You don’t need another doom and gloom article about the impact of inflation. Your bank account sees it, your wallet feels it, and your credit card company smiles. Instead you need effective ways to save money so you can buy the things you need ideally without giving up all the things that make life enjoyable.

Here are my 11 best ways to save money with high inflation.

- Track your spending

- Seek value

- Minimize inventory

- Reduce your fixed costs

- Evaluate your spending priorities

- Avoid credit card debt

- Increase your income

- Ask for help

- Keep emergency savings

- Protect your peace

- Fight inflation by investing

Please note I am not a licensed financial advisor. This information is for education purposes only. Every person has a unique financial situation. The best approach will be different for everyone. Accordingly, do your own due diligence before making any financial decision.

How to save money with high inflation

Track your spending

It’s most important to track your spending when you want to do it least. Even I still struggle to track my spending when I know I spent more than I intended to. But I do it anyway.

I was curious about the impact inflation has had on my own spending, and because I track this, I can share the findings.

The impact of inflation on my spending

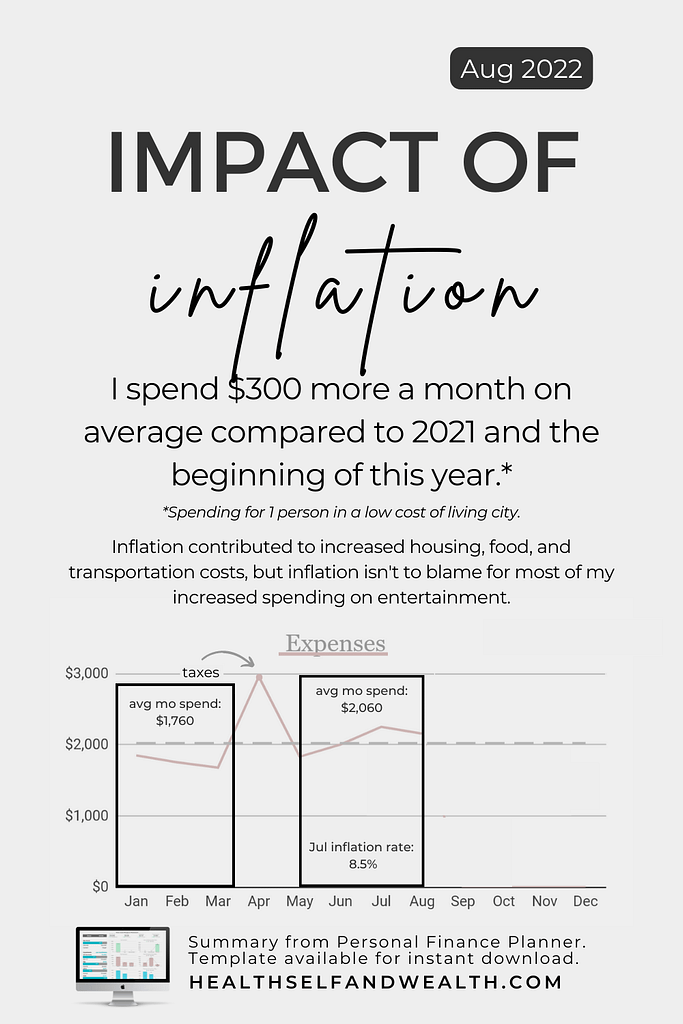

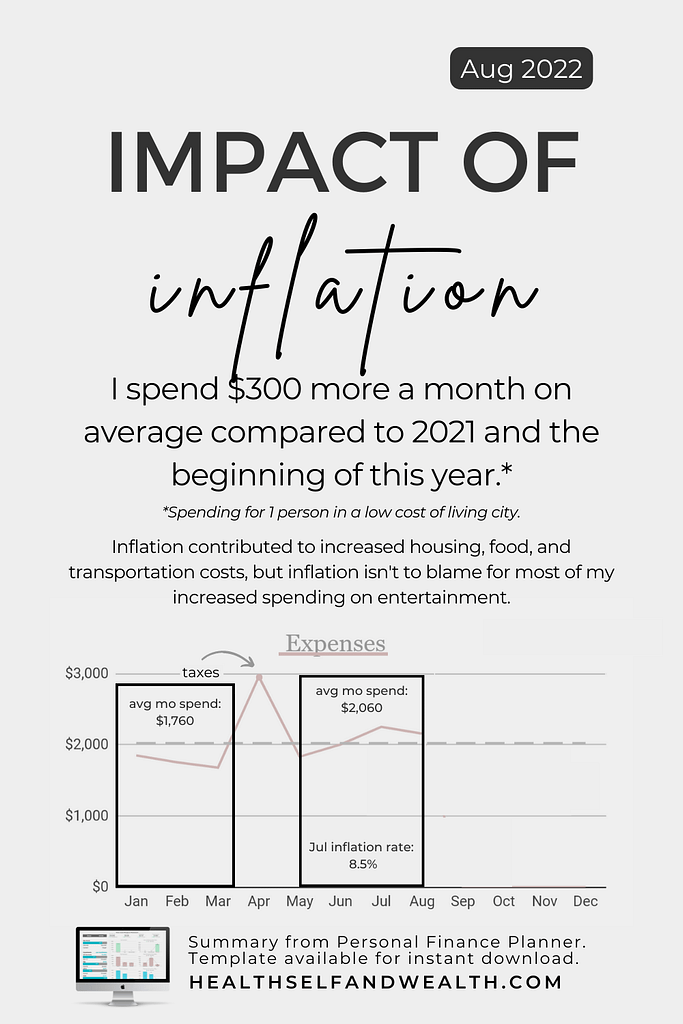

The past 4 months, I’ve spent an extra $300 a month on average compared to my average spend in 2021. I’m spending more in 4 main areas: housing, food, transportation, and entertainment.

Inflation contributed to increases in housing, food, and transportation.

Inflation is not to blame for all the increased spend though. The increases in entertainment comes from increased spending on experiences like Machine Gun Kelly concerts and flights out west.

Here’s a visual from my 2022 Personal Finance Planner, which is how I identified the overall increase in spending. I then used the details on my progress tracker sheet to identify the specific categories contributing to the increase.

I estimate inflation is the reason for about 50% of my increased spending, as the current inflation rate is at 8.5% based on the latest data from July 2022. That means I spend an extra $150 a month now just because prices have gone up.

If I wouldn’t have been tracking this, I wouldn’t have known how to explain the increase in spending, as for the most part, my habits haven’t changed that much.

Over the course of a year, this increase means I spend an extra $1,800. Inflation is not equal for all items though. The food inflation rate sits at 11%, while energy, like gas for transportation, sits at 33%.

I spend less than the average person. I don’t have kids. The more you spend, the more inflation will impact you. So I’m going to look at averages to understand what a typical millennial may be experiencing right now.

The impact of inflation on the average millennial household

The average millennial household spends $5,850 a month, based on data from 2020. That means the average millennial household would need to spend $6,350 a month now to keep buying the same things.*

That’s an extra $500 a month, or $6,000 a year.

This becomes problematic when the average raise in 2022 is 3.4%. That doesn’t keep up with inflation at 8.5%.

I promised not to dwell too much on the challenges, so let’s pivot with this context towards finding a solution.

Why tracking your spending matters so much

The best place to start is by tracking your spending because the formula for building wealth is spending less than you earn and investing the rest.

Our averages suggest the typical millennial household would need to spend an extra $300 a month they haven’t earned just to keep the same spending habits from the previous year.*

*Calculated after accounting for 8.5% inflation and a 3.4% raise.

In other words, its almost impossible for the average household to keep the same exact spending habits from last year without going into debt, assuming the household had average raises.

Now these are just averages, so your financial situation will be unique. That’s why the best place to start is by understanding your habits.

If you don’t know where to start with tracking, check out Beat the Budget, a google sheets budget template that tracks your incomes and expenses.

This template is the one I started with when I first learned to manage my money. It helps you understand your spending habits and compares those habits to your spending intentions.

I don’t like suggesting that people cut their spending because that’s what Dave Ramsey is here for. But for the average millennial household, the 2 options for following the formula for building wealth are spending less and/or earning more.

While I always encourage earning more, it’s easier and faster in the short term to trim back the spending.

My credit card also has a spending tracker and maybe yours does too. There are also budgeting apps you could try. And if you’re more of a pen and paper gal, you could also track your spending in a bullet journal.

Regardless of the method you choose, track your spending. You cannot improve your situation if you don’t know what your situation is.

Seek value

During this high inflationary time, seek products that have the best value, whether it’s a superior premium brand or a good enough store brand.

Maybe buying a superior product works better so you use less and spend less overall. Or maybe the generic brand works just as well so you get that one.

I also seek value by shopping at retailers that always have low prices. Yes, I’m talking about Walmart.

Using coupons and rewards apps/cards also help you get more value for your money.

Minimize inventory

Minimizing the amount of product you store at home is another way to spend more intentionally.

This looks like only buying the items you will consume within a timeframe that feels right to you.

For example, maybe you normally buy the 3-pack of Crest, and then store the extra inventory until you need it. Instead you could buy the one you need and wait to restock until you run out again.

Particularly I notice this approach has the greatest impact when I minimize my food inventory. Now I always meal plan before I go to the grocery store and only buy the items I need for my meals this week.

This also helps prevent food waste especially as fresh produce doesn’t last as long anyway.

Reduce your fixed costs

Sometimes we forget about the control we have over our consistent recurring expenses, like housing, insurance, subscriptions, etc.

If there’s any fixed expense that doesn’t give you enough value, that could be a painless way to cut back on spending.

When many people start tracking their expenses, they realize they still have subscriptions/memberships they don’t use anymore.

It’s easy to forget about them when they automatically bill your credit card!

Even if you don’t have any subscriptions you don’t use, you can also price compare or negotiate your bills for your other fixed expenses. Think of expenses like car insurance, wi-fi, phone bill, bank account fees, etc.

Evaluate your spending priorities

After you’ve taken all the above steps, you may decide you still want to find ways to spend less. If so, then you may want to reflect further on your spending priorities.

Not all spending creates the same value in your life. When people reflect on their spending habits, they realize they may not value certain spending.

In a materialistic society, we have been taught success looks like living in the best neighborhood in town and waving to our neighbors as we gracefully step out of our BMWs one Louboutin after the other.

Society teaches us to keep wanting the luxuries those around us do. Our consumption keeps the top 1% getting wealthier and handcuffs us to our jobs working for them to keep affording the lifestyle at some point we decided we wanted.

I’m asking you to take off your metaphorical rose colored glasses and evaluate what spending actually makes you happy. And what you spend money on because society has made you think you should.

For me, I have 5 things I refuse to spend money that shocks people. The first most shocking one is drinks, including both alcohol and coffee. Another one is clothes.

See the other 3 on tiktok. Shameless plug to follow it if you want to see more of my controversial money content.

I don’t value these things though, so I’m not giving anything up.

It took me unlearning some deeply rooted beliefs and really reflecting on what I truly care about to realize spending money on material things, like clothes, doesn’t usually make me happy (unless it’s food.)

What actually makes me happy is spending my time with my close friends and fun experiences.

Is there anything you spend money on but it doesn’t add enough value into your life?

Avoid credit card debt

Even if you are budgeting and not spending any penny unnecessarily, it may still be difficult to spend less than you’re earning.

If you find yourself in this situation, it may seem like credit cards are your only option.

Only use them as a last resort because it makes the situation worse over time, like a snowball rolling down a mountain.

While it will temporarily help you buy what you need in the short term, the high interest debt will compound.

It would be like breaking your arm and then taking a pain killer. Sure, the pain in your arm may temporarily fade, but it’s not going to heal until you fix the root source of the problem.

Increase your income

That brings me to the root source of the problem. If you are in this situation, especially if there’s no where to cut back in your budget, it’s likely your income may be the problem. Increasing it is likely the answer.

It’s not a secret wages have not kept up with inflation. The top 1-10% keep getting richer and everyone else stays the same ish.

But staying the same is getting worse once you consider rising prices with inflation.

If you are here reading this, I believe you have the power to change the course of your own life. I won’t tell you it will be easy. It will require you to make hard choices.

Here are 5 ways to increase your income.

I believe so strongly you can, perhaps because I feel my actions changed the course of my own life. While we all have factors influencing our situation outside our control, I strongly believe we make our own luck by the decisions we make.

If you’re curious about my story, you can read it here.

Ask for help

My heart goes out to everyone who is struggling right now. To all the people who don’t need a budget to know things are not alright.

I’ve been there. It’s okay to ask for help. I’m so grateful for the people who helped me and my family during the time we struggled.

Check local food banks, religious organizations, and government aid. And any friends, family, or people in your community you feel comfortable asking.

Keep emergency savings

Keeping savings in case of emergencies is the single best financial decision. It prevents one unexpected expense from sending you into credit card debt.

It’s like a sky diver having a parachute.

Learn more about why having an emergency fund is the BEST money decisions and how to start one.

Protect your peace

I’m giving you the advice I wish I could have started practicing years ago. Find ways to let go of the stress and feel at peace. Even if it’s only for 10 minutes on your morning walk around the block.

Spend your time doing at least one activity a day that brings you comfort and peace.

Fight inflation by investing

Lastly, if you have an extra money after paying your bills, you don’t have high interest debt, and you have an emergency fund, consider investing.

Investing is the one money decision that builds your wealth. It’s also our best shot at fighting inflation.

Learn how to start index fund investing with this complete guide for beginners.

Conclusion

The odds seem stacked against the average households right now. Even so, you are the only person who can change your financial situation. Now you have 11 ways to save money with high inflation you can use to improve your money landscape.

What way will you use to save money with high inflation first?

If you want more weekly insights for being the CFO of your own life, check out our free Wealthy Women Club. Get once weekly newsletters summarizing the latest news with actionable tips so you can make your financial situation 1% better every week.

Check out the club here. All genders welcome.