My friend asked me, “What makes you so good at managing your money?”

Lately when someone asks me that, it’s easy to elaborate on my obsession with personal finance. I am a 23 year old personal finance creator after all! I spend my Friday nights researching my blog posts, and I actually enjoy it!

But the truth is, I didn’t embark on my personal finance journey for fun. I learned how to manage my money 4 years ago, at age 19, out of necessity.

Here’s a glimpse into my story with the 5 best financial decisions in your 20s. These 5 choices transformed my financial situation from struggling to pay my $350 rent to having a 5-figure net worth.

Spend less than I earn

This rule has been my #1 guiding principle throughout life, before I even became obsessed with personal finance. I have my mom to thank for that. She provided a strong example of how to spend intentionally.

This rule makes so much sense. Having money in your bank account provides financial security, stability, and peace. To get and keep money in your bank account, you must spend less than you earn.

Now you’re probably saying, well duh! Knowing this rule does not automatically mean it’s easy to follow though.

The typical net worth among 35-year-olds and younger is $8,206.

Those same 35-year-olds and younger spend an average of $6,240 a month. And make $4,167 a month before taxes.

Essentially that means the majority of young Americans are living above their means, paycheck to paycheck, and are one emergency away from a disaster.

I’ve been there too. When this happens, most people turn to credit card debt.

No credit card debt

Credit card debt never felt like an option for me. Again I have my mom to thank for this.

Growing up she taught me that a credit card works just like a debit card as long as you pay off the full balance each month.

Having a credit card doesn’t mean you can buy anything you want.

Watching Hannah Montana and Jackson with their first credit cards reinforced this lesson for me. There’s nothing fun about owing more than you can repay.

Credit card debt breaks the golden rule of personal finance: spend less than you earn.

All that said, I recognize some people may need to use credit card debt because it’s the only way to pay for necessities.

If you are in this situation, credit card debt is the first beast you must slay on your personal finance journey.

Credit card debt quickly piles up, like a snowball rolling down a mountain.

Out of all kinds of debt, credit card debt is one of the most intense because of the high interest rates (sometimes 20%+!).

Living that debt free life has some great resources on getting out of debt.

I made a budget

So I said I avoided credit card debt, but how? What did I do instead?

I knew the implications of spending more than I earned and I decided to avoid digging myself into a worse financial situation if at all possible.

I turned to a spreadsheet because I could solve any problem with one. That’s when I created my first budget.

Here it is. (My food budget would have been lower if I wasn’t gluten free.)

| Category | Budget |

| Rent | 350 |

| Groceries | 300 |

| Gas | 50 |

| Restaurant | 75 |

| Entertainment | 20 |

| Supplies | 50 |

| Emergency | 100 |

| Electric | 35 |

| Gas Heat | 35 |

| Utilities | 20 |

| Wifi | 23 |

| Total | 1058 |

If you don’t have a budget yet, you can check out the template I used, fully upgraded since your gal learned new spreadsheet skills. You can also use a free budgeting app or even pen and paper!

When I first made this budget, I didn’t know how much my rent would be because I had yet to figure out housing.

I also was an unemployed college student at the time, so the entirety of this $1000 monthly budget was living above my means.

Not to mention, I hadn’t accounted for college costs like tuition in the budget either.

This made my next three steps crystal clear:

- I needed to minimize my rent costs by whatever means necessary. (I found somewhere without heat or A/C for $350 a month + utilities.)

- I needed a job or two to pay for my expenses and stay in school. (Not that the thought of dropping out ever crossed my mind until someone asked me about it a few years later.)

- A job alone wouldn’t be enough to cover the costs of college. I needed another way. I wanted to avoid loans. I decided I would apply for scholarships until I was no longer at risk of spending more than I earned.

You may be thinking, “Those next steps would be obvious to anyone.”

Perhaps, but my budget made it crystal clear I was $12,000 + tuition costs short. I now knew exactly how much I needed to earn to cover those expenses.

It’s one thing to know I need a job and another to know I need a job making $15 an hour working 20 hours a week and a $10,000 scholarship.

I often hear people resist a budget because they don’t want to feel restricted. Even in this situation, I NEVER felt like my budget restricted me.

Instead, it showed me what it would take to reach my most important goals. I intentionally designed it to show both incomes and expenses so I could monitor what really matters, the difference between them.

It can be terrifying to make a budget when you know the numbers aren’t going to work out in your favor.

However, if you don’t know where to start, a budget makes a significant difference because it helps you figure out how to follow the golden rule.

I also want to address a common myth that if you just had more money, you’d be able to live below your means.

Earning money and keeping money are two completely different skill sets. It’s why 1 out of 3 six-figure earners live paycheck to paycheck.

Just because you are reading this, you are taking time to improve your financial well-being. One day you will earn more money than you are right now.

If you can live below your means now, you’ll have that good habit for life, including when you start earning more.

My budget helps me successfully live below my means.

I built an emergency fund

I shared my first budget earlier. I only ended up spending an average of $800 a month, which was less than I budgeted. I also earned more than I anticipated.

Everything at this time felt very fragile to me, like a game of Jenga with lots of pieces missing from a wobbling tower.

So when I had leftover money, I kept it in my savings account.

That survival instinct motivated me to save as much as I possibly could, until I had 3 months of expenses saved up. Then 6.

This buffer saved me when the pandemic hit and I got laid off from my job. I felt the Jenga game ending, but my savings gave me time to recover and start again.

This buffer is called an emergency fund. Having an emergency fund is the BEST money decision because it provides you with a greater sense of financial stability and peace. Also if an unexpected expense occurs, like car maintenance, you won’t have to go into credit card debt to cover it.

I learned how to invest

At this point, I felt like I had been doing everything right. I was spending as little as possible and earning as much as possible while still doing well in school.

But one little set back and it almost all came crumbling down! I didn’t like being so close to the edge. How could I break this cycle so I would never have to worry about money again?

I remembered my corporate finance professor walking across the room with a dollar bill repeating, “A dollar today is worth more than a dollar tomorrow.”

That’s when I first began to understand compound interest, investing, and inflation.

Essentially money in your bank account loses its value over time. It’s because $1 is still $1 in the future BUT everything costs more! So $1 tomorrow won’t buy as much as it will today.

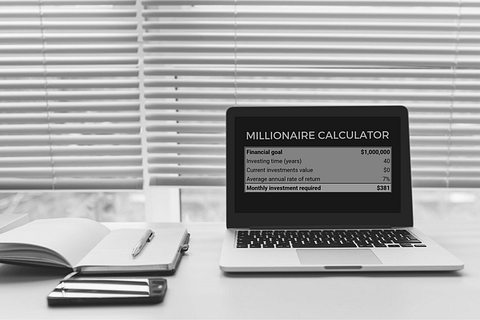

I learned how to calculate the value of money over time in that finance class, so I really understood the impact investing has, especially when you’re in your 20s or even 30s.

Time and compound interest will build your wealth while you sleep. I wanted that. But I was also afraid.

If you want to see how this could work for you, try this free Map to a Millionaire to see when investing and compound could make you a millionaire.Even though I took this corporate finance class, there was still so much I didn’t know. What’s the difference between an index fund, an ETF, and a mutual fund? Everyone says to buy the S&P 500? But how? Which one?

Is just investing in the S&P 500 enough? Shouldn’t I be diversifying?

Even though I decided to invest, it took me 6 months of research or so before I felt comfortable. No, that’s not quite true. The more I learned the less confident I felt because the more I learned, the more questions I had.

This uncertainty paralyzed me for 6 months. I missed out on the Covid dip because of all the time I spent learning. I didn’t want to lose any money and I was so afraid of doing something wrong!

I ended up just taking a small step. I opened a Roth IRA and invested just a little bit of money into an S&P 500 index fund. After taking that first step, I felt more comfortable with it because I saw first hand how it worked.

As I gained comfort and confidence, I began investing more and more. (While still always keeping 6 months of expenses in my savings account for emergencies!)

It’s been 2 years since I first started investing. It has grown my net worth double digits by 24%, 5 figures.

Becoming an investor is one of the best financial decisions in your 20s.

Although this is not the first step in a personal finance journey! We all start with what our current financial situation calls for.

We need to spend less than we earn so we have leftover money to save for emergencies, pay off high interest debt, and then invest.

Increase my incomes

Now I’m at financial peace, although I must admit sometimes instinct kicks in and I catch myself operating from a survival, scarcity mindset.

In this part of my journey, I’m focused on increasing my earnings. Why? So I can invest more! Why? So I can reach financial independence. Why? So I can live my life on my own terms. Why? I only get one life so I want the freedom to spend my time however I desire.

(And if you asked me today, I’d say I’m spending my time exactly the way I would if I were financially free because I don’t believe in waiting until you hit a number in a bank account to give yourself permission to chase your dreams.)

The most impactful financial decision I made to increase my income was switching jobs and earning a significant pay raise.

I also have 4 streams of income: my 9 to 5, my investments, Health Self and Wealth, and my super easy side hustles.

I also should mention, I’m increasing my earnings but I’m keeping my spending well below my means, following the golden rule.

What do I do with the rest? You guessed it, I invest it.

Conclusion

Retroactively it’s easy to reflect on the good decisions I made then that helped me get to where I am today. It would also be ignorant not to believe luck played a role.

But here’s the thing, I didn’t always get lucky. Things didn’t always work out well.

But when they didn’t, I refused to give up. I found another way.

I recognize my choices weren’t easy at the time. But now I’m at a place of financial peace.

I share the struggles to provide context for the choices I made. And I hope if you find them relatable, they bring you some comfort because if I could transform my situation, you can too.

It starts today. The single best thing you can do to transform your financial situation is to understand your current landscape.

Once you understand where you are right now, it’s easier to see what step to take next so you can get closer to your goals.

My success didn’t happen overnight. I’ve been meticulously obsessing over my finances for the last 4 years.

If you only have one takeaway from my journey, I want it to be that we make our own luck. If I could transform my financial situation, you can too.

If I were starting all over, I’d tackle it the same way again. You must understand your current financial landscape so you can make informed decisions.

You can check out the spreadsheet I used 4 years ago, although it has been updated since your gal has gained new spreadsheet skills. Or you can use a free budgeting app or even pen and paper!

Use whatever method you feel most comfortable with and begin tracking your cash flows: what’s coming in and how it’s coming out.

Once you have this understanding, you can then see what steps you need to take.

Thank yourself for taking this step in your financial journey. Keep the momentum going by checking out our Wealthy Women Club.

Get weekly personal finance news and tips directly to your inbox AND get opportunities to ask me your money questions directly.

Check out the club here.