Anyone who has started investing has probably made a mistake or two along the way. I sure have. That’s okay though because if you haven’t made a mistake investing, you probably just haven’t started yet.

I’ve seen and even made some of the worst investing mistakes beginners and even experienced investors fall into. I’m sharing 7 common investing mistakes, so you can avoid them.

- Waiting to invest

- Timing the market

- Trying to beat the market

- Not purchasing investments

- Prioritizing taxable investment accounts

- Believing it’s too soon to invest for retirement

- Trusting a financial advisor, blindly

Please note: I am not a licensed financial advisor. This is for educational purposes only and is not advice. Always do your own due diligence before making any investment decision.

Waiting to invest

The first investing mistake that held me back was waiting to invest. I recognized how much I didn’t know about investing. I didn’t feel confident in my ability to pick index funds.

I wasn’t sure what my overall portfolio should look like. I spent hours researching and comparing basically equal index funds. And when I finally invested, I still wasn’t sure if I was making the most optimal decisions.

With unlimited information about investing available, it’s so easy to feel overwhelmed and under confident.

Even though these characteristics delayed my first investment (by 1.5 years!), they make me a good investor now.

If you can relate, these characteristics can hold you back from taking the leap, but they’ll make you a better investor once you get started. Because they help you avoid impulses and emotional responses.

After all those hours spent researching, do you know what I finally invested in when I started? I invested 100% into the S&P 500.

I didn’t even use all the research I did about building a diversified portfolio with index funds! I knew the S&P 500 was a good investment 1.5 years before I decided to do it!

Looking back, I wish I just would’ve taken the first step I felt confident in, and figured out the rest as I went along.

That’s what I ended up doing anyway, I just could’ve done it 1.5 years earlier!

Now that I’ve been investing for longer and have gained more comfort, I do have a more diversified portfolio than when I first started.

If I could go back and tell myself one thing during the time, I would say:

“I don’t have to know all the answers right now, as long as I keep thinking critically, questioning, and learning.”

It’s what I would say to you too if you’re hesitant to take the leap.

Investing mistakes may happen, but the biggest mistake is not investing at all.

Timing the market

I also initially fell into the trap a lot of new investors do – trying to time the market. Once I had finally landed on investing in the S&P 500, my next battle was deciding when to invest.

Again, in retrospect, the obvious answer would have been the same day I had decided to invest in the S&P 500.

Instead, I had this misconception that since the S&P had a higher value than ever before, it wasn’t a good time. I wanted to wait for a dip so it was “on-sale”.

I’m embarrassed to admit it took me another 3 months to invest waiting for a dip that never came.

I set up monthly auto-investments to prevent myself from falling into this trap again.

Time in the market matters so much more than timing the market.

Trying to beat the market

After I had been investing for a while, I wondered if I could do better than the S&P 500. Even though most investing professionals failed to beat this index over the long term, I daydreamed about the reward if I could.

This idea enthralled me when all the cool kids were trading on Robinhood and sharing huge gains from Gamestop, AMC, and dogecoin.

As an under-confident investor, I prefer certainty over uncertainty. That characteristic saved me from making investing mistakes here.

I never made any investments to try to beat the market, although I did consider it.

Attempting to beat the market can be tempting. If you find yourself in this situation consider what will happen if you make a wrong bet.

Are you willing to lose your entire investment on a stock or asset that could go to $0?

For me, I’m not willing to risk making those investing mistakes. I prefer to accept the market returns with moderate risk than to take a high risk with a greater likelihood of higher losses.

Not purchasing investments

This investing mistake hurts the most! Sometimes people contribute to an investment account for years without realizing they never invested the money.

Once you’ve contributed to an investment account, you have to buy investments.

If not, your money has been sitting in cash, not growing at all.

If you’re reading this and you’re not 100% sure your money is invested, go check it.

The sooner you realize it, the sooner you can purchase investments.

If you realize this happened to you, it’s also happened to a lot of others. It’s okay, just invest the money now.

Especially if you put this money in a Roth IRA. You’re better off now, even though the money wasn’t invested than people who never contributed that money to an IRA.

Believing it’s too soon to invest for retirement

I hear people say, “I’m young, retirement is so far away. It’s too early to invest for that.”

My insides curdle when I hear that. Time matters more than the amount you invest.

It hurts me to think about the sacrifices they’ll have to make in the future to retire with enough money.

Conversely, someone who starts early, can slack off in the later years and still end up with more money than someone who starts later.

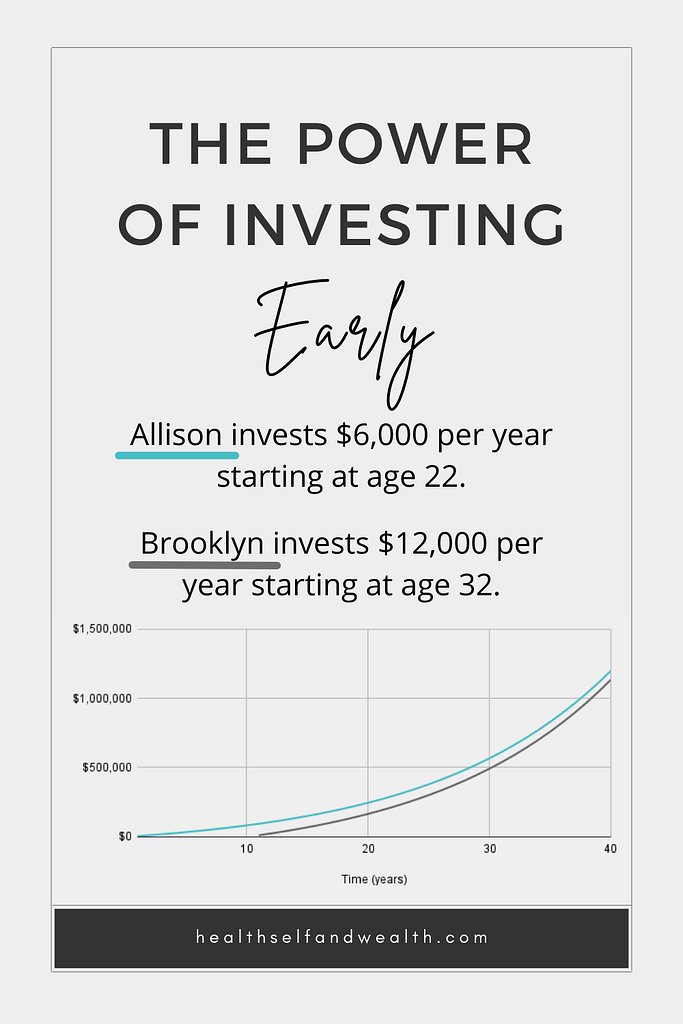

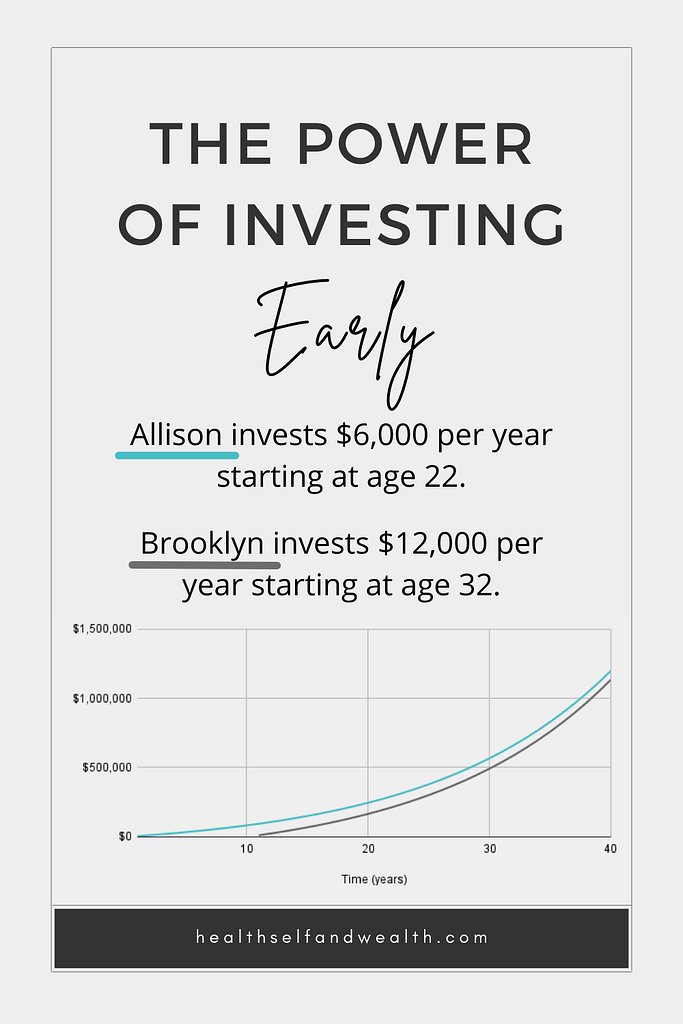

How does this work? It’s the power of compound interest and time. If you’re a visual person, here’s an example of two people.

Allison invests $6,000 per year starting at age 22. Brooklyn invests $12,000 per year starting at age 32. Here’s what happens if they both plan to retire at 62.

Allison invested a total of $240,000 while Brooklyn invested $360,000. Allison invested less and still ends up with more money. Time is the most important factor in investing.

Start early, your future self will thank you.

Prioritizing taxable investment accounts

I often see this decision combined with the investing mistakes above. Sometimes people think retirement is too far away, so they don’t consider investing in a tax-advantaged account, like an IRA (individual retirement account) or 401(k).

Other times, people just aren’t aware there are tax-advantaged investing options. This especially happens when people are using a broker, like Robinhood, that doesn’t offer IRAs.

This leaves a lot of money on the table! Is there any reason you’d want to pay the government more than you have to?

Here’s a full breakdown of investing accounts and tax benefits.

Trusting a financial advisor, blindly

This last one hurts me even more than the misconception that it’s too early to invest for retirement.

I have yet to meet someone who didn’t get screwed over because they blindly trusted a financial advisor to invest on their behalf.

It’s tempting when you don’t know what you’re doing to outsource investing to someone you believe is an expert.

You don’t realize that you’re outsourcing your future to a salesperson.

That creates a conflict of interest. Do they truly invest in what’s best for your financial future or fattening their own wallets?

If you do want financial advice, it’s better to go to a fee-based financial advisor. You pay them to create a plan for you that you execute yourself.

That’s the only way you can be certain your financial advisor’s advice doesn’t have ulterior motives.

On top of that, here are 6 more reasons to invest on your own, without a financial advisor. The short version is you pay them A LOT more for typically WORSE outcomes.

It hurts a lot more to pay someone to make investing mistakes on your behalf.

Conclusion

A lot of these investing mistakes are learned the hard way. I made at least half of these, and if I didn’t personally make them, I saw people close to me suffering because of it.

Your future self thanks you for proactively learning about these investing mistakes so you don’t have to make them! And if you’ve already made one of these investing mistakes, you can address it and resolve it now.

Do your future self one more favor and subscribe to get weekly personal finance tips in your inbox.