfident enough to think I could consistently beat the market, even if most professionals can’t.

Let’s rewind for a second. I want to invest because I want to achieve my #moneygoals. I definitely don’t want to lose any money. I also don’t want to spend my time hand picking individual stocks like Chad or Brad.

I wish there was a way to get good investing returns, while minimizing my risk and effort required. Can you relate?

Meet index funds, your investing BFF. Instead of trying to predict winning stocks, buy hundreds or thousands all at once with an index fund.

An index fund is a collection of assets that track an index. In other words, an index fund is a holding of a group of stocks that typically doesn’t change much over time. An S&P 500 index fund would be a classic example of an index fund.

Index funds significantly reduce your risk of losing all your money. For that to happen, every single company in the index fund would have to go out of business at the exact same time.

Additionally, you will earn market returns, or average returns. Now, even if you’re used to being above average, I’d argue the stock market rewards mediocrity.

I personally like earning average returns because it comes with average risk. Risk and return are highly correlated. The more risk you’re willing to take, the greater potential for higher returns.

Unlike Chad and Brad, my goal isn’t to beat the market. It’s to earn average investing returns to build wealth steadily and somewhat predictably. Accordingly, I like to stay near the middle of this chart with index funds.

Chad and Brad would hang out towards the right side of the chart where they could get above average returns, however, they are taking on above average risk. The risk lowers their chances of getting those high returns and increases their probability of making less than the market.

Investing for the long-term further reduces risk you are taking. The S&P has had positive returns for every 15-year period in history. Although, I should note that historical outcomes do not guarantee future outcomes.

To recap, an index fund is a group of assets that tracks an index. They earn average returns and typically have average risk.

When to start index fund investing

Now that you know the power of investing and what index fund investing is, when should you start investing?

As a general rule, experts recommend doing two things before you start investing:

- Have at least 3 months of emergency savings and

- Be free of high-interest debt.

A guaranteed way to lose money in a stock market is to sell an asset at a loss. An emergency savings fund gives you access to money to cover unexpected expenses. This reduces your likelihood of needing to withdraw from your investment accounts.

You can learn more about why emergency funds are great and how you can start one here.

Earlier we talked about how compound interest makes investing so amazing. Well, if you have debt, particularly high-interest debt, that works against you. The S&P 500 is an index of the 500 biggest companies in the U.S. and serves as a benchmark for market returns.

Over time, the S&P 500 has returned an average of 7%, which is why 7% is often the number used for estimating returns.

If you have any debt over 7%, paying that off before investing will make the biggest impact on your net worth growth.

If your rate is less than 7%, you may want to consider paying off only the minimum balances. Then contribute any leftover money into investments. That’s because an average return of 7% in the stock market will have a greater impact on your net worth growth.

If you have an emergency fund and don’t have any high-interest debt, now may be a good time to start investing for the long-term.

Long-term is a keyword here. Do NOT invest money you will need tomorrow or maybe even a year from now. It’s a best practice to keep your money invested over the long-term, like 10-15+ years.

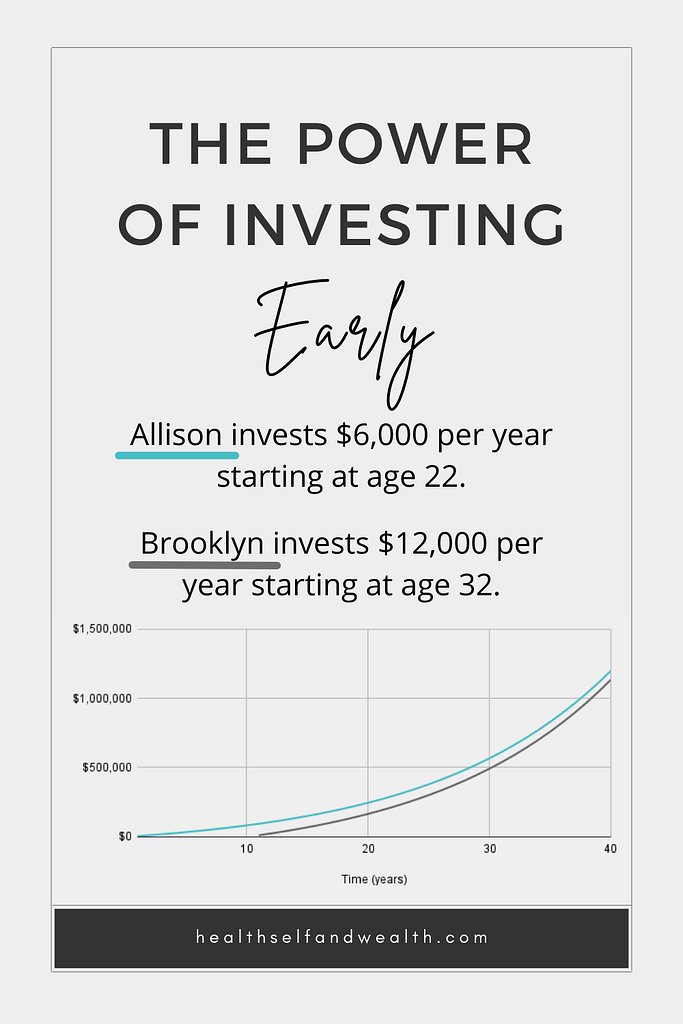

The sooner you invest, the more time will do all the hard work for you. Let’s see an example of index fund investing for women. Allison invests $500 a month starting at age 22. Let’s compare that with Brooklyn, who invests $500 a month starting at age 32.

Allison invested a total of $60,000 extra than Brooklyn. Because she started earlier, she ended with over $500,000 more at the end of the 40 years.

What if Brooklyn invests double the amount of Allison? Any bets on who will have more money at the end of 40 years?

Brooklyn invests $120,000 more than Allison over the course of those 40 years. Allison still ends up with more money because more time allows for more compounding.

These examples show that TIME has the biggest impact on your investing wealth. The sooner you can start investing, the better.

How to start index fund investing

This is index fund investing for women, with a detailed guide so you feel equipped to start or optimize your investing. This section has a lot of information so you can feel confident. If you’d prefer to take this step by step, here’s a free 10-day investing challenge. It summarizes this section into easily digestible snippets of information with daily activities.You can sign up for the free 10-day investing challenge here.

If you’ve signed up and confirmed your email, you can skip to the next section: how to make investing a habit.

This section will provide detailed instructions on index fund investing for women including how to…

- Set money goals

- Determine how much to invest

- Choose investment accounts

- Decide to self manage or outsource

- Select a broker

- Mitigate investing risk

- Define portfolio strategy

- Research index funds

- Avoid common investing mistakes

Set Money Goals

Up until this point, the focus has seemed like it’s on money. Let’s take a step back. Money is simply a tool that provides you the freedom to live your life on your own terms.

Accordingly, money goals shouldn’t be to reach an arbitrary number in your bank account. Good money goals are rooted in your lifestyle goals for two main reasons.

- Lifestyle goals are motivating because it transforms money decisions into more tangible outcomes. This makes it easier to make balanced decisions.

- Lifestyle goals can define how much money you need to achieve your goals. So often people make the goal to get rich. Then they never feel like they’ve reached it because they could always have more money.

All money goals should align with your lifestyle goals. Accordingly, reflect on the questions below to think about what you’d want your life to look like.

- How would you spend your time if you didn’t have to work for money?

- Who is in your life?

- Where do you live?

- What do you do for fun?

- When are you the most fulfilled?

If you’d like more tips on defining your best life, here is a 5-step process to help you find clarity.

Maybe your dream life involves sipping strawberry daiquiris in the Bahamas or fighting for social equality. Whatever your dream life looks like, now it’s time to set investing goals in pursuit of your best life.

Here are 5 questions to answer when you are defining your investing goals:

- What are your desired investing outcomes?

- Why do you want to achieve those results?

- How many years do you have to achieve this goal?

- How much progress, if any, have you already made towards this goal?

- How much are you willing to invest each month?

If you need help estimating the total $ amount you’d like to have at the end of your timeframe, you can use the rule of 25.

Rule of 25

A Trinity study found 25X your annual expenses is a magic number for investing. Once you have that amount invested, you can withdraw 4% a year for the next 30 years with a 95% success rate. This doesn’t consider inflation, but you can use this as a starting point to estimate your investing needs.

Determine how much to invest

There are 2 main approaches I use to decide how much to invest:

- The maximum amount I can invest

- The estimated amount I’d need to invest to reach my goals

Each approach will probably provide a different amount to invest each month.

The advantage of using approach 1 is you’re investing all that you can. The disadvantage of this approach is it may not be enough to reach your goals.

The advantage of the second approach is that it sets expectations. Although it’s just an estimate, you will at least know if you’re on track to reach your goals.

I ultimately use both. First I figure out how much I’d need to invest to reach my goals. Then I see how much I realistically can invest.

In the short term, I invest what I can. Then I make money plans for how to make up the difference over the long term.

For more guidance, here’s a 4-step by step process for determining how much to invest.

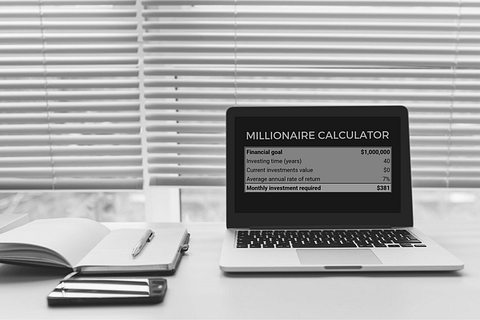

As a bonus, here’s a free calculator to make estimation easier.Please keep in mind that actual results will vary. Every individual has a unique financial situation. Accordingly, always do your own due diligence before making any investment decision.

Choose investment accounts

There are two groups of investment accounts: tax-advantaged and taxable. Some tax-advantaged accounts include an IRA and a 401(k). Some taxable accounts include brokerage accounts like a Robinhood account. Each investment account has what I call its “superpower”.

Before we get into that, this is not a complete list of all investment accounts. Accordingly, always do your own due diligence before making any investment decision.

Now here are a few common investing accounts and what I call their “superpower”.

- 401(k): employer match

- Roth IRA: tax-free gains😍

- HSA: triple tax-advantaged

- Brokerage: no contribution limits

If you want a quick rundown of the pros and cons of these accounts, read this. This quick summary will help you see which accounts align with your goals.

If you want to maximize your investing profit, then look into tax-advantaged accounts, like the 401(k), IRA, and HSA.

If you’re like Hannah Montana and want the best of both worlds, you can choose multiple accounts.

Decide to self manage or outsource

So often, I hear women say, “I don’t know how to invest. I’m just going to have a financial advisor do it for me.”

These women say this with the best of intentions. It seems more time efficient to hire an expert to manage your money right? They may feel afraid they are going to screw something up and trust these “experts” more.

They don’t realize these “investing experts” are SALESPEOPLE. They trust it’s the best decision to put their money in the hands of financial advisors. They don’t realize that more often than not, these financial advisors have a conflict of interest because many are paid on commission.

Do they always recommend investments that are best for you or investments that are the most profitable for themselves?

Here are 6 reasons you should consider managing your own investments. TL;DR: historical data suggests you can make more money and pay less fees through index fund investing.

If you choose to hire an advisor, choose a fee-based advisor instead of a manager who takes a % of your portfolio. You will pay them less over time. They are more likely to give you unbiased advice because they don’t have a conflict of interest. A robo-advisor is another viable alternative.

Select a broker

If you’ve decided to manage your own investments and you are choosing an IRA or a brokerage account, you will also likely need to select a broker. A broker is the financial institution where you will have your accounts and purchase investments.

I recommend looking into low-cost brokers first because they are low-cost. Some examples include Vanguard, Fidelity, and Charles Schwab. It also may be worthwhile to choose an established institution because they tend to be more trustworthy.

Mitigate investing risk

| Type of Risk | How to Mitigate It |

| Risk of not investing and losing money to inflation | Invest to avoid inflation risk. |

| Risk of not understanding your investments (You don’t let a friend go to a bathroom by herself. Don’t let your money go into an investment unless you know exactly how it will be coming back to you.) | Conduct research to understand your investments. |

| Market risk/volatility: how much your investment swings up or down in the short term. Think of volatile investments like a rabbit, frequent up and down movements. Investments with less volatility will be more like a turtle, not a whole lot of up and down movement. | Invest for the long-term to avoid short term market risk. |

| If you own individual stocks, the value could go to $0 and you could lose your money. | Diversify your portfolio with a variety of funds and asset classes. |

Knowing your risk tolerance can help you create an investing strategy that aligns with your comfort with risk.

There are a lot of factors that go into this. Here’s one question for a starting point to predict your risk tolerance.

There is no right or wrong answer, as long as you are honest with yourself.

What would you do if you had $100,000 invested and the value dropped to $50,000?

- I would sell the remaining $50,000

- Nothing, I would do nothing

- I would invest more

The answer to the question may also vary with the amount you have. If you are a millionaire and the market crashed so you only have $500,000, what would you do?

- I would sell the remaining $500,000

- Nothing, I would do nothing

- I would invest more

It’s okay if your answer is different for each scenario. If your net worth is a million dollars, go with your answer from that question. (And if so, let’s take a moment to celebrate your win!!!)

If not, use your answer from the first question. This exercise demonstrates your risk tolerance can change as your financial landscape does. It’s okay to re-evaluate your risk tolerance.

I’m going to dive a little deeper into each answer and some potential implications for you to consider.

- I would sell the investment – Certain Champions

It seems your natural instinct is to avoid risk. You may have a preference for certainty over uncertainty. You want your portfolio strategy to align with this.

That means you may consider a mix of less volatile investments to offset the more volatile ones.

Volatile in this case means how much something moves up or down. Think of volatile investments like a rabbit, frequent up and down movements. Investments with less volatility will be more like a turtle, not a whole lot of up and down movement.

You may also want to limit checking your accounts so you aren’t tempted to sell during a downturn.

Selling your investments while the market is down is a guaranteed way to lose money in the stock market.

You could set up automatic investing and limit how often you check your accounts. Another alternative is hiring an advisor or robo-advisor to manage your investments for you.

- Nothing, I would do nothing – Consistent Conqueror

You make a plan and stick with it. It helps if you are investing for the long term because the market has recovered from crashes over time.

If you can stomach deep losses without panic selling, you may want to consider managing your own investments.

- I would invest more – Investing Queen

You accept the risk comes with the reward. If it was a good investment when you bought it, it’s a good investment now that it’s half off.

You may want to manage your own investments so you can easily keep an eye on them.

Knowing your risk tolerance helps you to design a portfolio that sets you up for investing success.

Define portfolio strategy

At a high level, your portfolio strategy is like your game plan. Let’s compare it to a game of monopoly.

When you get started, you may create a game plan with a wish list of properties you’d like to own. Ultimately, you want a property that you think you’ll profit off of. You may also want a mix of properties (diversification) instead of owning just one.

Think of diversification the way “that guy” thinks about “dating.” If he’s only talking to one woman and she ghosts him, then he won’t have anyone to text at 2am. That’s why he “diversifies” his “investments” into Amy, Susie, Eva, Karmin, and Taylor.

Diversification lowers that guy’s risk of not getting laid, and as an investor, it lowers your risk of not getting paid.

In the stock market, there are various assets including stocks, bonds, real estate, and more. You can look at investments by the size of the companies: large cap, mid cap, and small cap. You can also look at investments by growth or value or blend. There are also many other ways to distinguish assets. The more variety of assets you own, the more diversified you are.

If you choose a robo-advisor, it will likely define a target portfolio for you based on its assessment of your risk tolerance.

Alternatively, if you are investing on your own, you can research suggested portfolios for someone your age with your risk tolerance. I defined my portfolio strategy by starting with a recommended portfolio and further tweaking it to fit my unique needs.

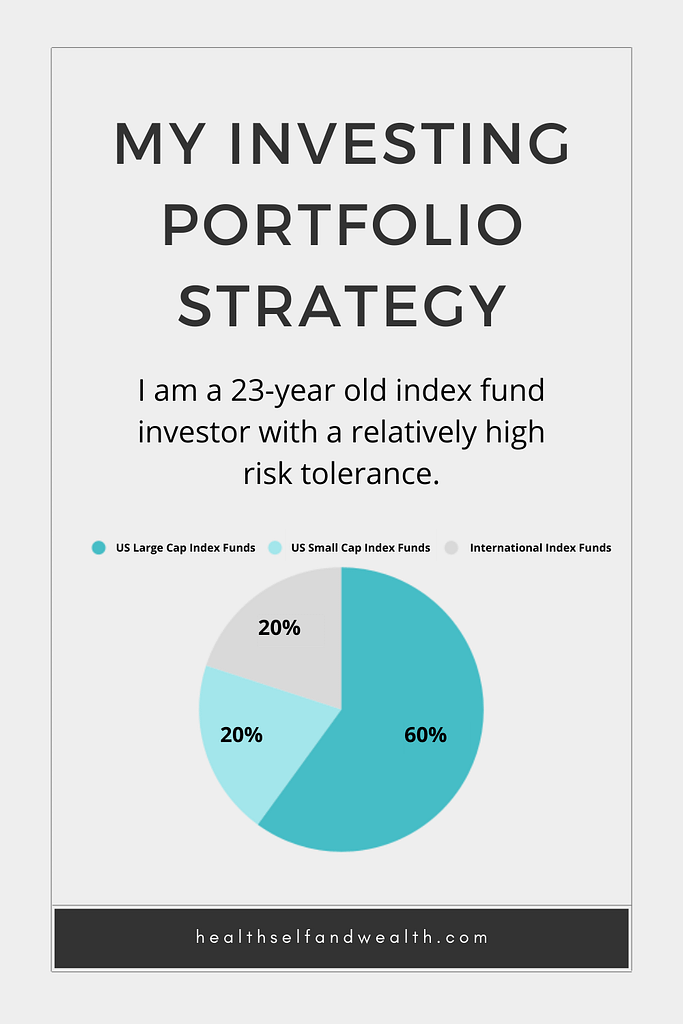

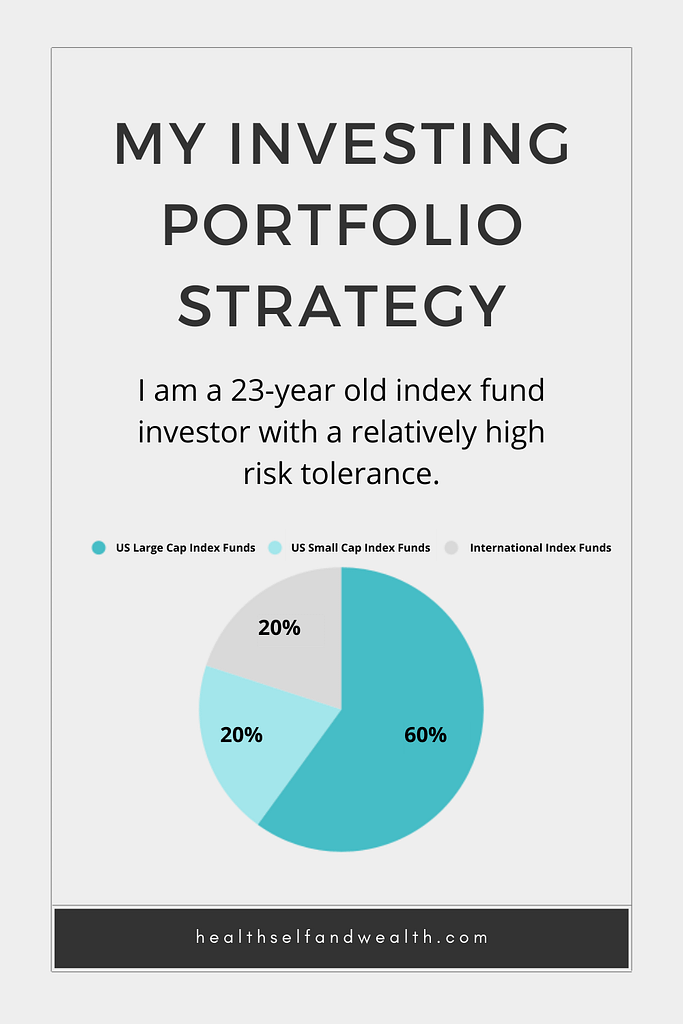

So you can see an example, here’s my target allocation as a 23 year old investor with a relatively high risk tolerance.

Remember, your portfolio strategy is like your game plan. If you feel confident sticking with your strategy over the long term, no matter what is happening on a day to day basis, that’s a sign of a good strategy. In other words, if the market crashed tomorrow, you wouldn’t sell everything.

A portfolio strategy will help guide your decision making. It will also help prevent emotional decisions that don’t align with your long-term goals.

It is not easy to define a portfolio strategy. Start by looking at recommended portfolios based on your age and risk tolerance. Then tweak from there as you feel more comfortable.

Research index funds

There are so many options when it comes to investing your money. I personally like low-cost index funds.

Index funds are a collection of assets, like stocks or bonds. They typically offer more diversification than holding individual stocks. An index fund would be like buying an eye shadow palette instead of buying individual eye shadows. You have many eye shadows in one palette and less risk you won’t have the shade you need.

Index funds also tend to have low fees, which helps maximize your investing profit. They have lower fees because someone isn’t actively buying and selling for you everyday. These funds buy and hold stocks passively, which has lower fees.

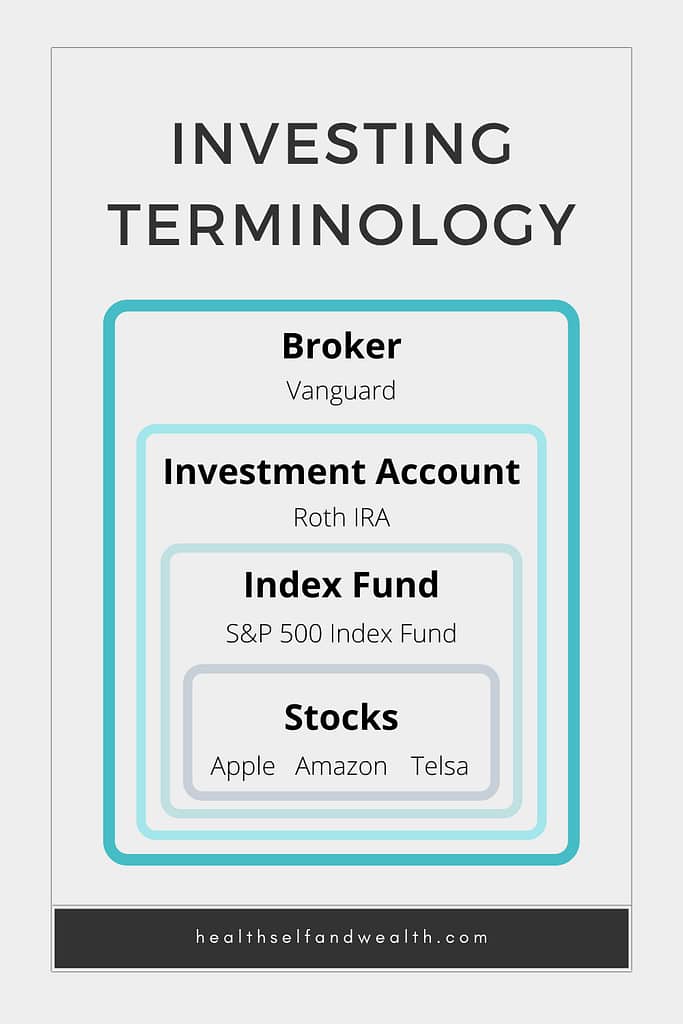

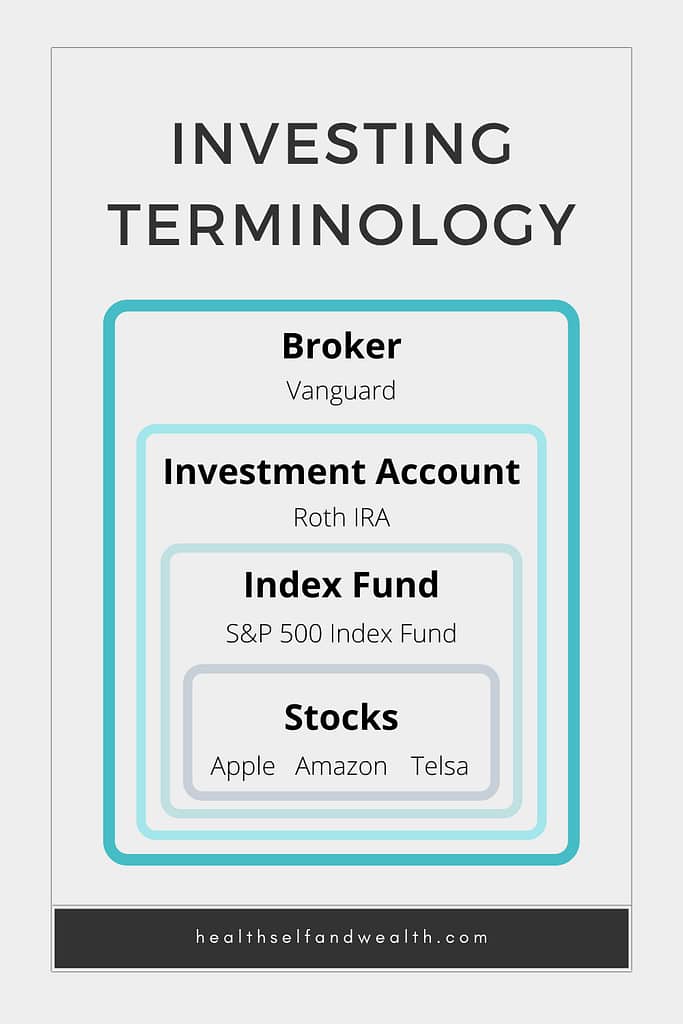

So far we’ve talked about brokers, investment accounts, funds, and stocks. Here’s a visualization to see how these items relate to each other.

Your broker stores your investment account. Your investment accounts hold your funds. Your funds have stocks in them.

You can begin researching index funds by reviewing your 401(k) or HSA investment options. Alternatively, you can research funds through your broker as well or online.

Avoid common investing mistakes

Here are 7 common mistakes investors, new and experienced, make. I’ve made quite a few of these…

- Waiting to invest

- Timing the market

- Trying to beat the market

- Not purchasing investments

- Prioritizing taxable investment accounts

- Believing it’s too soon to invest for retirement

- Trusting a financial advisor, blindly

Learn more about these common mistakes here to see how you can prevent them or address them.

I also want to note, if you are investing on your own, you are probably going to make a mistake at some point. However, don’t let perfection stop you from taking action. Even though I made some investing mistakes when I first started, I’m in an infinitely better place now because I started investing.

When you start you don’t have to be perfect. What matters is that you start and keep learning. For an easy way to keep learning, subscribe to Health Self and Wealth for weekly personal finance tips directly to your email inbox.

How to make index fund investing a rewarding habit

Investing is an action. Actions have the potential to become habits. You can build a habit by making it easy and rewarding.

Automating your investments is the easiest way to invest consistently and easily. For example, you could enroll in a 401(k) through your employer. Then have a portion of your paycheck automatically invested.

If you are self managing through a broker, you can set up auto contributions and auto investments.

Once you’ve made your investing habit easy, it will make it almost effortless for you to keep doing it. To set yourself up for even more success, the next step is to make your investing habit rewarding.

As humans, we are naturally motivated by our own progress. It’s hard to see your investing progress though, especially if you have money in multiple accounts.

Wouldn’t it be motivating if you could see your investments connected to your net worth growth?

Seeing this type of progress is even more important for women because women often have less comfort with investing than men. Men are taught their whole life that they are supposed to be making money and to use investing to build wealth.

Women aren’t usually encouraged to make money because it disrupts the patriarchy. Think about it, if a woman can make her money, then does she really need a man?

Accordingly, women usually don’t get as much information on investing and therefore tend to feel less comfortable with it.

That’s why seeing the impact investing has on your net worth over time can be so powerful, especially for women. It will build confidence in your investing ability.

The Personal Finance Planner connects your investments to your net worth. I spend about an episode of The Office one time a month updating my planner. (Maybe 2 if the episode was really funny.)

Seeing your progress will give you a reward, which motivates you to stick with investing. This is the key to making investing a habit.

If you want to start tracking your investing progress, you can download your Personal Finance Planner here.

Conclusion

Thank yourself for taking time to prioritize your financial wellbeing. If your brain is exploding from information overload, that’s okay. You can sign up for the free 10-day investing challenge to receive step by step recaps and daily activities to get started investing.We went over a lot today, so here are links back to any section you may want to revisit.

- How does investing build wealth

- What is index fund investing

- When to start index fund investing

- How to start index fund investing

- How to make index fund investing a rewarding habit

If you found this helpful, please share it with someone else it could help too.

As women, we’re told talking about money is taboo, and that’s part of the reason it’s difficult to overcome the wealth gap.

Ladies, let’s help each other. Health Self and Wealth is the place where we build wealth together.