There’s only one decision that builds your wealth. How to become wealthy boils down to one proven formula for success: spend less than you earn and invest the rest.

Please note I am not a licensed financial advisor. This information is for education purposes only. Every person has a unique financial situation. Accordingly, do your own due diligence before making any financial decision.

Why Wealth Matters

Wealth matters because it’s the means to earn complete freedom over how you spend your time. Happiness comes from having control over your own time.

Accordingly, Health Self and Wealth believes your money goals should be based on the lifestyle you want to live. Here are 5 journal prompts to help you determine what that looks like for you.

Live Below Your Means

Wealth is not about how much money you make. It’s about how much money you keep.

You could make $5 million per year, but if you spend $5 million per year, you aren’t wealthy. Someone who makes $50K per year, but spends $40K and invests $10K would be wealthier.

The money you don’t spend, but invest, is how to become wealthy.

The first step to building wealth is creating a budget that works for you. A budget may sound unappealing, but it’s really just a plan for how you want to spend your money.

A good spending plan will allocate money towards the things that make you happy and put you on track to reach your financial goals.

If you are not spending intentionally, your money will own you until you do.

Do you have a spending plan where you spend less than you earn?

If so, you’ve mastered the first step towards building wealth.

If you don’t have a spending plan yet or feel there’s room to optimize yours further, check out these resources:

Investing is how to become wealthy

Does your spending plan allocate money towards investing? Investing in this context means making a decision that increases your net worth.

Net worth is a measure of wealth.

Net worth= assets – liabilities

Assets include investments, real estate, savings, etc., and they increase your net worth. Liabilities include debts and they decrease your net worth.

Pay off debt and your net worth goes up. Invest in the stock market and your net worth goes up. The list goes on.

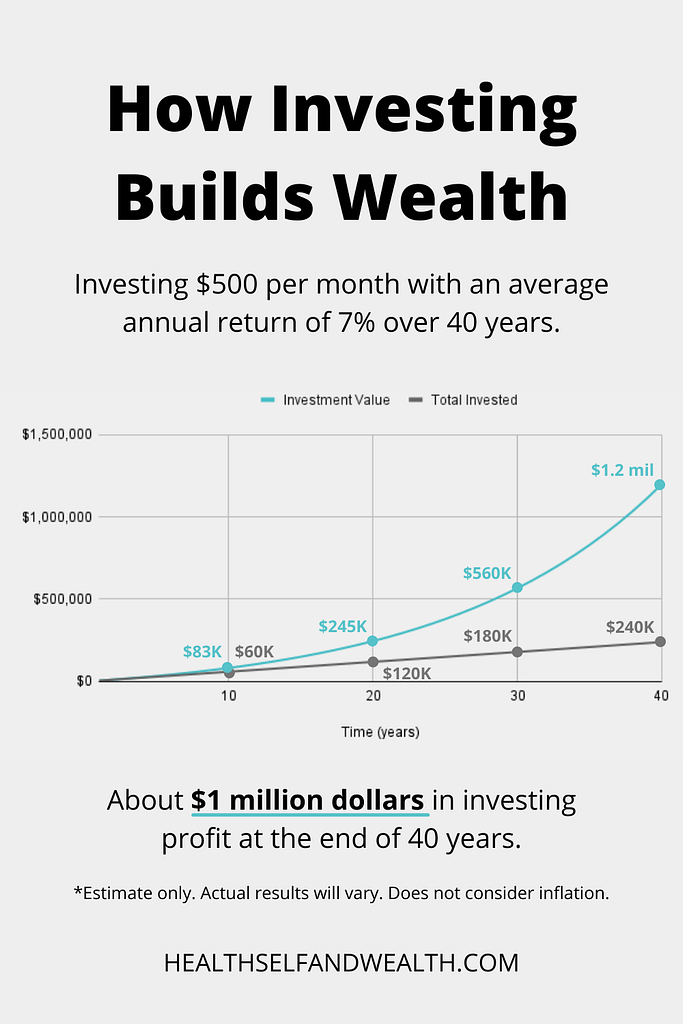

Over time, investing builds your wealth exponentially. See the chart below for a visualization of this.

Here are some resources to help you get started investing:

Making More Money

The difference between your earning and spending is how to become wealthy. There’s a limit to how much spending you can cut before you start sacrificing things that improve your life.

So once you develop good spending habits, it’s time to shift your focus towards making more money.

While there’s only so much you cut your spending, there’s no limit to how much you can earn.

When you increase your earnings, you can increase your investments, which will speed up your progress towards building wealth.

There are many ways to increase your income and can involve your career, side hustles, passive income, and more.

Here are some resources to help you get started:

- Posts on making money

- 99 passive income ideas

- A spreadsheet for mapping your progress towards your financial goals

Conclusion

How to become wealthy all circles back to one decision: investing. The proven formula for having money to invest is spending less than you earn.

Ultimately your path to wealth will be determined by how much you invest.

What move will you make next to get yourself one step closer to your financial goals?

If you found this content valuable, perhaps you’ll take your next step now. Make learning about wealth part of your routine with weekly newsletters from Health Self and Wealth.

Try it out here. You may unsubscribe at any time.