If you want to learn how to start investing, here are 6 benefits of investing without a financial advisor. Spoiler alert: you can do it on your own, often with better results than hiring someone else. Here are 6 reasons to consider managing your own investments:

- Ensure your best interests are prioritized.

- Investing can be easy and quick.

- Achieve higher returns over the long-term.

- Avoid high fees that could cost you upwards of $1 million over your lifetime.

- You have complete control.

- Make better, informed financial decisions that will help you build wealth.

Please note: I am not a licensed financial advisor. This information is for educational purposes only and is NOT financial advice. The content in this post is personal opinion based on research and math. Every individual is unique and accordingly will have varying results. Always do your own research and due diligence before making any decision.

Ensure your best interests are prioritized

Learning how to invest can be intimidating. The Financial industry has its own lingo, it can seem like trying to learn a foreign language.

So perhaps you visit a financial advisor. Surely an expert can help you make the best financial decisions, right?

Well – let’s take a step back and consider the incentives for financial advisors.

The financial advisors are in sales. They can get paid from management fees and commissions.

Management fees are typically 1% of your portfolio. They get this fee regardless of if they made you money, or lost you money.

The commissions are based on the specific investments they recommend for you.

That means there could be a conflict of interest: does your financial advisor choose the best investments or the highest commissions?

If you decide to hire a financial advisor, do your own due diligence to make sure your money is in good hands.

I helped a close friend talk to their financial advisor and here’s what happened.

I helped a friend talk with their financial advisor a while back. I asked a simple question asking about the fees associated with my friend’s investments. He spent an hour on the phone, using complicated jargon I didn’t understand to skirt around the question.

He tried to make us feel dumb and inflict us with fear. He wanted my friend to keep investing in the funds that gave him the greatest commissions.

He never answered the question about the fees, but he didn’t know I was already able to estimate them online.

The fees were high and the fact that he wouldn’t answer confirmed low-cost index funds would undoubtedly be less.

This kind of experience could make new investors doubt themselves. I want to encourage you to trust yourself.

If someone can’t explain to you how your money will be invested, how can you trust that they’ll make you any money?

Investing can be easy and quick

People often think investing is difficult. That’s what financial advisors want you to think. Their business relies on it.

Fund managers can work up to 80 hours a week buying and selling stocks on your behalf. These types of funds are called actively managed funds.

But what if you learned how you could easily invest on your own, AND make more money doing so? Oh, and you could do it all in one hour, not 80.

That’s where index fund investing comes in. An index tracks a specific set of stocks.

Achieve higher returns over the long-term

The S&P 500 is a popular index used as a benchmark for investment returns and risks. It includes the 500 biggest companies in the U.S., like Apple, Microsoft, Amazon, Tesla, and Google.

Over the last 50 years, the S&P has earned an average annual rate of return of about 10%.

That means you can hire someone else to manage your money, but they probably won’t beat the S&P 500 AND you will pay them more.

Alternatively, you could decide to research low-cost index funds and invest yourself.

Avoid paying fees that could exceed $1 million

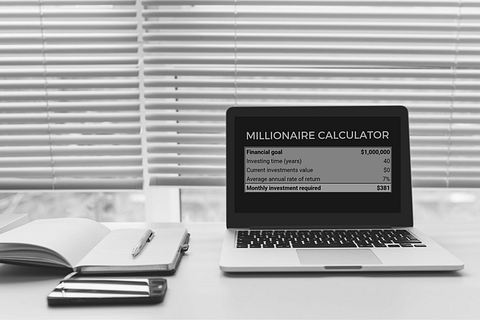

Earlier we touched on that 1% management fee. Now 1% may not sound like a lot, but let’s see how much that can be over time. (Spoiler alert: it could be $1 million!)

Meet Annie:

- She’s 25 and plans to retire at 65.

- At age 25, she started investing $1,000 a month. She plans to continue investing that much until she reaches retirement.

- She’s considering index fund investing or hiring a financial advisor to invest for her.

- Scenario 1: She’s investing in an S&P 500 index fund, which we’ll estimate earns an average annual return of 8% per year.

- Scenario 2: She’s investing in an actively managed fund that uses the S&P 500 as a benchmark. For this example, we’ll assume she also earns an 8% average annual rate of return. (Even though we’ve already talked about the high probability this will be less than the index.) She also pays a 1.5% management fee. Her real rate of return is 6.5%, the market return minus the management fee.

This example is for illustrative purposes only.

Here’s an estimate of her returns for each scenario.

| Scenario 1: Low Cost Investments | Scenario 2: Management Fees | |

| Time (years) | 40 | 40 |

| Avg Annual Rate of Return | 8% | 6.5% |

| Annual Payment | $12,000 | $12,000 |

| Future Value | $3,108,678 | $2,107,583 |

Scenario 2, paying 1.5% in management fees, loses a significant amount of money compared to low-cost index fund investing. In this example, Annie could lose upwards of $1 million dollars if she decides to pay that 1.5% fee.

There are lots of factors that influence the amount paid in fees, like investment contributions and time. They are also invisible. That means they are automatically subtracted from your account, so you never see them.

Complete control

If you choose to invest yourself, you will have the ultimate control over your portfolio. You can ensure your decisions put you on track to reach your goals and align with the risk you are willing to take.

I’ve seen people outsource their investing to a financial advisor and are shocked when they discover the decisions made on their behalf.

More investing knowledge, better decision making

If you decide to manage your own investments, it will be a learning process. The more you learn about investing and building wealth, the more informed decisions you can make.

Taking the time to learn about managing money is a great investment for your future.

Next Steps

To recap, 6 benefits of investing without a financial advisor are

- prioritizing your best interests.

- investing easily and quickly.

- earning higher returns on average over the long run.

- avoiding high fees that slow down your path to wealth.

- having complete control over your portfolio.

- understanding how to make better financial decisions.

Learning to invest can still be intimidating. Health Self and Wealth will teach you about index fund investing so you can reach your financial goals.

If you want personalized guidance, consider signing up for a one-on-one coaching session. These sessions clearly define steps you can take to reach your financial goals faster.

To get daily personal finance tips, follow us on Instagram and Pinterest.

Receive exclusive content, tools, and freebies when you join the email community.Would anyone else be interested in this information? Share this with them!

[…] top of that, here are 6 more reasons to invest on your own, without a financial advisor. The short version is you pay them A LOT more for typically WORSE […]