When it comes to money management, do you feel like an elephant trying to learn a hip hop dance routine without a coach? Like your overwhelmed and never sure if you’re doing the right steps?

Money management is THE most important life skill, yet it’s not taught in school. Your ability to manage money will impact how financially secure and comfortable your life is.

I’m sharing the money management system and process I used to go from living paycheck to paycheck to being able to retire as a multimillionaire.

If you’re ready to create a money management system and plan that works for you, you’ve come to the right place. Welcome to Money Management 101, where we’ll cover:

- Assessing your current financial landscape

- Creating a money management system and plan

- Taking your next steps

Assessing your current financial landscape

The first step to creating a money management system is to understand where you currently are. This exercise will help you evaluate your current financial landscape. You must first understand where you are before you can get to where you want to go.

Do you have any of the following? If so, check it off and write down the amount if you know it.

- Expenses – how much do you typically spend in an average month?

- Incomes – how much do you typically earn in an average month?

- Emergency fund – savings that could cover at least 3-6 months of expenses

- High interest debt – how much debt do you have at an interest rate at or above 7%?

- Low interest debt – how much debt do you have at an interest rate below 7%?

- Investment accounts – how much do you have invested?

- Assets – do you own any other assets besides the ones already listed? Assets are things of value you own, like a business, rental properties, or a home.

- Liabilities – do you have any other liabilities besides the debts you already listed? Liabilities are money you owe to someone else, like loans.

It’s okay if you don’t know your answers to some of these questions yet! I sure didn’t when I first started managing my money.

That’s why I started tracking these metrics. You can’t manage what you aren’t aware of. This completely transformed my financial journey. I first started managing my money out of necessity. At the time, I wasn’t sure how I was going to stay in college, keep a roof over my head, or even where my next meal would come from.

I started learning everything about money management. Four years later, I am on track to retire as a multimillionaire. I could even retire 13 years earlier than the average 62-year-old retiree if I wanted to.

Now it is my mission to share everything I’ve learned with you so you can transform your financial journey too.

Now you have an understanding of your current financial landscape. Next you can think about what you’d like your financials to look like and create a plan to get there.

Creating a money management system

No matter where you are currently at in your journey, a plan is necessary so you can ensure you’re on track to reach your goals. Before we dive into creating a money management system and plan, we need to take a step back.

Psychology of Money

Money is rarely ever about the money. Instead, money has underlying value, like comfort, security, safety, financial stability, freedom, choices, etc. When I started my money management journey, I wanted financial stability. Now it’s evolved into a desire for complete freedom over how I can spend my time.

A lot of women can turn away from money management for many reasons. Some women have negative connotations with the word money or wealth. Some even have negative perceptions of wealthy people. Society also doesn’t typically encourage or reward women with money.

This goes all the way back in time with Hetty Green. During the late 1800s, she was the wealthiest woman in the U.S. Her claim to fame is being the “Witch of Wall Street”.

If you have negative views surrounding money or wealth, take a moment to reflect on them.

Then think about the value money could bring you, your loved ones, or even the planet. It’s time for more women to step into wealth. When more women have more wealth, we’ll have the power to make our communities and our planet a better place.

What value would having money bring you?

Here’s another question to tackle this from another angle. If you woke up tomorrow with $1 million in your bank account, what would you do? Now, don’t think about what you would buy. Instead, how would you spend your time?

If you like journaling, take some time to write and reflect on this. Let yourself dream big and explore any idea that comes to you.

If journaling isn’t your thing, call a friend and share your answer with them. Ask them to do the same.

Hopefully these questions help you uncover what you value most and how you would want to spend your time.

Turning your goals into plans

Now you understand your current financial landscape and what money means to you. Next, let’s create a money management system and plan based on them.

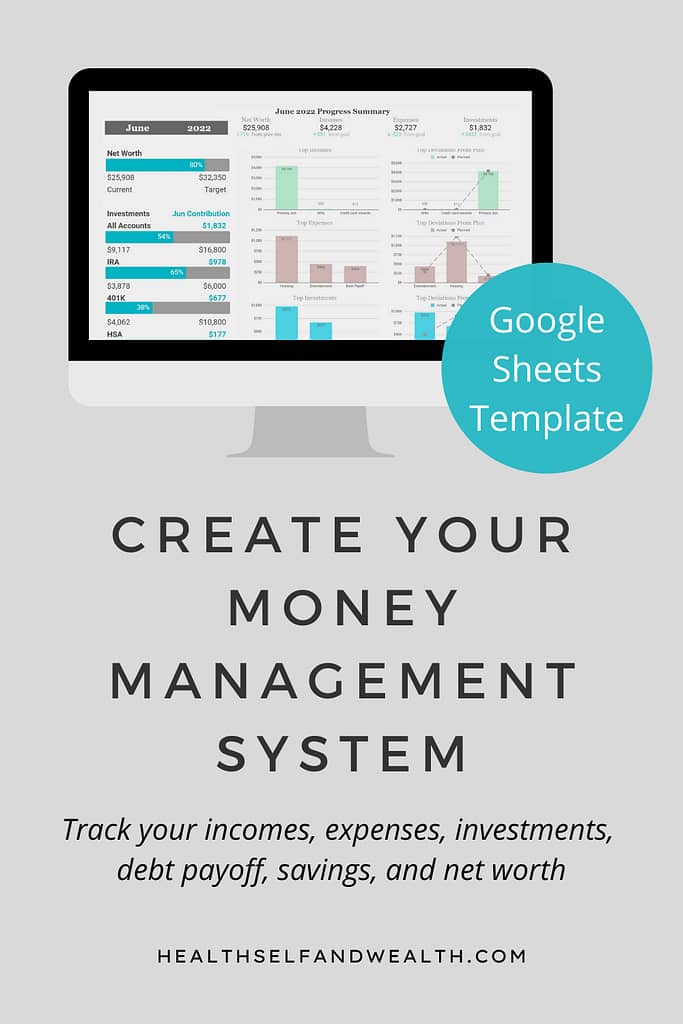

This is where it’s crucial to start tracking your money decisions. I track my incomes, expenses, investments/debt payoff/savings, and net worth all in a google sheets spreadsheet. Then each month I look at what decisions had the biggest impact on my net worth growth. If needed, I tweak my money management plan accordingly.

Take a moment to think about how you’d want to track your money decisions. If you want to grab the money management system I use, you can download yours here.

If you’ve decided to download your money management system, you can do these steps directly into the Goal Definition sheet. If not, you can write this down on paper.

Incomes

Start with entering your expected monthly earnings in the incomes section. Include income from every source you have. For example, I have my salary, my side hustle, credit card rewards, and app rewards.

Investments/Debt Payoff/Saving

Now this next step will vary depending on your current situation. Go down this list and see which step describes your current situation first. Think of this as a fun little quiz to help you define your money goals.

- Do you have an emergency fund? (3-6 months of expenses saved)

- If not, building an emergency fund is your first money goal. This will provide you with financial security throughout your financial journey. Read more on why this is the most important money decision and how to build one here.

- Do you have high interest debt? (7%+ interest rate)

- If you do, paying this off as quickly as possible is your first money goal. That’s because this type of debt is like a snowball rolling down a large hill. The longer you let it roll down the hill, the bigger it grows. That’s why you want to eliminate this beast as quickly as possible to avoid paying a lot in interest.

- Investing!

- This money decision will transform your financial journey. The earlier you can start investing, the more your money will grow over time. Oh and the best part, it’s truly passive income, meaning you’ll make money even while you sleep. Check out this Index Fund Investing Guide for Women to get started.

Whether you are building an emergency fund, paying off high-interest debt, or investing, enter that goal within the investments section of your planner. The reason for that is all these money decisions build your net worth. In other words, these are all ways to invest in yourself.

If you already know the amount you want to contribute towards this goal, go ahead and enter that. If not, it’s okay if you just put the name of the goal in for now. We’ll come back to determining the amount later.

Expenses

Now for the step everyone thinks of: creating a spending plan. What types of things do you spend money on? Here’s an example list to give you some inspiration.

- Housing (rent/mortgage, utilities, insurance, etc.)

- Food (groceries, eating out, meal services, etc.)

- Health (gym membership, health insurance, doctor visits, etc.)

- Transportation (car payment/lease, ride services, public transportation, gas, insurance etc.)

- Entertainment

- Children

- Pets

- Clothing

- Travel

- Other

The Personal Finance Planner money management system allows up to 10 categories because it will provide you with a big picture view of how you’re spending. Look over your expenses over the last month or two and decide up to 10 expense categories to track.

Each expense should fit into only 1 category and every expense should have a category. It’s a best practice to include an other category to account for unexpected or random expenses.

Once you’ve decided on your categories, you can set spending goals for each one. This is optional at this point.

If you know how much you spent last month on these categories, you can use this as a starting point for the goals. If you didn’t put your investing goals in yet, you can estimate those as well.

You can always come back and adjust these amounts later once you have a better understanding of how you’re spending and how you want to be spending.

Profit/Loss Statement

Whether you do this step now or next month, you’ll want to check the monthly profit/loss statement at the top. This will provide an estimate on how much extra money you’ll have leftover each month. Or it will tell you how much more money you’re spending than you’re making.

If it’s the latter, you may want to adjust your plan so you are not spending more than you’re making. Tracking is so important because it provides you awareness of how your decisions impact your financial wellbeing!

If you are calculating this yourself take your incomes – expenses – investments and see how much is leftover.

Net worth

Net worth is another good metric to assess your current landscape.

Net worth = assets – liabilities

Ideally, you want your money decisions to make your net worth go up over the long-term. You can set up this tracking by entering your assets and liabilities into the net worth section.

Assets include:

- Savings/checking/other bank accounts

- Investment accounts like a 401(k), IRA, HSA, Brokerage account, etc.

- Real estate

- Businesses

- Anything else with value

Liabilities include

- Credit card debt

- Student loans

- Mortgage

- Car payment

- Anything else you owe

Now you have your initial money management system and plan set up! You can come back to adjust amounts as you learn more about what brings you value.

Taking your next steps

Now you have a money management system and plan for tracking your money decisions and outcomes. From here, choose a day that you’ll update your money management system every month.

I have a finance day every month on the 25th where I pay all my bills and update my Personal Finance Planner. Put it on your calendar, set a reminder, do whatever you need to do to remember.

Start by tracking your money decisions each month without judgment. When you find opportunities to be more intentional, update your plan accordingly.

This is a journey, not a marathon, so be patient with yourself. As a part of that journey, incorporate personal finance resources into your routine. If you found this information helpful, I invite you to join our Wealthy Women Club.

You’ll get weekly emails from me with

- the latest news in personal finance,

- actionable tips to help you improve your well-being,

- and a place to ask your burning personal finance questions and get answers.

In the meantime, here are some more resources to help you tackle your financial goals from the quiz earlier.

Investing

- Index Fund Investing Guide for Women

- 5 types of investment accounts

- How much should I invest?

- Investing strategy that beats 90% of professionals

Emergency Funds

Paying off high-interest debt

Thank yourself for taking the time to prioritize your financial well-being today.