This is a step-by-step guide for building long-term wealth. If you want the freedom to choose how to spend your time, then building long-term wealth will give you that freedom. This post will walk you through how to prioritize your investment accounts with the goal of building long-term wealth and retiring with $1 million +. If you haven’t already, read Stop Losing Your Money and Time first because it explains how your money can make you millions.

Please note: I am not a licensed financial advisor. The content in this post is personal opinion based on research and math. It is NOT financial advice. Every individual is unique and accordingly will have varying results. Always do your own research before making any decision.

Money Allocation Step-by-Step

Based on the personal finance books I’ve read, experts agree on the amounts to contribute and the order to prioritize your investment accounts. The goal of this recommendation is to maximize your long-term returns. Here’s the order and then I will explain why this is optimal.

- Pay off high interest debt (anything greater than a 6% rate)

- Contribute to your 401(k) up to your match

- Max out your IRA

- Max out your 401(k)

- Invest in a taxable brokerage account

*Before doing any of the items on the list, first you should build an emergency fund in a savings account to cover 3-6 months of expenses. In case of an emergency or an unexpected expense, you will have the funds easily accessible.

Why This Maximizes Wealth

High-Interest Debt

Paying off high interest debt should be your first priority. There’s something really powerful about compounding when you invest your money. But that same principle works against you with debt. The real cost of debt is more than the amount you originally borrowed because interest compounds over time.

If your debt’s rate is less than 6%, you may be better off investing extra money as opposed to paying off your debt quicker. The reasoning for this is that you can earn more money by investing it in the market. The average rate of return for the S&P 500 (500 of the biggest companies in the U.S. and a benchmark for the market) is conservatively 7%.

Tax-Advantaged Accounts

After paying off high-interest debt, the next step is to contribute to tax-advantaged retirement accounts. When you contribute to a Roth 401(k) or IRA, you invest your money now, but when you retire, you can withdraw your earnings without paying tax. To incentivize you to save for retirement, the government allows you to withdraw your contributions and earnings tax free. The government already taxes your income, then you put your after-tax income into one of these tax advantaged retirement accounts. In the example below, you would have almost $1 million to withdraw completely tax free from your Roth account.

| Roth IRA | |

| Annual Investment | $6,000 |

| Average Annual Rate of Return | 7% |

| Value in 40 years | $1.2 million |

| Amount Invested (already taxed through income tax) | $240,000 |

| Investing Profit (not taxed ever) | $960,000 |

*A Traditional 401(k) or IRA is also tax-advantaged. You don’t pay taxes on your initial contributions immediately. Instead, you pay taxes on the full amount of your withdrawals. In the above example, you would pay taxes on the full $1.2 million, gradually as you withdraw the funds. The distinction between Roth and Traditional retirement accounts is more complex than as outlined here. Do your own research before making any investment decisions.

401(K) Match

For most people, it makes sense to contribute to their 401(k) first if their employer has a match program. If you invest a percentage of your salary to your 401(k), employers will also contribute that same amount up to a certain percentage. The average match is about 5%, so if you contribute 5% of your salary, then your employer will also contribute 5% of your salary. The following example illustrates this, but it is essentially free money you should take advantage of.

| 401(k) | |

| Salary | $50,000 |

| Your Contribution 5% | $2,500 |

| Your Employer’s Match 5% | $2,500 |

| Total Annual Contribution | $5,000 |

IRA & 401(k)

Then you want to contribute to your IRA and 401(k) next because they are tax advantaged, which the example earlier showed. There is a limit to how much you can contribute to these accounts because they are so awesome.

Taxable Brokerage Account

If you’ve paid off your high-interest debt and maxed out your tax-advantaged accounts, then any extra money you have to invest can go into a taxable brokerage account.

Next Steps

So now you know how to strategically allocate your money to maximize your wealth. The next step for you is to determine how much money you have available for paying off high-interest debt, building an emergency fund, and investing. You need a plan, and a financial plan is called a budget. It is crucial to know how much you spend each month so you can determine how much you can invest.

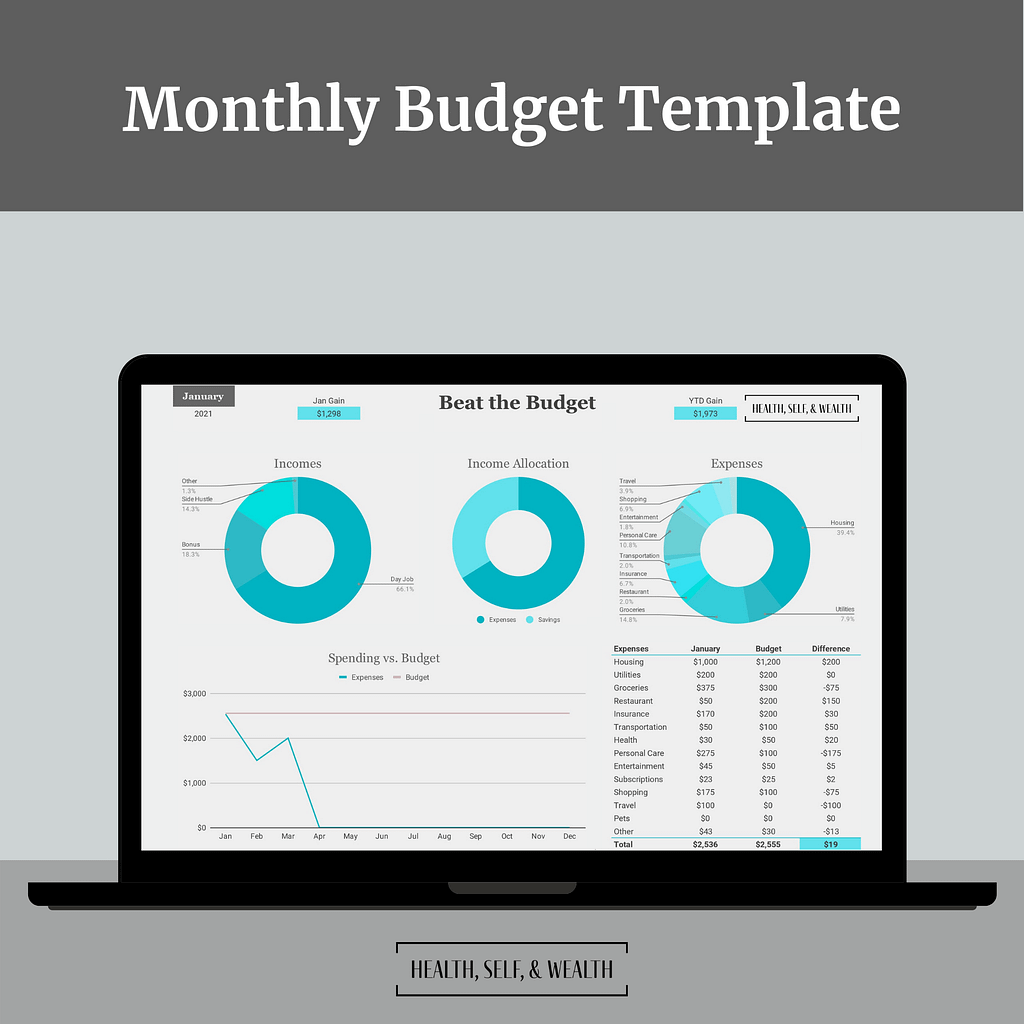

I already promised you wouldn’t have to do any math, so I am linking the budgeting tool I created and use every month. I track my income and spending for each month, and then just check the summary page to see if I’m on track to beat my budget and meet my goals.

It also automatically calculates your surplus for each month so you know how much you could contribute to your investments, debt payoff, or emergency fund. The digital budget spreadsheet is available for instant download on the shop page.

If you want to maximize your investments and build long-term wealth, the first step is to track your spending with some sort of budget. Once you have a budget and a good understanding of your expenses, you can clearly see how much money you have available for investments.

The next wealth post will walk you through making your first investment. In the meantime, how will you track your monthly income and spending?

[…] If you want to invest in an index fund, you have to determine what type of investment account is best for you. Read this post to determine which investment account(s) you should prioritize. […]

[…] To learn about the pros and cons of different investment accounts, read more here. […]

[…] Here’s a full breakdown of investing accounts and tax benefits. […]

[…] Read this post for more information on why this approach is optimal. […]